#OECD: Richest nations face $17tn government #debt burden from coronavirus.

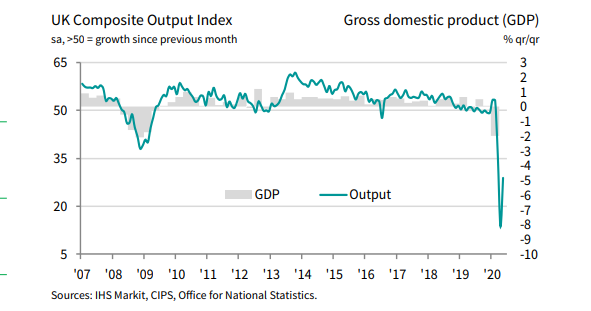

“The UK economy remains firmly locked in an unprecedented downturn, with business activity and employment continuing to slump at alarming rates in May. Although the pace of decline has eased since April’s record collapse, May saw the second largest monthly falls in output and jobs seen over the survey’s 22-year history, the rates of decline continuing to far exceed anything seen previously.

“Travel and tourism firms, hotels, restaurants and producers of consumer goods such as clothing were again the hardest hit, reflecting virus containment measures, but this remains a shockingly broad-based downturn with very few companies left unscathed by the COVID-19 pandemic.

“An improvement in business confidence about the year ahead for a second successive month is welcome news, and the easing of restrictions in coming months should help boost activity in some sectors as we head into the summer.

“However, the UK looks set to see a frustratingly slow recovery, given the likely slower pace of opening up the economy relative to other countries which have seen fewer COVID-19 cases. Virus related restrictions, widespread job insecurity and weak demand will be exacerbated by growing business uncertainty regarding Brexit. We are consequently expecting GDP to fall by almost 12% in 2020. While the quarterly rate of decline looks likely to peak at around 20% in the second quarter, the recovery will be measured in years not months.”

-0.4% m/m

-0.7% y/y

A capex indicator for Japan in the months ahead. The data point is a volatile one.

Manufacturers index -44 in May vs -30 in April, falls to lowest level since June 2009

Manufacturers august index seen at -51

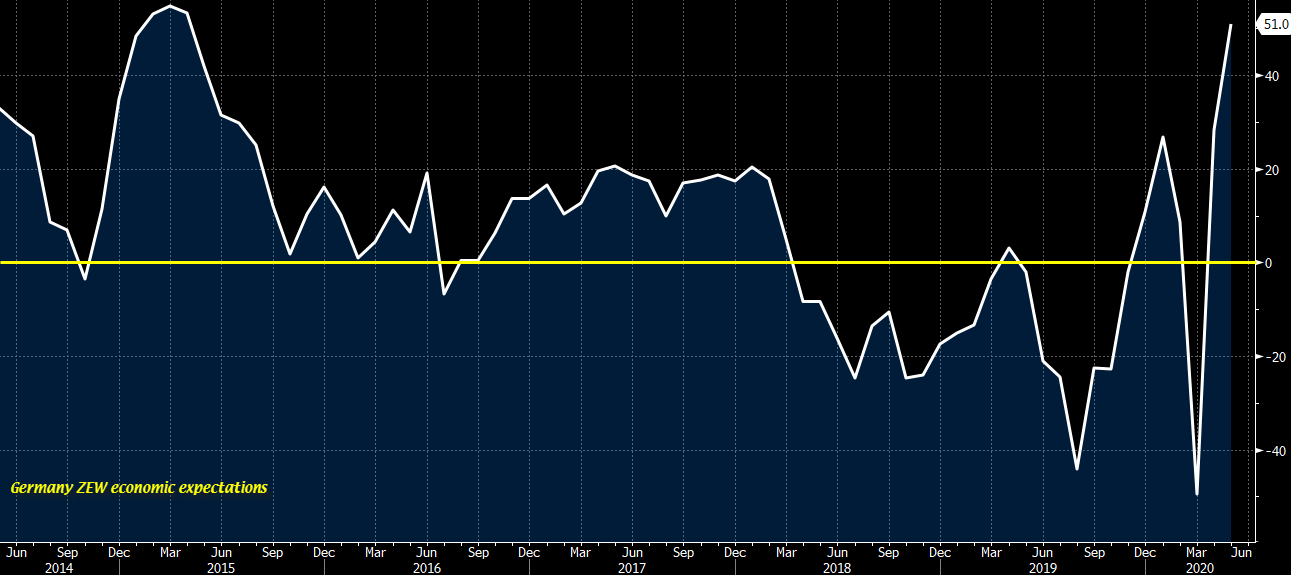

A couple of token remarks from the Bundesbank with the headline pretty much reaffirming what we all already know about the German – and Eurozone for that matter – economy.

GDP -3.4% annualised sa q/q

GDP deflator (an inflation indication) %

Private consumption -0.7%

Business spending -0.5% (capex)