Archives of “Crude” category

rssUS crude oil inventories +4.892M vs -2.200M estimate

DOE oil inventory data for the week of July 17, 2020

- Crude oil inventory showed a build of 4.892M vs. a draw of -2.2M estimate

- Gasoline inventory showed a draw of -1.802M vs expectations of -1.5M

- Distillates inventory build of 1.074M vs expectations of 0.5M

- Cushing OK crude inventory build of 1.375M vs last week’s build of 0.949M

- Crude oil implied demand 16342 vs. 17673 last week

- Gasoline implied demand 9029.7 vs. 9248.4 last week

- Distillates implied demand 4661.6 vs. 5023.7 last week

NOTE….the private data last night surprised with a 7.544 million barrels build in inventories. That helped to push the price of crude oil lower on the day.

The price of the September contract just prior to the release was trading at $41.38. The price is currently trading at $41.47

Oil to trade flat to lower through to the end of 2020

View for the balance of H2 from Rabobank, this in brief (bolding mine):

enormous stockpile of drilled but uncompleted wells (DUCs) amassed in the Permian Basin over the last number of years … the latest figures showing an impressive 3,488 DUCs waiting to be tapped. In fact, nowhere else in the world that we know of holds such a vast stockpile of drilled wells that have yet to be completed. This is a huge buffer for crude oil supplies that can be called upon to meet demand needs for months and even years to come and this is in addition to the record amount of crude stockpiles sitting in onshore tanks and offshore tankers.

- oil market still struggling to clear the massive surge of Saudi exports that resulted from the short-lived price and market share war back in April

- data … shows a massive spike in Saudi oil exports to the US that have come onshore over the past six to eight weeks. In fact, there is still a large amount of crude oil on the water that is waiting to be cleared.

- We continue to see limited upside to both flat price and calendar spreads as a result of fundamental and quantitative market pressures. As such, it would not surprise us to see a washout of the out-sized speculative “longs” that have built up in crude oil futures in recent months and specifically in WTI as retail investors continue to flee the space in droves.

- On the flip side though, we still expect any major dips in crude to be bought as oil still looks attractive on a relative basis to other asset classes and especially given the amount of stimulus flushing through financial markets, a dynamic we expect to remain in place for the foreseeable future.

Global recovery unlikely to be v-shaped, says Shell chief

The head of Shell spoke in an online interview, in a nutshell said that there will be no V-shaped recovery for the global economy after the coronavirus epidemic

- this will curtail oil and gas demand for years to come

Ben van Beurden, Chief Executive of Royal Dutch Shell:

- “Energy demand, and certainty mobility demand, will be lower even when this crisis is more or less behind us. Will it mean that it will never recover? It is probably too early to say, but it will have a permanent knock for years”

- “It is most likely not going to be a v-shaped recovery.”

- Shell & others have had to reduce spending sharply, postpone investment and will continue to do so “for some time to come”

