Trade balance data out from China Sunday will not be viewed as a positive input for China-related risk markets.

The counter to this is, of course, the expectation of stimulus from China, some of which we have already indeed seen (eg. only on Friday we got news of the cut to the RRR) and more is forecast.

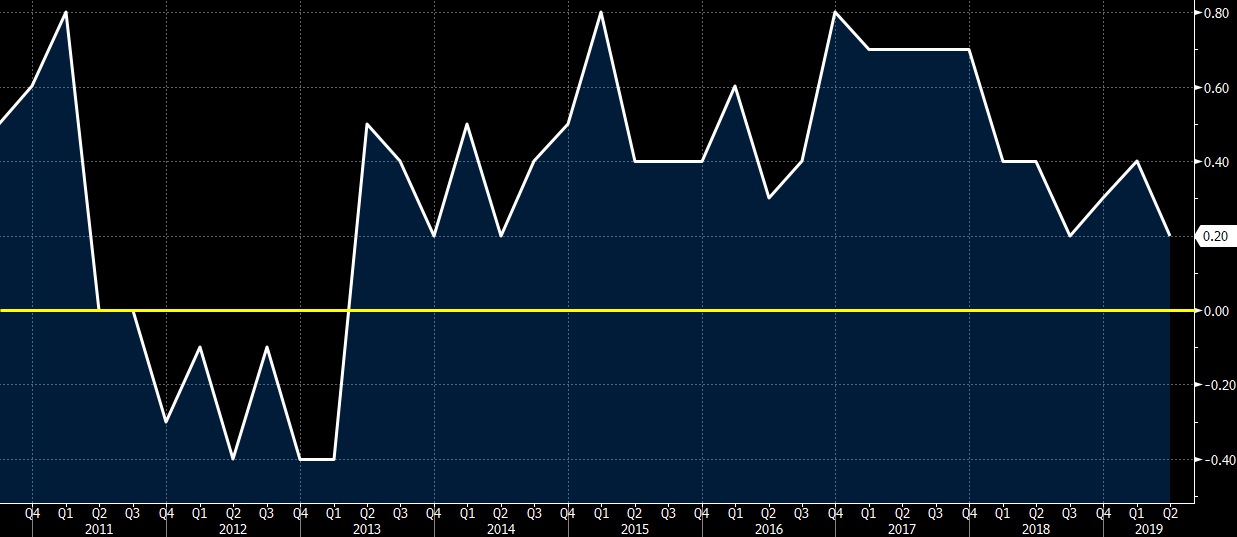

Yuan terms trade balance data

Surplus for the trade balance of 239.60bn … miss

- expected CNY 299.3bn, prior was CNY 310.26bn

Exports +2.6% y/y … miss … slowing global growth and US tariffs key points for exports missing

- expected +6.3%, prior was +10.3%

Imports -2.6% y/y – falling imports are often associated with domestic economic weakness -this result not as sharp a fall as expected.

- expected -3.1%, prior was +0.4%

USD terms

China trade balance: $+34.84

- expected $44.3bn, prior was $44.58bn

(more…)