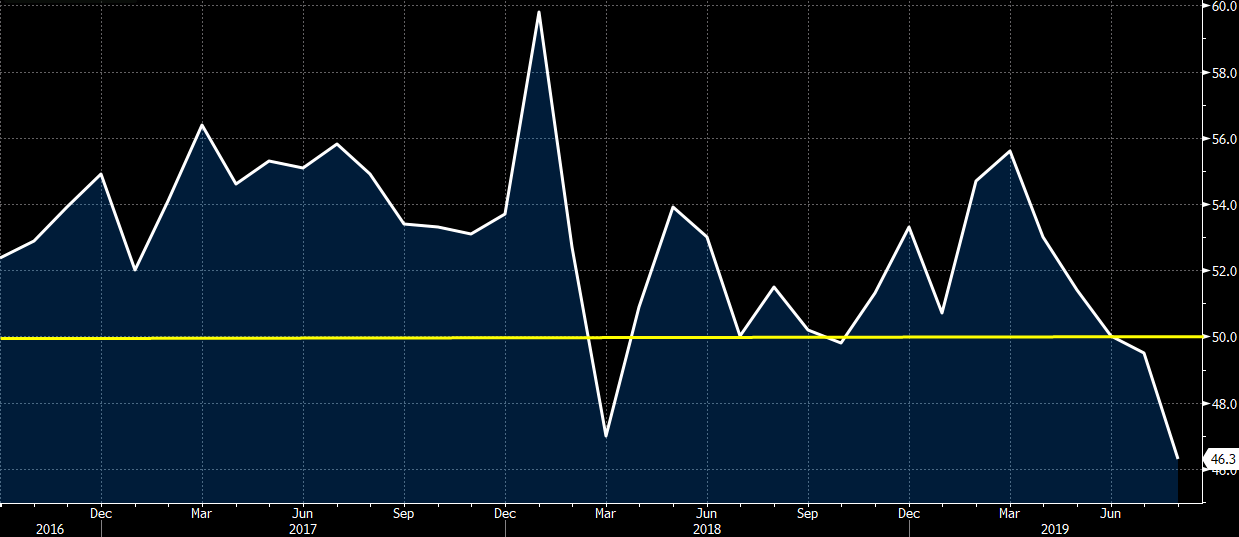

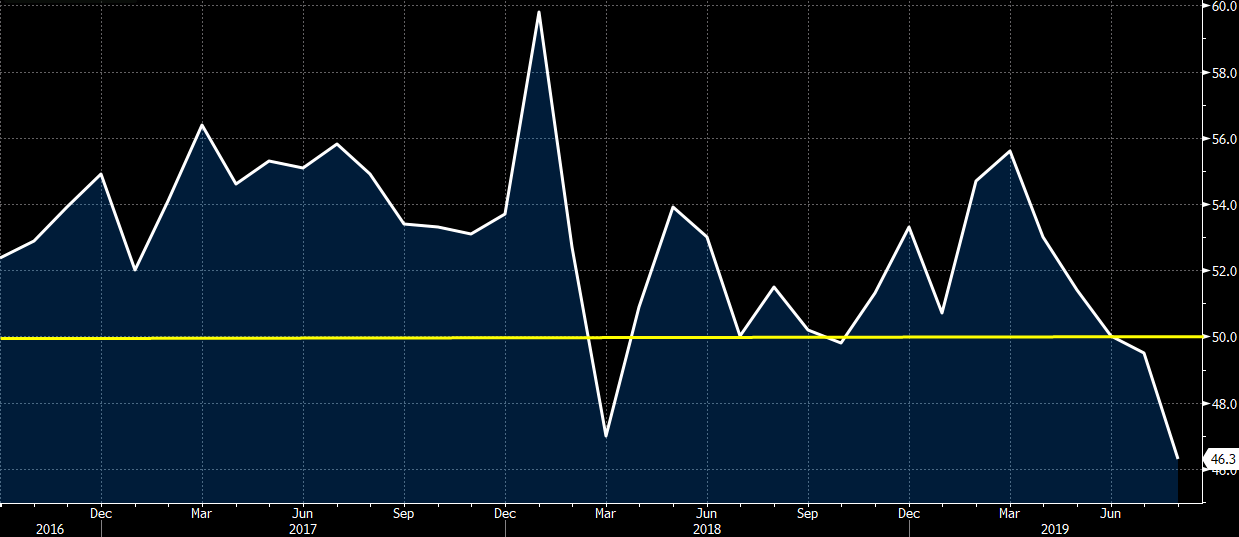

Latest data released by Markit – 5 September 2019

- Prior 49.5

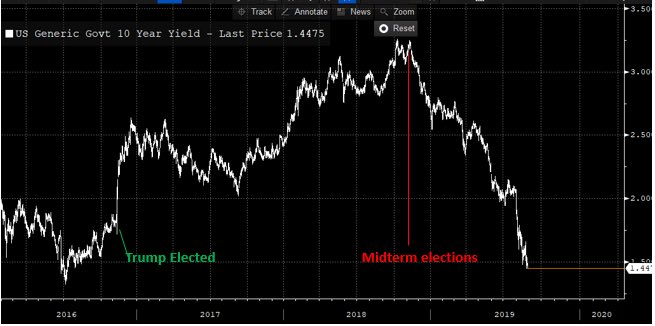

As China allows the yuan to depreciate to a level not seen in 11 years, financial authorities have rolled out measures to stem capital outflows from the mainland.

The new rules include stricter oversight of banks in times of capital flight and restrictions on real estate developers’ access to foreign currency bonds. If the financial system is judged to be on the brink on instability, the State Administration of Foreign Exchange, or SAFE, will declare the situation “abnormal.”

Under that assessment level, banks will be evaluated on the amount of yuan wired offshore and the volume of foreign currency sold. If the levels stray too far from the national average, the bank’s grade will diminish. Such lenders will then face limits on banking activities.

