IEA remarks in its monthly report

- Vaccine rollouts should help to unlock stymied demand for oil, especially in Asia

- Signs that COVID-19 cases are abating should see demand rebound sharply by 1.6 mil bpd in October and continuing to growth until year-end

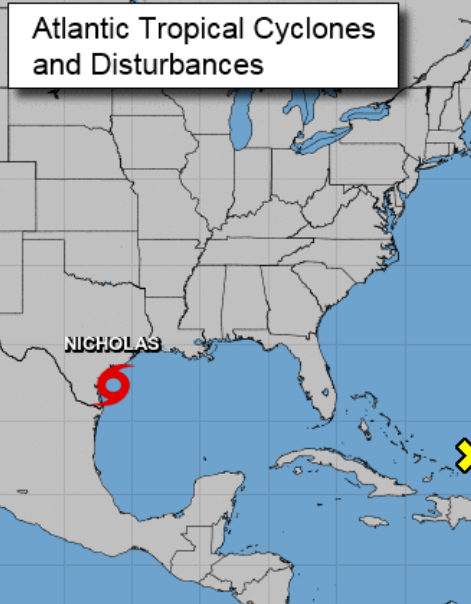

- Unplanned outages from Hurricane Ida offset increases by OPEC+

- Estimates that global oil demand fell for three straight months to date amid the COVID-19 resurgence in Asia

- Adds that the market should shift closer to balance from October if OPEC+ continues to unwind output cuts

- By early 2022, supply will be high enough to allow oil stocks to be replenished

A good summary on the oil market situation right now as delta variant concerns are still persisting but less impactful as what we saw over the past few months. Adding to that is the hype surrounding fossil fuels amid a cold winter and higher energy prices.

Oil is up 0.8% today and testing the $71 mark as buyers look to build on a daily break above $70 in trading yesterday.

EIA out with demand and supply forecasts

EIA out with demand and supply forecasts