Reuters reports, citing two sources on the matter

Adding that OPEC+ is likely to extend the existing oil output cuts until June next year when they meet up in Vienna next month.

I don’t think this really comes as much of a surprise to anyone as this is pretty much the baseline expectation going into the meeting. In any case, it presents a chance of an upside surprise if they commit to any form of deeper cuts when the time comes.

But then again, it’s OPEC. There’s always a leak somewhere.

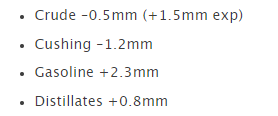

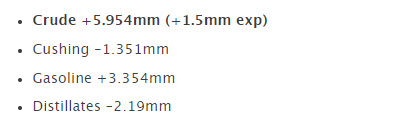

The price of crude oil has moved higher after the lower than expected build. The price currently trades at the high for the day at $56.12. The lower earlier in the day extended down to $55.16.

The price of crude oil has moved higher after the lower than expected build. The price currently trades at the high for the day at $56.12. The lower earlier in the day extended down to $55.16.