via Reuters

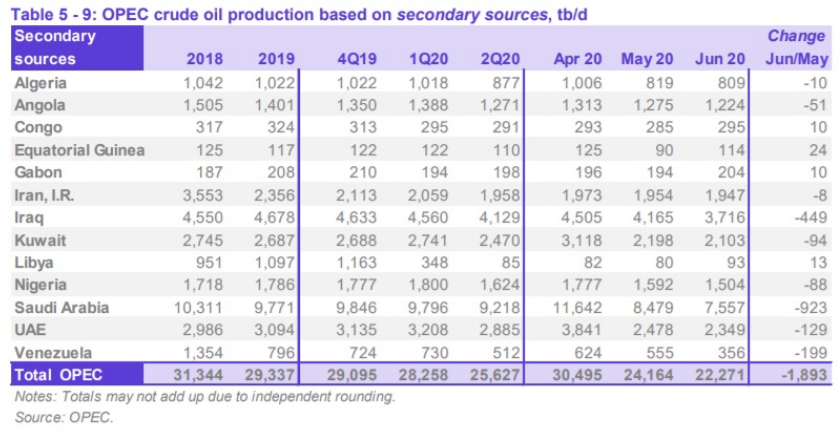

OPEC: Sees demand falling 8.95 mbpd this year, rising by 7 mbpd in 2021

Highlights of the OPEC monthly oil report

- Sees 2020 demand -8.95 mbpd vs -9.07 in prior report

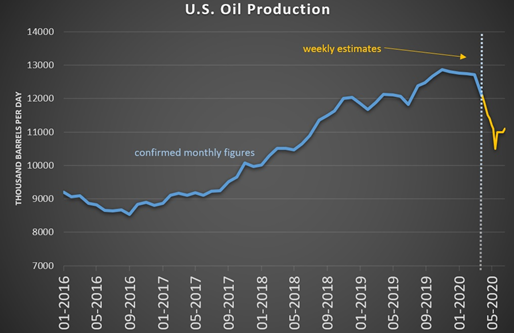

- Sees US output down 1.37 mbpd this year; +0.24 mbpd next year

- Oil stocks are 210 million barrels above 5-year avg

- Efficiency gains and remote working to cap demand rise in 2021 to below 2019 levels

A separate report, citing delegates, sees OPEC+ June compliance at 107%.

Heads up for oil traders – OPEC to release June report Tuesday

OPEC will release its monthly market report later on Teusday (I donlt don’t have the time sry).

- will provide OPEC production numbers for June

- which will show compliance levels so far (with the agreed cuts)

- preliminary numbers showed compliance for the group was over 100%, aggregated,due to extra output curbs by from Saudi Arabia, the UAE and Kuwait

An Update :US Dollar ,Sterling ,Euro ,Yen ,CAD ,AUD ,Chinese Yuan ,GOLD ,Crude -Anirudh Sethi

The bearish technical case for the dollar appears to be growing. It is a little disconcerting that it seems to have become the consensus view, and the gross and net long speculative euro positioning in the futures market is near two-year highs. However, the speculative positioning in the other currency futures is not nearly as extreme. Indeed, speculators are still net short sterling, Australian dollar, and Canadian dollar.

Turns in the market often appear to have a cascading effect. The turn does not happen all at once. Given that the euro is the single most important currency in the world after the dollar, that is the real interest. The Swiss Franc can sometimes be seen as its lead indicators. The Golden Cross (50 and 200-day moving averages) crossed down for last July. The euro’s averages crossed late last month, and at the start of last week, the 50-day moving average moved below the 200-day moving for the Dollar Index. The moving average for the Swedish krona crossed in the middle of June, while the Aussie’s averages crossed on the last session in June.

To read more enter password and Unlock more engaging content

OPEC and its partners will consider increasing oil output at a meeting this week

Saudi Arabia and most others in the OPEC+ alliance support increasing output by around 2 million barrels a day say reports ahead of this week’s meeting.

- Key members of the Organization of the Petroleum Exporting Countries and its Russia-led allies will hold a virtual meeting on Wednesday 15 July

There is no further detail on this, link here

The increased optimism comes as hopes are up that demand is beginning to recover and will continue to do so. Its not going to be smooth sailing though.

IEA warns that oil demand recovery is at risk from coronavirus resurgence

IEA remarks in its latest monthly report

- Global oil supply fell by 2.4 mil bpd in June to a 9-year low of 86.9 mil bpd

- Demand decline in Q2 2020 was less severe than expected

- Raises 2020 oil demand forecast by 400k bpd to 92.1 mil bpd

- Crude oil floating storage fell by 34.9 million barrels to 176.4 million barrels from all-time high seen in May

If you go by the numbers, the latest take by the IEA is certainly encouraging but they reserve caution amid the accelerating number of coronavirus cases. Adding that they see the risks skewed towards the downside for the oil market.

The agency says that demand should rebound sharply in Q3 as economic activity resumes but a flare-up in virus cases is “casting a shadow over the outlook”.

If anything, the fact that some countries have vowed not to return to mass lockdown is good news for oil – in the sense we won’t see a similar collapse as we did in April. But rising virus cases and partial lockdowns will still limit demand conditions moving forward.

EIA weekly US oil inventories +5654K vs -3250K expected

Weekly oil inventories from the US EIA

- Prior crude -7195K

- Gasoline -4839K vs +550K exp

- Distillates +287K vs +287K

- Cushing +2206K vs -263K prior

The numbers from API released late yesterday:

- Crude +2000K

- Gasoline -1800K

- Distillates -850K

The kneejerk in crude was about 25-cents lower but it’s rebounded quickly.