Archives of “Economy” category

rssChina GDP for Q2 comes in at +11.5% q/q (vs. expected at +9.6%)

April to June GDP data from China +11.5% q/q (sa) and +3.2% y/y

- expected 9.6% q/q, prior -9.8%

- expected 2.4% y/y, prior -6.8%

Debate will rage about the veracity of Chinese economic data but there oyu have the headlines FWIW.

WSJ: “The world has never had so many economic problems in a year as in 2020.”

BOJ’s Kuroda: Economic activity has gradually resumed

BOJ governor, Haruhiko Kuroda, begins his press conference

- But Japanese economy remains in an extremely severe siituation

- Pace of recovery to only be moderate

- Inflation is likely to be negative for the time being

- Future economic developments remain extremely unclear

- Risks are tilted to the downside for prices, economic growth

- BOJ won’t hesitate to ease further if needed

- Will continue to support corporate financing, markets

Kuroda is still maintaining a more subdued take on the economic situation but that is hardly a surprise. The recent economic data from Japan have been rather poor and a possible virus resurgence only adds to more risks surrounding the outlook.

But Kuroda stands firm in assuring that the BOJ policies since March are having an impact, though I’m sure they pretty much lucked out on this one with the Fed and ECB doing most of the heavy lifting to appease financial risks in the market for the most part.

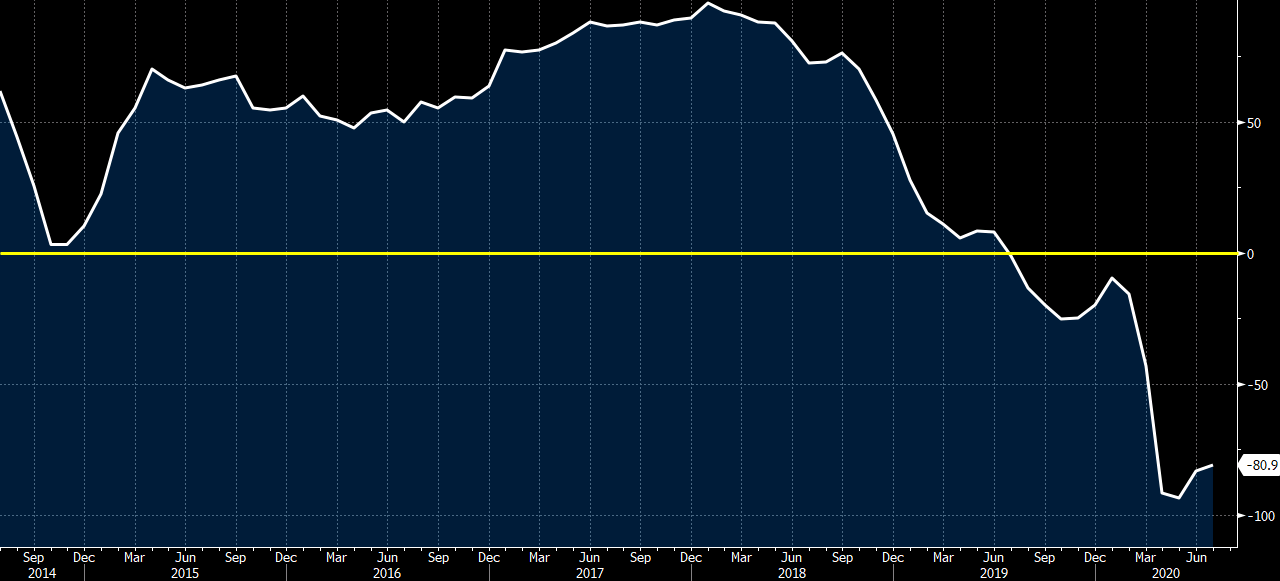

Germany July ZEW survey current situation -80.9 vs -65.0 expected

Latest data released by ZEW – 14 July 2020

- Prior -83.1

- Expectations 59.6 vs 60.0 expected

- Prior 63.4

What stands out in this report here is that any rebound in economic sentiment remains tepid at best and while expectations are still elevated, they have dropped off slightly – a hint that optimism about the future is becoming more measured.

