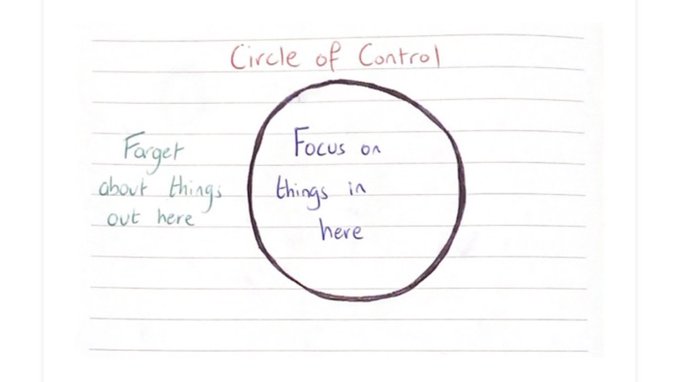

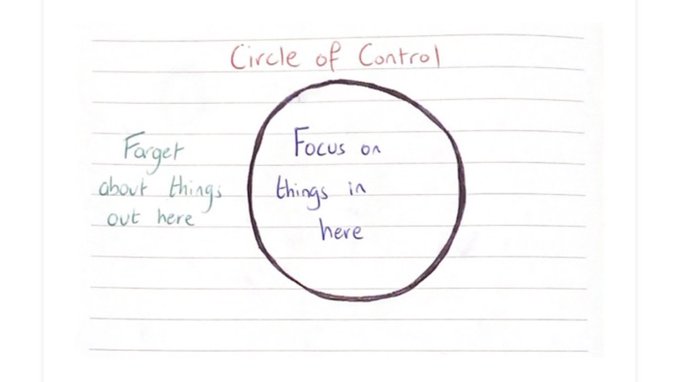

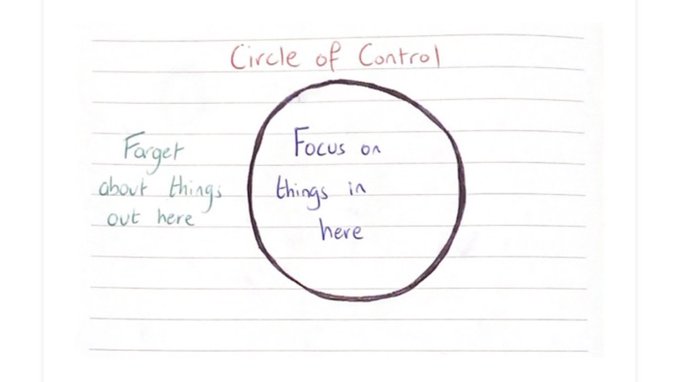

Focus on things you can control

The latest Reuters poll has 67 of 91 analysts polled forecasting a 75-basis-point Federal Reserve rate hike in July.

The Reuters report goes on:

Bank of Japan April 2022 meeting minutes

Minutes are preceded many weeks in advance by the summary,:

Headlines via Reuters:

One member said BOJ must look not at commodity, forex moves themselves, but the impact they have on economy and prices

One member said weak yen is positive for Japan’s economy at a time like now, when output gap remains big, inflation trend is very low

Full text:

Reuters reports on remarks from Heather Boushey, a member of President Joe Biden’s Council of Economic Advisers, on Tuesday at an event hosted by the Washington Post.

Sheesh. This does not sound too convincing and I suspect she is just going through the motions. Other members of Biden’s administration are talking the economy up also. For example:

Coming up on 22 June 2022:

Federal Reserve Chair Jerome Powell heads to the US Congress for his semi-annual congressional testimony

Both the Fed and Congress want to lower inflation (as does Biden). Nevertheless, he’ll get a grilling from the Senators. Powell won’t be backing down on his commitment to hiking rates in the months ahead.

I’m awaiting the publication of Powell’s prepared testimony. Its in the Q&A to follow that spontaneous comments will occur.

Powell is up at 1330 GMT.

The major US stock indices are closing higher on the day. The major 3 indices are closing with gains of over 2% led by the Nasdaq which rose 2.51%. Having said that, the indices are off the highs.

The final numbers are showing:

The final numbers are showing:

The Dow industrial average has been down 11 of the last 12 weeks. That has never happened. The NASDAQ and S&P are down 10 of the last 11 trading weeks.

Looking at the Dow 30, Disney and Home Depot were the only stocks to decline (-1.04% and -0.49% respectively).

The top 3 Dow 30 stocks were:

German DAX futures +0.6%

German DAX futures +0.6%That carries over the positive tone from yesterday, though it hardly chips into the fall from last week. For now, equities are keeping the calm but I reckon we might get more volatility once Wall Street enters the fray later today.

Elsewhere, US futures are keeping more positive with S&P 500 futures up 1.5%*, Nasdaq futures up 1.5%*, and Dow futures up 1.3%*.