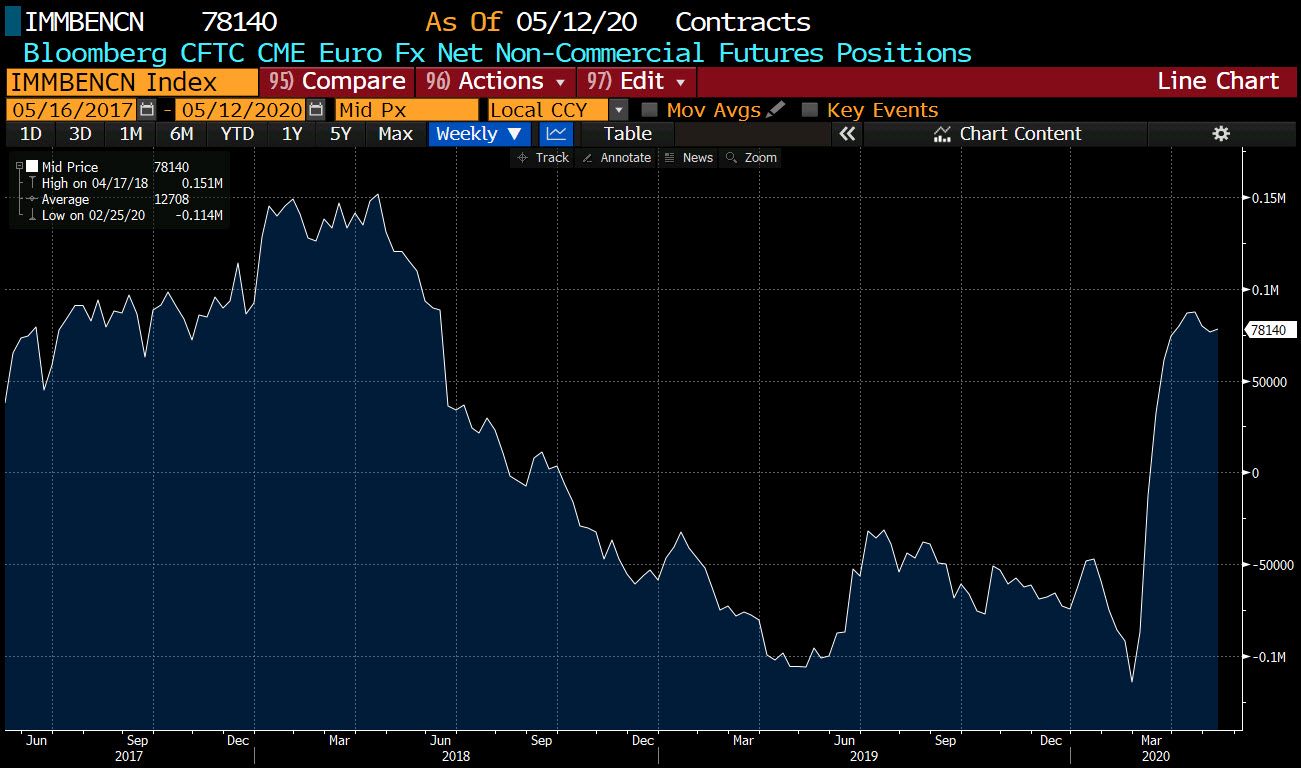

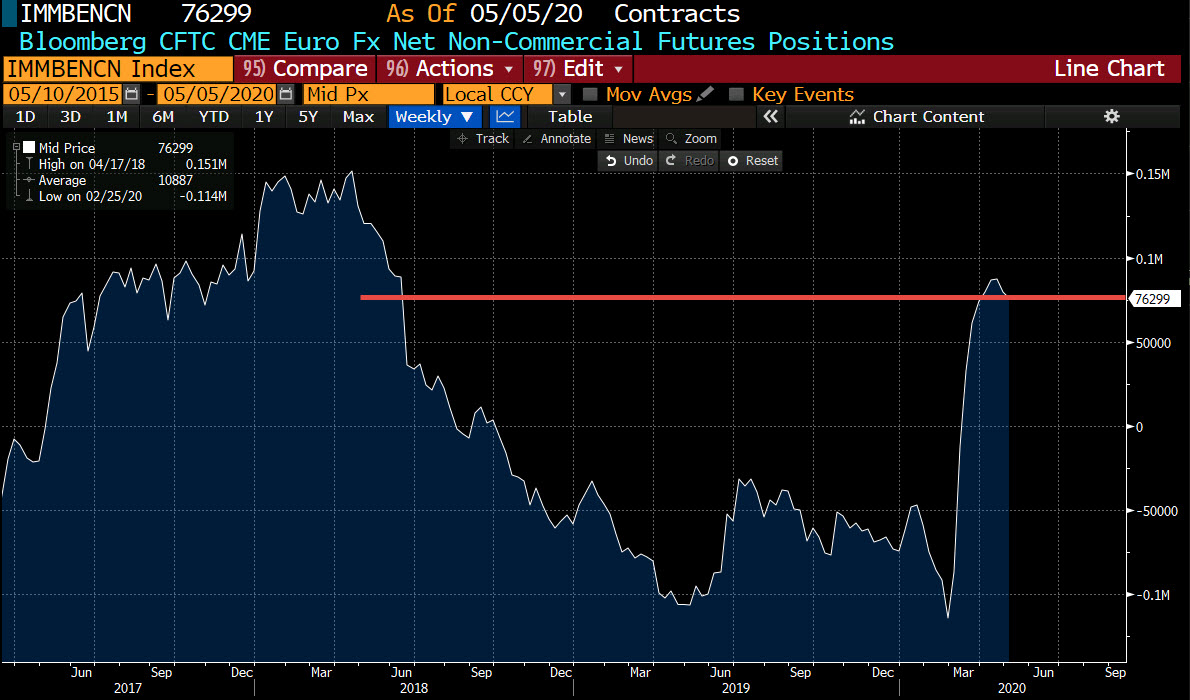

Via Bloomberg

The options market is pricing in the possibility of EURCHF below parity in 12 months time. The strength of the CHF is a constant concern for the Swiss National Bank keen to defend its export market.

Now, Thomas Jordan has said that the SNB is not thinking of imposing a new minimum exchange rate. Remember Jan 2015 and what a disaster that was when the SNB gave up defending the EURCHF peg? However, don’t rule out a new minimum exchange rate for EURCHF indefinitely.

Here are some things to look out for that could prompt the SNB to act:

- the pace of currency appreciation in the spot market

- the franc’s real effective exchange rate

- the depth of deflation in the nation (-0.3% is already factored in for 2020 in its bulletin)

- the strength of inflows into the nations assets

One key think to remember, if the SNB do act, or do put in a new minimum level. just don’t over leverage. Remember, there are old traders and there are bold traders. However, there are no old, bold traders.

:max_bytes(150000):strip_icc()/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)