Archives of “Education” category

rssEasy to forget how most market participants think.

John Kenneth Galbraith, an economist, says the financial markets are characterized by…

“…extreme brevity of the financial memory. In consequence, financial disaster is quickly forgotten. In further consequence, when the same or closely similar circumstances occur again, SOMETIMES IN A FEW YEARS, they are hailed by a new, often youthful, and always extremely self-confident generation as a brilliantly innovative discovery in the financial and larger economic world. There can be few fields of human endeavor in which history counts for so little as in the world of finance.” [emphasis mine].

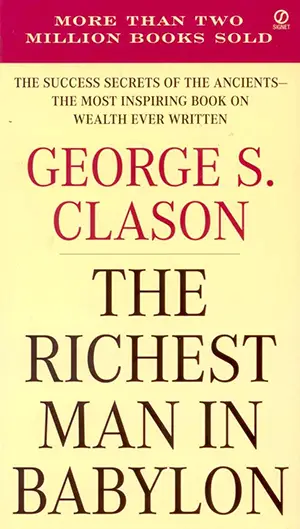

The Richest Man in Babylon Rules

The Richest Man in Babylon is a great little personal finance book set as an ancient fictional tale that explains the ‘The Seven Cures to a Lean Purse’ and ‘The Five Rules of Gold’.

The Richest Man in Babylon is a great little personal finance book set as an ancient fictional tale that explains the ‘The Seven Cures to a Lean Purse’ and ‘The Five Rules of Gold’.

The Seven Cures to a Lean Purse:

- Start thy purse to fattening. Pay yourself first. Save money before you pay any bills.

- Control thy expenditures. Don’t spend every penny you make or you will be broke no matter how high your income becomes.

- Make thy gold multiply. Invest capital in assets that go up in value.

- Guard thy treasures from loss. Your number one priority is to keep your investment capital safe from loss.

- Make of thy dwelling a profitable investment. Buy a home in the right location as a hedge against inflation and to create equity and ownership over the long term.

- Insure a future income. Convert your earned income into assets that can create future case flow.

- Increase thy ability to earn. Grow your earning power through education, building skills, gaining experience in a field, or promotions to higher levels of responsibility.

The Five Laws of Gold:

- Gold cometh gladly and in increasing quantity to any man who will put by not less than one-tenth of his earnings to create an estate for his future and that of his family. Save 10% of your income each time you are paid and convert it to investment capital.

- Gold laboreth diligently and contentedly for the wise owner who finds for it profitable employment, multiplying even as the flocks of the field. Invest your capital for growth and compounding.

- Gold clingeth to the protection of the cautious owner who invests it under the advice of men wise in its handling. Find a successful model or system to copy for investing your money.

- Gold slippeth away from the man who invests it in businesses or purposes with which he is not familiar or which are not approved by those skilled in its keep. Never put money in something you don’t fully understand.

- Gold flees the man who would force it to impossible earnings or who followeth the alluring advice of tricksters and schemers or who trusts it to his own inexperience and romantic desires in investment. This fastest way to go broke is to try to get rich quick.

trading rule from Paul Tudor Jones

On this day in 1995: Amazon launches

Way to Time an Entry for a Position Trade

For position trades, you may not want to be too involved in the intraday timing for your entry. Nonetheless, rather than just buying at a random time, e.g. at the open or at the close, your entry price can be improved by taking note of the intraday trend using some quick-and-dirty methods.

For position trades, you may not want to be too involved in the intraday timing for your entry. Nonetheless, rather than just buying at a random time, e.g. at the open or at the close, your entry price can be improved by taking note of the intraday trend using some quick-and-dirty methods.

A quick-and-dirty way to determine the trend is to say that if price is above the 50-period SMA, and the 50-period SMA is sloping upwards, then it is an uptrend. Reverse those conditions for a downtrend.

Now say you want to take a long position

- If the intraday chart shows an uptrend based on the method above, then immediately enter your position.

- If the intraday chart shows a downtrend, wait for the trend to change to up, then enter immediately.

If you want to take a short position, reverse the instructions above. If you want to add some complexity to trend determination, you can also add in an additional condition for higher highs and higher lows for uptrend, and lower highs and lower lows for downtrend.

Synthesized happiness (sour grapes)

- By cutting off that possibility (or imposing a self-restriction on my flexibility), my psychological immune system gets triggered to synthesize happiness.

- My non-conscious processes immediately ‘downgraded’ the idea of trend continuation (if I can’t get on, the trend must be bad), and boosted the idea that the trend will end.

Fear and Greed

Greed and fear are borne from the same parents. They feed on each other. A falling market prompts more selling just as a rising market feeds on itself.

It’s a concept that I just had to learn myself.

Why do stocks that are undervalued continue to be undervalued?

Why do stocks that are overvalued continue to be overvalued?

These momentum types of traits are of the same nature.

Fear prompts more aggressive panic selling ; that’s why stocks that are already slumping continue to be sold and enter a vicious cycle ;

Could be margin calls causing them to fall even further .

This same self reinforcing process operates in the same way on why stock prices can be propelled into the stratosphere. A great story can go on forever whenever the herd mentality is strong. Investors copy each other buying and selling. Greed prompts more euphoria until the loudest and most vociferous voice of the bull market must admit that the honeymoon is over and when it happens; it is a sobering and humbling experience.

When these happen; the most conservative option is to cut costs and hope for the best.