On the latter, it would be a focal point moving forward as that will more or less give an idea about the pace of the recovery and this early stutter isn’t all too encouraging.

More China trade data, this time in USD dollar terms

USD terms:

- Exports +0.5% y/y: expected -2.0%, prior -3.3%

- Imports +2.7% y/y: expected -9.0%, prior was -16.7%

China June trade data, exports +4.3% y/y, imports +6.2% y/y (yuan terms)

china trade, yuan terms:

trade balance: expected CNY 425bn, prior was CNY 442.75bn

- Exports +4.3% y/y: expected +3.5%, prior was +1.4%

- Imports +6.2% y/y: expected -4.7%, prior was -12.7%

Exports have now risen for 3 consecutive months

The data is only dribbling out, do not have the trade balnce announced from China yet, nor the figures in USD terms. Nevertheless, bounce of both imports and exports is encouraging for the Chinese economy.

China has said trade with the US is down 6.6% y/y in H1.

Singapore Q2 GDP -41.2% q/q (annualised), bigger contraction than expected

The April to June quarter was always going to be a bad one, but SG GDP is worse than expected.

This confirms (in case you needed any confirmation) the SG recession

For the y/y, down 12.6% (expected -10.5%)

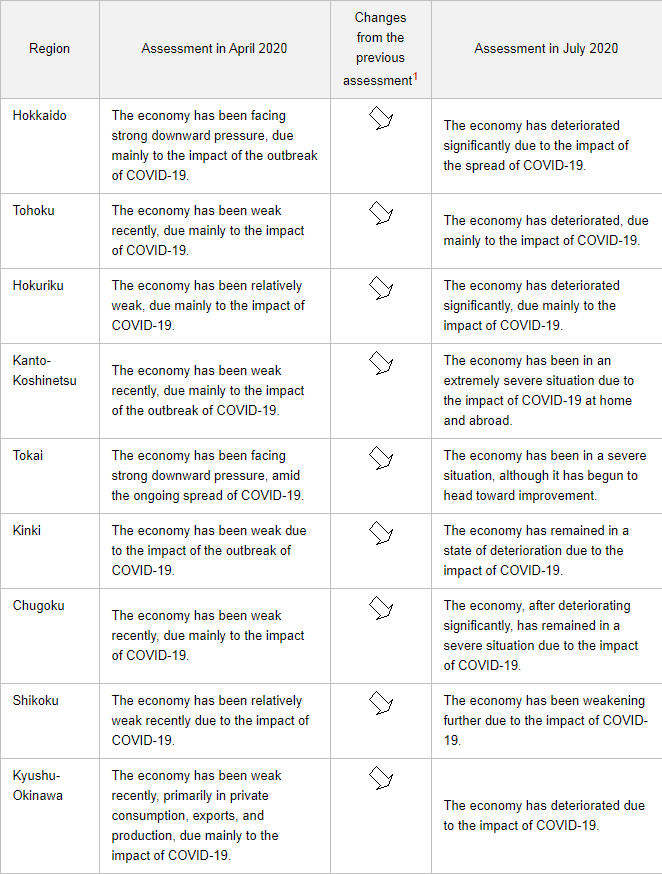

BOJ cuts assessment for all 9 Japanese regions in latest quarterly report

BOJ sees all of Japan’s regional economies as worsening or in a severe state

This isn’t much of a surprise as the downgrades to the assessments are all attributed to the economic fallout from the virus outbreak impact:

Japan Core Machinery Orders for May +1.7% m/m (expected -5.0%)

Japan Core Machinery Orders is an indicator for capex spending in Japan in the months ahead

- Comes in at a beat, +1.7% m/m expected -5.0%, prior -12.0% m/m

- and -16.3% y/y vs. expected -16.8%, prior -17.7% y/y

more to come