An Update : $GOLD #SILVER #PALLADIUM #PLATINUM ►►#AnirudhSethi

Twitter shares were down 5.35% on the report today and closed at $34.84 — far below the $54.20 agreement. For more than a month, there have been signs that Musk has a bad case of buyer’s remorse.

What’s far less clear is that he will be able to walk away from the deal.

He accused Twitter of being “in material breach of multiple provisions” of the merger agreement.

“Mr. Musk is terminating the Merger Agreement because Twitter is in material breach of multiple provisions of that Agreement, appears to have made false and misleading representations upon which Mr. Musk relied when entering into the Merger Agreement, and is likely to suffer a Company Material Adverse Effect (as that term is defined in the Merger Agreement)”

However he signed an agreement to complete a purchase of Twitter. It wasn’t an agreement to think about buying Twitter and the social media company has said it will enforce the deal.

Delaware courts, where this will be adjudicated, have been consistent in ruling that the bar for breaking a merger agreement is extraordinarily high. Musk has said the bot count is too high but Twitter this week released a presentation saying it was below 5%. Legal expert say that even if it was 20% it will be tough to argue it’s a material adverse clause. (more…)

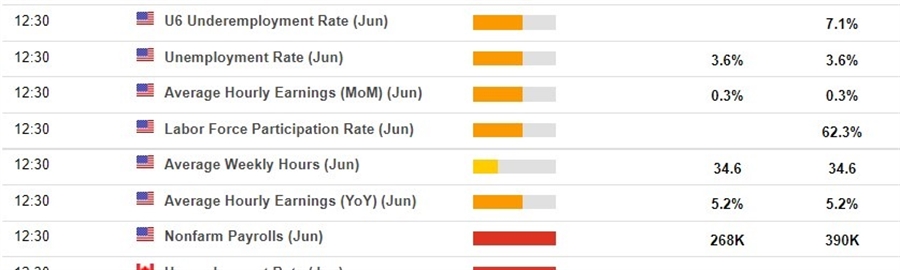

A look at the final numbers shows:

For the trading week all the indices were higher led by the NASDAQ index:

Looking at the Dow 30 this week, the gains were led by:

The Dow losers this week included:

Some big gainers this week included:

Some big losers this week included:

Westpac:

Cites 3 factors:

Hatzius’ forecasts:

Japan was unlikely to intervene in the FX market to stop it from sliding, 45% of 22 poll respondents said.

Ten of 22 poll respondents said Japan would not intervene.

—

USD/JPY update: