Archives of “October 29, 2021” day

rssThe next big shoe to drop in the global bond market

Bund yields have been sub-zero since Q2 2019

The bond market is all over the place. The hawkish shift from central banks (aside from the ECB) is being met with dislocations and some nasty, whippy moves.

It’s month end so that might be feeding through but it’s tough to hear what the bond market is saying.

Technically though, there’s one spot that could set off waves of further dislocations. That’s the 10-year German bund. Today yields moved up 7 basis points and it’s now yielding -0.08%. That’s a hiccup away from a return to positive yield. It’s also threatening to break the high of the year, which could set off a cascading move.

Given the chop in FX and bonds, it’s tough to see how this all shakes out but you would think it leads to some euro inflows, if only among those who have to hold bunds and would be able to lock in a meager return.

Major European indices end the day mostly higher

France’s CAC +0.3%. German Dax down -0.1%

the major European indices end the day mostly higher. The exception is the German Dax which fell marginally. The Italian FTSE MIB is also a little lower.

The provisional closes are showing

- German DAX, -0.1%

- Francis CAC +0.3%

- UK’s FTSE 100 +0.1%

- Spain’s Ibex, +0.35%

- Italy’s FTSE MIB, -0.05%

for the trading week,:

- German DAX, +0.94%

- France’s CAC +1.44%

- UK’s FTSE 100 +0.4%

- Spain’s Ibex +1.7%

- Italy’s FTSE MIB +1.2%

For the month the major European indices also had solid gains:

- German DAX, +2.81%

- France’s CAC, +4.76%

- UK’s FTSE 100, +2.26%

- Spain’s Ibex, +3.0%

- Italy’s FTSE MIB +4.7%

Chinese stocks are underperforming the world for a ninth month in October. That’s the longest stretch since HSCEI data going back to 1993.

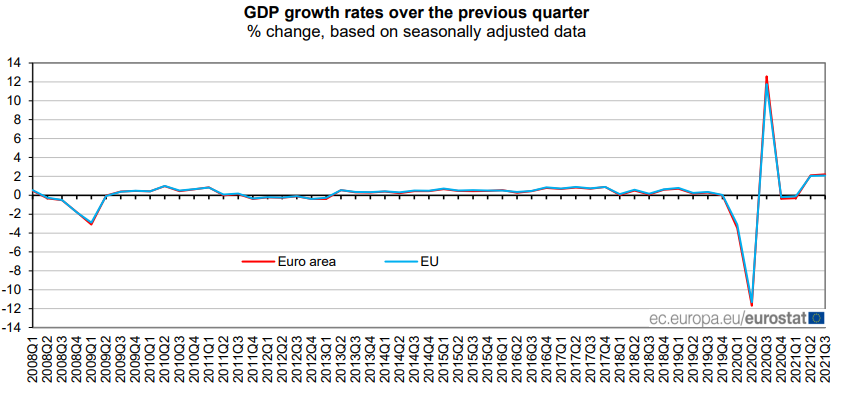

Eurozone Q3 preliminary GDP +2.2% vs +2.0% q/q expected

Latest data released by Eurostat – 29 October 2021

- Prior +2.2%

- GDP +3.7% y/y

- Prior +14.3%

The euro area economy grew by a little more than expected as overall conditions picked up further after the easing of restrictions that began in Q2. The outlook is still a worry though considering rising inflation and supply bottlenecks persisting.

Beijing to enact more virus prevention measures as China seeks to curb latest COVID-19 outbreak

Beijing is chasing zero cases ahead of the upcoming Winter Olympics

The latest flare-up in COVID-19 cases in China has seen more than 200 persons contract the virus since 10 days ago and that is prompting local authorities to take strict measures in preventing a further spread of infections across the country.

Three cities (Heihe, Lanzhou, and Ejin) have already been placed in lockdown this week as China sticks to its zero tolerance approach when dealing with the virus.

Amid the switch in focus to ‘common prosperity’, economic figures from China may not be as crucial as before but they are still important when assessing the global situation. As such, the virus trend and lockdown measures are key things to be mindful about.

Bank of Canada rate meeting : what’s the takeaway?

BoC

The hawkish tilt was in the headlines. QE has ended and rate hikes are now expected sometime in the middle quarters of 2022. Prior to the meeting the expectations were for the BoC to reduce QE from CAD$2 billion per week to CAD1$ billion per week and interest rate hikes were not expected until the second half of 2022.

GDP revised lower

The 2021 GDP figure is now revised lower to 5.1% from 5.0^% expected and 6.0% previous. However, 2022 and 2023 growth was both revised higher

Inflation concerns

Like most central banks the BoC expressed its concern for rising inflation. The BoC is now ‘closely watching inflation expectations and labour costs to ensure that the temporary forces pushing up prices do not become embedded in ongoing inflation’. The causes for the inflation by the BoC is seen as increased demand for goods, but shortage in labour and production & distribution alongside surging energy prices.

The output gap

The output gap is the difference between GDP and the potential GDP. It gives you a snapshot of how the economy is performing compared to its possible performance. The current gap is less than it was in Q2 (-3 to -2%) and is now at -2.25 and -1.25%. The gap is expected to close around the middle quarters of 2022.

Summary

It was good news for the CAD out of the meeting and this should result in some CAD strength over the medium term, at least on dips as it could be argued that much of the good news was priced in. If the BoE push back against the strong rate hikes projected by SONIA futures next week (no less than four 25bps hikes projected for 2022) then more GBPCAD downside looks attractive. Be aware this outlook is dependent on the BoE meeting next week as there needs to be a deeper divergence between the BoC and the BoE to initiate a medium term trade.

While still trading at distressed levels, Evergrande USD bonds have rallied hard these last two weeks.

Hertz Global CEO Says Tesla Interest Exceeds Expectations, Website Visits Surge to More Than 10,000/Day – Bloomberg, Citing Interview

By submerging Bitcoin Miners in liquid, heat and noise is reduced by 95% and we can recapture up to 40% of the heat and convert this to power.

Bitcoin will be 100% green by 2024. No other system will be more green.