Archives of “Education” category

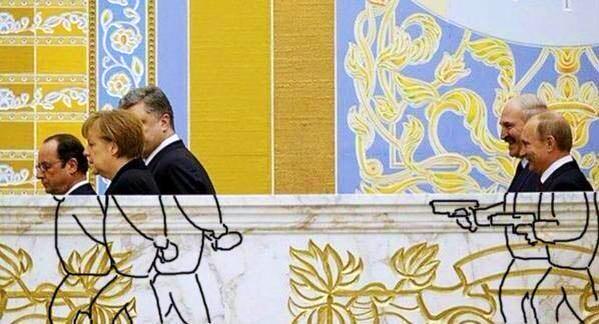

rssNaughty, these scribblers.

Never forget risk of ruin is, NOT LINEAR

Great Ad Placement

Traders :It’s OK To Be Emotional

Read any book or blog about trading and you’ll be told controlling one’s emotions is a key skill needed to trade well. On the surface, this sounds like good advice. After all, greed and fear are killers at a trading desk right?

But the evidence doesn’t back up such a notion.

These writers are saying you must be very calm and not get too excited. You must keep an even keel and not ride an emotional roller coaster – as if to imply emotional restraint is a desired state.

I’ve never completely agreed with this concept because I know from casual observation most successful people are very emotional.

SOME EXAMPLES

- Michael Jordan, Tiger Woods – very intense, very emotional!

- Bobby Knight, Coach K – love them or hate them, they’re extremely emotional and extremely successful.

- Muhammad Ali – intensity, passion, showmanship and yes, emotion.

- Paul Tudor Jones – if you can get your hands on a copy of the PTJ 60-minute documentary the subject supposedly bought up, you’d learn he has off-the-charts competitiveness, intensity and is very emotional.

THE TRADING TEMPERAMENT

Yet it’s a rarity to meet a calm trader, who doesn’t seem to be overly intense or competitive, become successful. This doesn’t mean you have to hurl your keyboard out the window every time you lose money.It’s just means you aren’t likely to succeed if you don’t have a little fire in your gut.

Trading is tough. It takes years of study and practice. Without a strong emotional drive, it’s unlikely a newbie would be willing to put in the time necessary to get good. (more…)

Read Links and Update yourself

- China turns tables on AAA debt time bomb nations (Bloomberg)

- Gold at new record high after Saudi reserves double (FT)

- Germany and France examine two-tier euro (Telegraph)

- So that’s why investors can’t think for themselves (WSJ)

- Failed AAA-deal rated Rembrandt spurs outcry (Bloomberg)

- Medvedev sees chance for new world order (FT)

- Amid the crisis, Wall Street touted BP stock (Reuters)

- Gold reclaims its currency status as the global economy unravels (Telegraph)

The Ten Cardinal Rules for Traders

1. Learn to function in a tense, unstructured, and unpredictable environment.

2. Be an independent thinker versus a conventional thinker.

3. Work out a way to handle your emotions and maintain objectivity.

4. Don’t rely on hope and fear in the conventional sense.

5. Work continuously to improve yourself, giving importance to self-examination and recognizing that your personality and way of responding to events are a critical part of the game. This requires continuous coaching.

6. Modify your normal responses to certain events.

7. Be willing to face problems, understand them, and recognize that they are in some way related to your behavior.

8. Know when problems can be resolved and then apply methods to solve them. That may mean giving up some control in order to gain a different control. It may mean changes in your personality, learning self-reliance, or giving up independence and ego to become part of a trading team.

9. Understand the larger framework in which trading occurs—how the complexity of the marketplace and your personality both must be taken into account in order to develop the mastery of trading.

10. Develop the right mind-set for trading—a willingness to commit to the kinds of changes in personal habits and beliefs that will drastically alter your life. To do this requires a willingness to surrender to the forces of the game. In order to be able to play at a maximum level, you have to let go of your ego and your need to have things your way.

Why Most Investors and Nearly All Traders Lose Money

I strongly suggest that you do not confuse being an Investors with being a Trader. I’ve been pointing out for many years that the Stock Market is greatly influenced by day-traders, flash-traders, program-trading firms, in for quick trades of a few hours, a couple of days at most, and back out again. That’s not Investing and certainly not Investing Wisely.

I strongly suggest that you do not confuse being an Investors with being a Trader. I’ve been pointing out for many years that the Stock Market is greatly influenced by day-traders, flash-traders, program-trading firms, in for quick trades of a few hours, a couple of days at most, and back out again. That’s not Investing and certainly not Investing Wisely.

The problem for Investors is that they have for decades, for the most part, considered themselves to be Buy and Hold Investors, (married to the stocks and mutual funds) through both good times and bad. When they finally get discouraged, (and they do!)they get out, usually due to large losses, and they tend to stay out for very long periods. An excellent current example is / are those who have been on the sidelines since the big bear market plunge of October 2007 through early last year, not enticed back in for even part of the new bull market of last year plus.

They (Mutual Fund Investors) tend to listen to Wall Street saying they need to have a long-term perspective when their stocks and mutual funds are plunging 25% – 50% and more, and so hold on. When they do decide to ‘reposition’ their portfolio they tend to listen to mutual fund managers, and brokerage firm sales persons and spokesmen on TV shows and in magazines, advising them to buy a stock that should be 30% higher 24 months from now, without considering that it might first be 30% lower three or more months from now.

Historically (way back when) Buy and Hold strategies and long-term outlooks work well in secular bull markets, when there is /was much less downside risk, when bear markets are more spaced out, less severe, and short-lived. In secular bull markets the long term trend is up, and when bear markets end the market ‘comes back’ to its previous high in the next cyclical bull market and continues on to still higher highs, continuing to be interrupted by only occasional mild bear markets.

Those days are gone and possible gone forever.

It’s the cyclical bull markets that are temporary, not exceeding previous highs before the next cyclical bear market takes the market back down again. In both secular and cyclical bear markets Buy and Hold is probably the worst imaginable investment strategy. Not only does it not produce gains, but even the most determined Buy and Hold investors are likely to give up with the worst of timing, after their losses have become larger than they can handle either financially or emotionally. (more…)

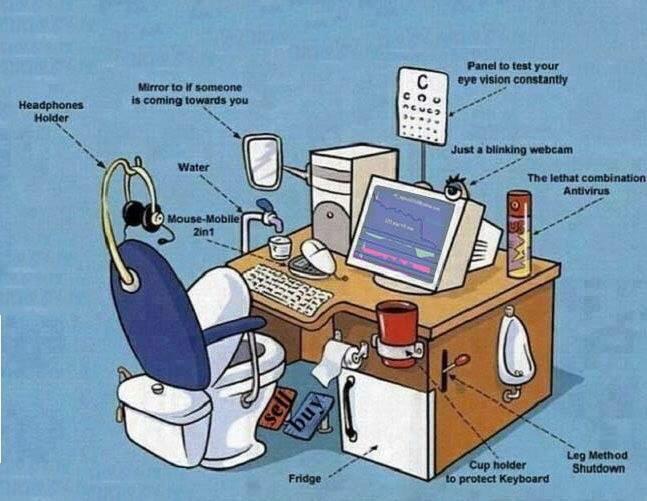

This For Hardcore Traders