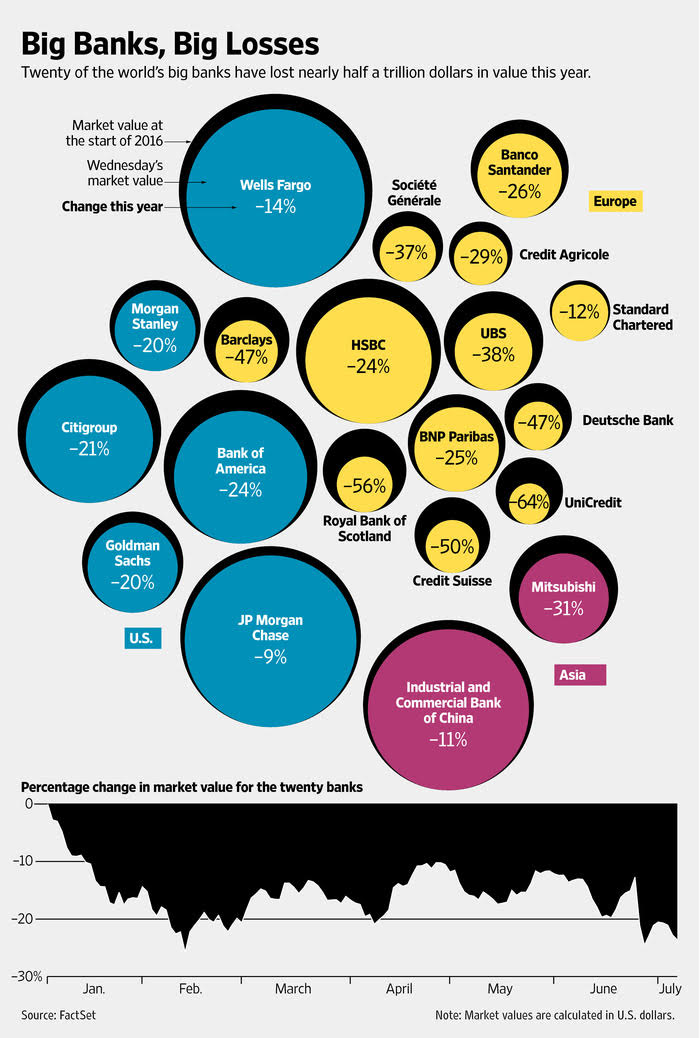

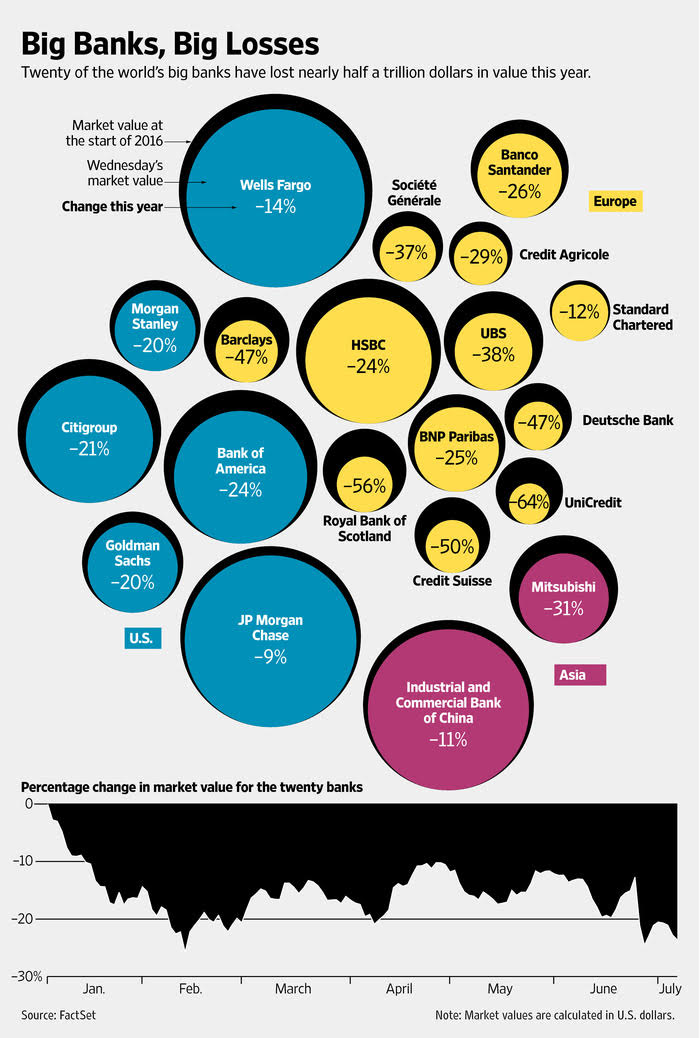

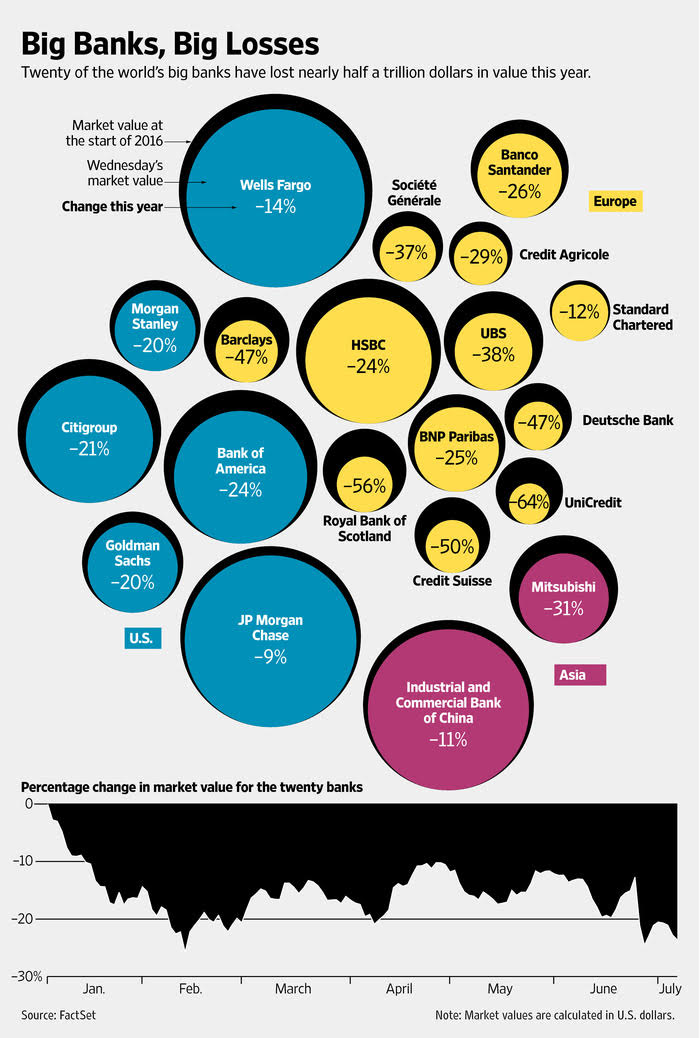

Big Banks, Big Losses

Risk is a very negative word for many, but as a trader you have to face financial risk (even ruin for some kamikaze traders) every day. But to make a living trading stocks you have to face risk in a bold way. IMO, the greatest opportunity for success goes to those who are not afraid of taking risks and at the same time managing risk in a proper way (and knowing excessive risk may lead to total ruin). By that you have to analyze risk in accordance to potential reward and to feel a little bit of fear. Success may come to those without fear, but many of the fearless have fallen by the wayside (and we never hear about them).

Risk is a very negative word for many, but as a trader you have to face financial risk (even ruin for some kamikaze traders) every day. But to make a living trading stocks you have to face risk in a bold way. IMO, the greatest opportunity for success goes to those who are not afraid of taking risks and at the same time managing risk in a proper way (and knowing excessive risk may lead to total ruin). By that you have to analyze risk in accordance to potential reward and to feel a little bit of fear. Success may come to those without fear, but many of the fearless have fallen by the wayside (and we never hear about them).

Actually, the biggest risk is not taking any risk! If you want to make money trading, you have to take risk. There is no way you will make money by being risk-averse.

