A look at what is on the board for today

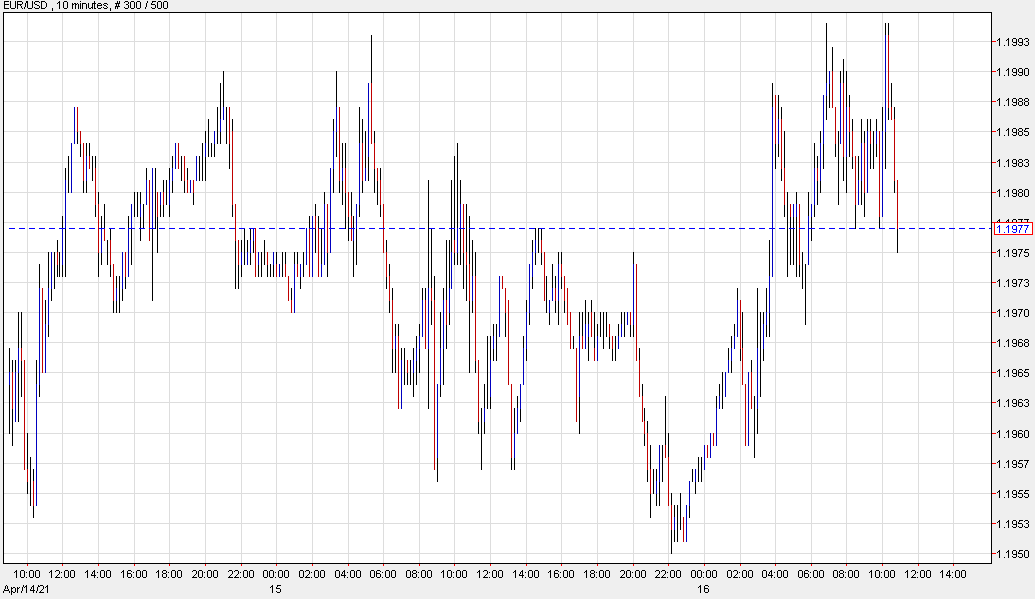

Not much on the board for today, with there being no significant ones. Even the board for the rest of the week seems a bit lackluster in terms of sizes (those near current spot levels at least) so just keep that in mind over the coming days.

There are some modest expiries for EUR/USD at around 1.2100 and some at 1.2140-50 on Wednesday but besides that, there isn’t much else to take note of for now.

It will be a big week in terms of headline risks with key releases, the FOMC and OPEC+ meetings, and big tech earnings releases adding to the mix. So, those might just be the more important factors dictating market sentiment in the days ahead.

/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)