The agency has a very modest outlook for 2020 GDP for the country, forecasting real GDP at +2.7% this year

- Says the economy is making a remarkable recovery

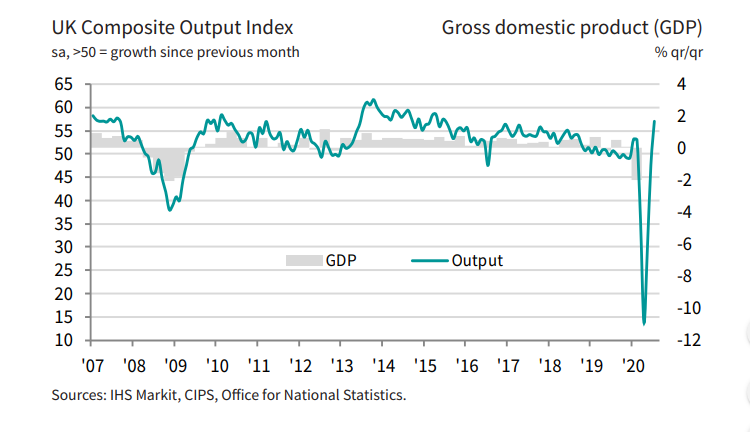

The easing of lockdown measures has spurred a solid upturn in UK business activity, but once again this just reaffirms that conditions here are much better than they were compared to the May to June period. Still, it is a positive takeaway nonetheless.

“The UK economy started the third quarter on a strong footing as business continued to reopen doors after the COVID-19 lockdown. The surge in business activity in July will fuel expectations that the economy will return to growth in the third quarter after having suffered the sharpest contraction in modern history during the second quarter.

“However, while the recession looks to have been brief, the scars are likely to be deep. Even with the July rebound there’s a long way to go before the output lost to the pandemic is regained and, while businesses grew more optimistic about the year ahead, a V-shaped recovery is by no means assured.

“New orders showed only a relatively small rise in July, indicating that demand remains worryingly low at many firms. Hence July saw yet another sharp cut to employment levels as increasing numbers of companies scaled back their operating capacity. Many households are therefore likely to remain cautious with respect to spending with the job market deteriorating.

“Furthermore, not only do many consumer-facing businesses remain especially hard-hit by the pandemic and ongoing social distancing, we remain very concerned about the extent to which the recovery could be smothered by a lack of postBrexit trade deals.

“July’s PMI represents a step in the right direction, but there is a mountain still to climb before a sustainable recovery is in sight.”

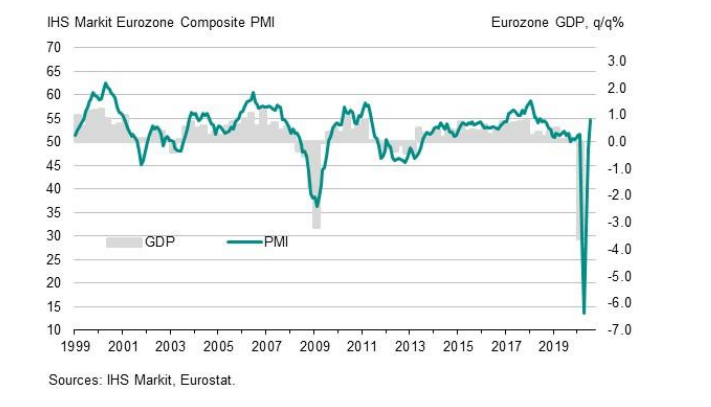

Solid beats across the board as preempted by the French and German readings earlier. Both the services and composite prints are their highest in over 25 months. Even the manufacturing beat is the highest in 19 months.

“Companies across the euro area reported an encouraging start to the third quarter, with output growing at the fastest rate for just over two years in July as lockdowns continued to ease and economies reopened. Demand also showed signs of reviving, helping curb the pace of job losses.

“The data add to signs that the economy should see a strong rebound after the unprecedented collapse in the second quarter.

“However, while the survey’s output measures hint at an initial v-shaped recovery, other indicators such as backlogs of work and employment warn of downside risks to the outlook.

“The concern is that the recovery could falter after this initial revival. Firms continue to reduce headcounts to a worrying degree, with many worried that underlying demand is insufficient to sustain the recent improvement in output. Demand needs to continue to recover in coming months, but the fear is that increased unemployment and damaged balance sheets, plus the need for ongoing social distancing, are likely to hamper the recovery.”

Japan trade balance for June Y -268.8bn

Trade balance adjusted Y -423.9bn

Exports -26.2% y/y

Imports -14.4% y/y