That also means not afraid of looking stupid. Remember that learning is inhibited by caution and experimentation. Children who are afraid will never learn. Children with totally risk-averse parents will struggle in an uncertain world. Children are in general not afraid of looking stupid and they are therefore much more adaptive than adults. Just look at how easy they learn a new language. (more…)

There is a Korean martial art called Kum Do. This is a brutal game that involves a fight to the death with very sharp swords. The way it is practiced today is with bamboo sticks, but the moves are the same. Kum Do teaches the student warriors to avoid what are called “The Four Poisons of the Mind.” These are: fear, confusion, hesitation and surprise. In Kum Do, the student must be constantly on guard to never anticipate the next move of the opponent. Likewise, the student must never allow his natural tendencies for prediction to get the better of him. Having a preconceived bias of what the markets or the opponents will do can lead to momentary confusion and—in the case of Kum Do—to death. A single blow in Kum Do can be lethal, and is the final cut, since the object is to kill the opponent. One blow—>death—>game over.

Instead of predicting, anticipating, and being in fear and confusion, you must do exactly the opposite if you are to survive a death blow from the market movements. You must watch with a calm, clear and collected attitude and strike at the right time. A few seconds of anticipation, hesitation or confusion can mean the difference between life and death in Kum Do—and wins or losses in the stock markets. If you are not in tune with the four poisons of fear, confusion, hesitation or surprise in the markets, you are at risk for ruin. Ruin means that your money is gone and the game is over.

How can you avoid the four poisons of the trading mind: fear, confusion, hesitation and surprise?

Replace fear with faith—faith in your trading model and trading plan

Replace confusion with the attitude of being comfortable with uncertainty

Replace hesitation with decisive action

Replace surprise with taking nothing for granted and preparing yourself for anything.

This chapter gives several examples of different peoples method of placing their trades, and uncovers the difficulties that many people have in following a trading method. Much of the difficulties lie in the behavior pattern of avoiding punishment. A speculator may make mistake and know that he is making them, but not why. He simple calls himself names and lets it go at that.

Mistakes are always around if you want to make a fool of yourself. Mistakes are part of the human condition, and should not cause lost sleep. But being wrong – not taking the loss – that is what does the damage to the pocketbook and to the soul.

Trading Commodities rather than stocks partakes more of the nature of a commercial venture than trading in stocks does. Commodities are governed by one law in the long run, supply and demand. Fundamental information is more concrete than in Stocks, where the investor must guess about many influences.

Technical analysis, or tape reading, works exactly the same for stocks as for cotton or wheat or corn or oats. Still, the average trader from Missouri everywhere will risk half his fortune in the stock market with less reflection than he devotes to the selection of a car. Today the popular analogy is that most people spend more time planning their vacation than they spend planning for their retirement. (more…)

* Distractions come from unfinished business;

* I’ve yet to meet an impressive person who has needed to impress people;

* Passion without commitment is wasted energy;

* The early bird gets the worm; the night hawk gets the early bird;

* Success comes when doing things right is combined with doing the right things;

* When you are doing what you’re meant to be doing, effort gives energy;

* In trading, as in life, you succeed by acting decisively on your convictions;

* You will never win if your goal is to not lose; * Successful people are productive; they traffic in efforts, not intentions;

* Narcissism craves admiration; self-esteem desires understanding. .

There are useful parallels between chess and trading. In the below quotation there is actually more than one lesson for those willing to consider it.

Pal Benko, a chess grandmaster said:

“Patience is the most valuable trait of the endgame player. In the endgame, the most common errors, besides those resulting from ignorance of theory, are caused by either impatience, complacency, exhaustion, or all of the above.”

1) Ignorance of theory

2) Impatience / Patience

3) Complacency

4) Exhaustion

See this 1 chess lesson morphed into 4 lessons:

Let me have a little go at highlighting some things that we can perhaps learn from this chess quote that apply to trading. (I’d love it if you told me yours in the comment section below. Go on, be brave and join in – dialogue is good :-))

1) Ignorance of Theory

Ed Seykota has been recorded as saying something like: until you master the basic literature and spend some time with successful traders, you might consider confining your trading to the supermarket.

Naturally with trading, getting comfortable with the basics is an important step. Make sure, however, not to end up one of those paralysed and stuck in student mode. At some point you have to be willing to move from student to trader. One of the useful ways of ‘spending time with traders’ if you are not employed in a trading firm is to utilise things like Stocktwits, trading groups, forums etc. (more…)

+(5).jpg)