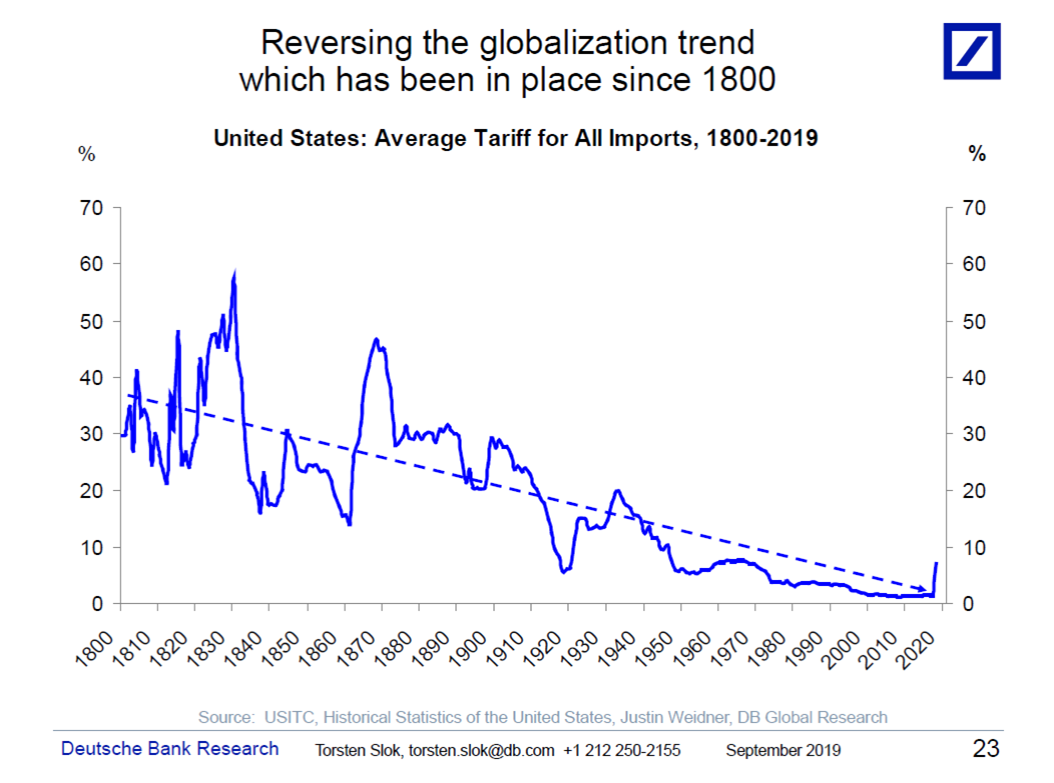

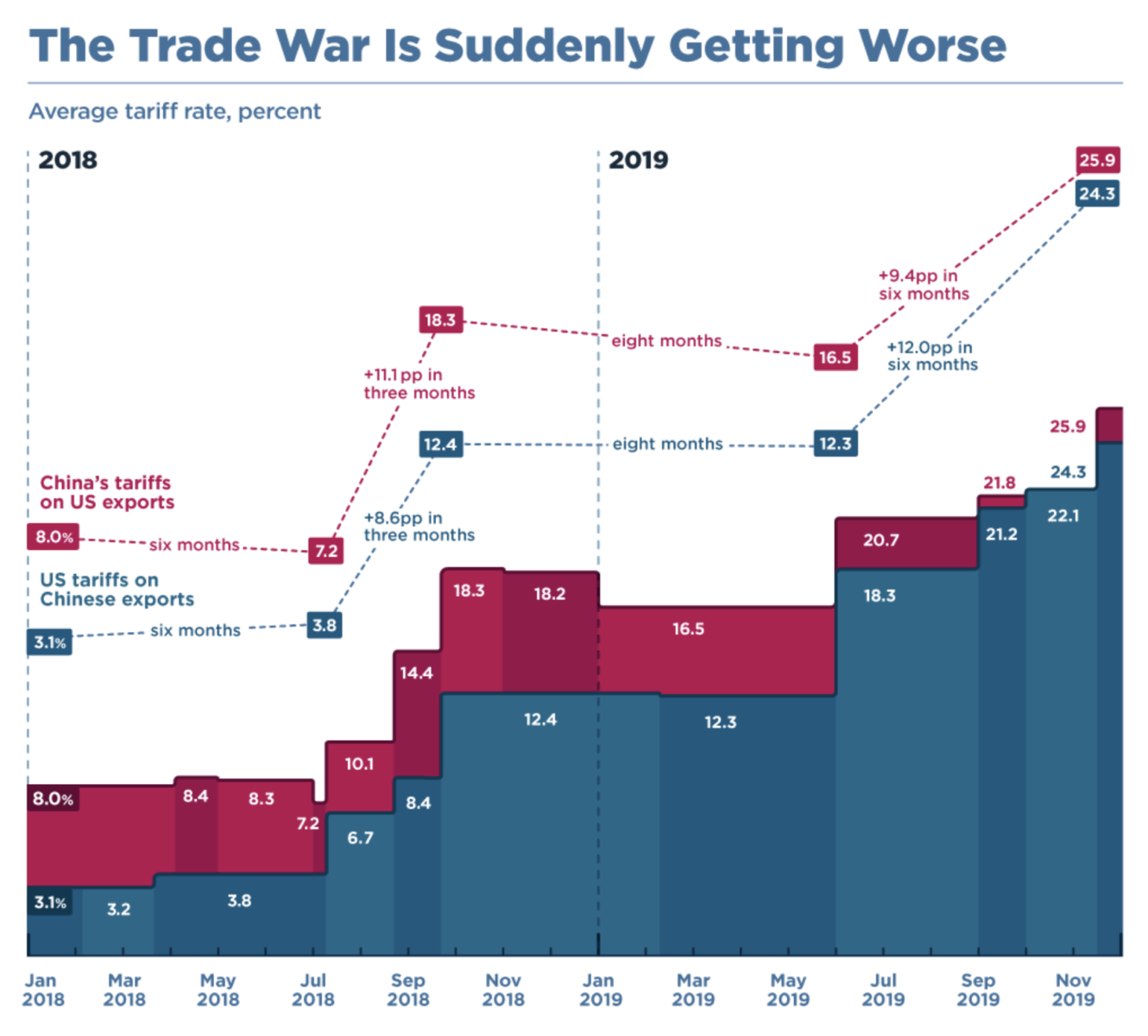

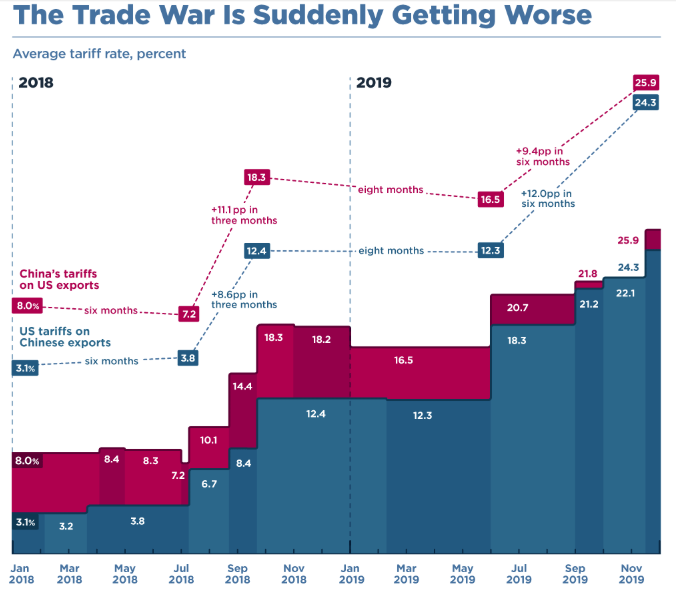

China is tolerating the softer yuan to ease the impact on domestic exporters during the prolonged U.S. trade war. But the government looks to avoid a repeat of 2015, when currency traders dumped the yuan after authorities lowered the reference rate.

In the wake of that currency shock, the foreign exchange regulator took steps in 2016 and 2017 to slow the outflow of funds. At the time, foreign nationals encountered hurdles when trying to transfer sums as small as a few thousand dollars. (more…)