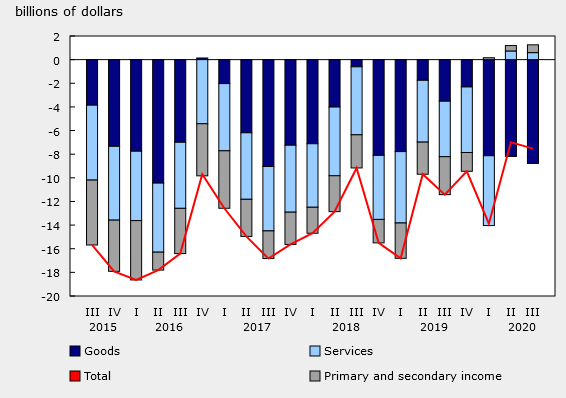

Canada third quarter current account data

- Q2 was -$8.6B

- Q3 2019 was -$11.5B

A larger deficit in trade in goods and services was moderated by a higher investment income surplus in the quarter.

Separately, the Canadian PPI report showed prices down 0.4% in October with raw materials prices up 0.5%.