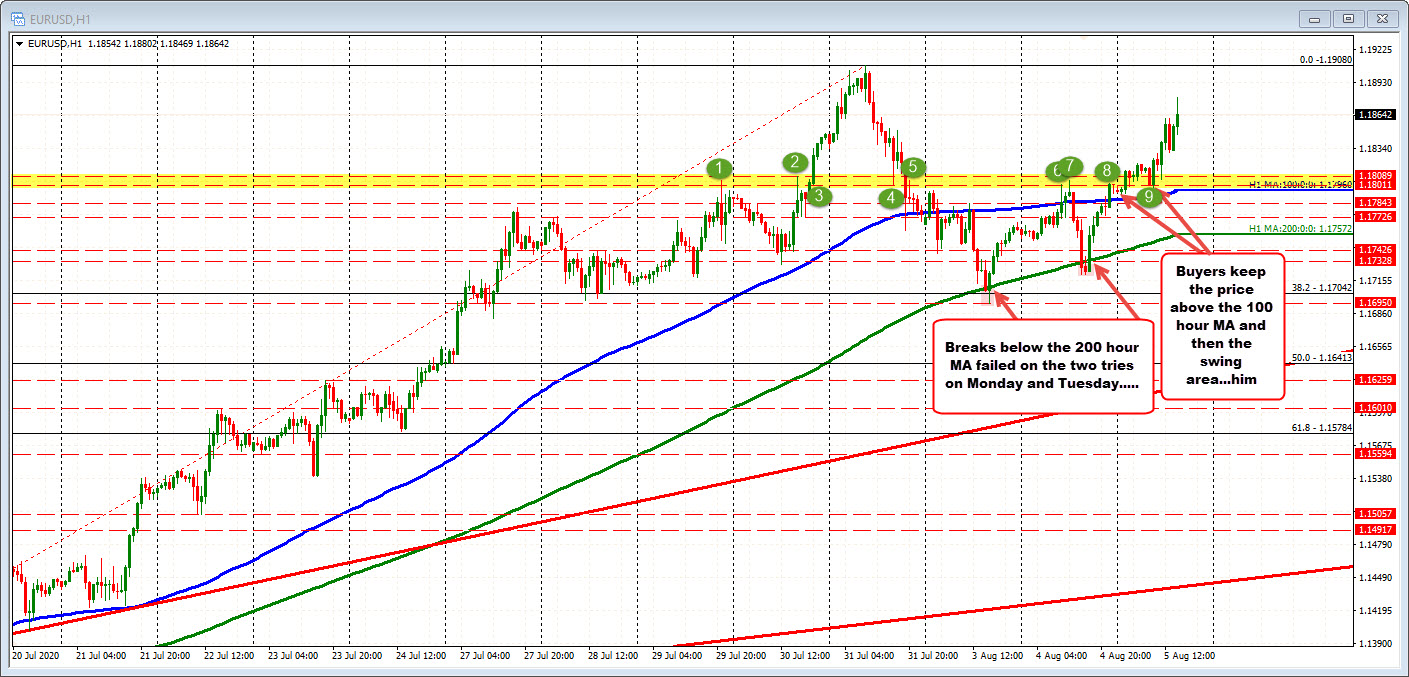

EURUSD high from July 31 reached 1.1908.

The EURUSD is climbing higher with the end of July high price of 1.1908 (call the target 1.1900 to 1.1908) as the next major target. The high price has reached 1.1880 so far.

The horse left the bearish barn after moving back above its 100 hour moving average late yesterday and then above its swing area between 1.1801 and 1.18089 in trading today. Stay above those technical levels kept the buyers in control and ultimately led to those buyers overwhelming the sellers and pushing the price higher. It would take a move back below those levels to hurt the medium term bullish bias.

Taking a view of the corrective move after the surge higher in July, the price low off the correction reached down toward prior swing lows from July 28 on Monday. The price did also break below the 200 hour moving average on Monday and again on Tuesday, but despite those breaks being the 1st and 2nd since July 10, momentum faded quickly on each. The price also fell below the 38.2% retracement but that break was even more brief.

As a result, the sellers really didn’t take back control. They simply corrected a bullish move and traders have to respect that the buyers are still in control.

That tilt can change. However it would take a move back below the 100 hour moving average now to give sellers some confidence (and then a move below the 200 hour MA). Without that, sellers are losing. The buyers are winning.