Crude starts the week higher

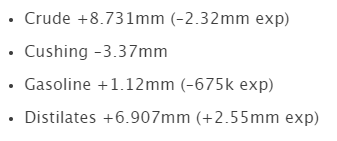

WTI crude rose as high as $39.90 shortly after the open. It’s since ticked a few cents lower to $39.83, which is up 25-cents on the day.

OPEC+ announced a one-month cut extension on the weekend but it wasn’t all good news as some Libyan production came back online.

Keep a close eye on the $40 with crude in the March gap. The bottom end of it is $41.05.