Archives of “October 27, 2021” day

rssChasing women, by Aaron Clarey

European major indices close lower

Euro Stoxx index comes off a record close reached yesterday

The major European indices are closing lower on the day. It comes a day after the Euro Stoxx 600 index closed a record level yesterday. Today, the index was down -0.1%.

Other provisional closes shows:

- German DAX, -0.4%

- France’s CAC, -0.2%

- UK’s FTSE 100, -0.3%

- Spain’s Ibex, -0.3%

- Italy’s FTSE MIB, -0.5%

In other markets as European traders move toward the exits for the day:

- Spot gold is trading marginally lower at $1792.40.

- Spot silver is down eight cents or -0.31% at $24.07.

- WTI crude oil futures are trading at $83.32 down -1.57%

- The price of bitcoin trades at $59,000

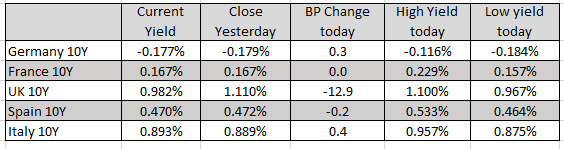

European benchmark 10 year yields are closing mixed in up and down volatility. The UK 10 year yield is down the most at -12.9 basis points but France (unchanged), Germany (+0.3 basis points), and Italy (+0.4 basis points) saw yields close marginally higher (but well off high levels as well).

Big squeeze underway in bonds

UK leads the way

Lower debt issuance in the UK appears to have set off some kind of short squeeze. UK 30s are now down 15.5 bps to 1.163%. Gilt yields are also down 11 bps and through the key 1% level.

The move is spreading globally to a lesser extent and bears very close watching.

The move in UK yields isn’t having much of an effect on GBP but the sands are shifting. Also note that there is a US 5-year auction today.

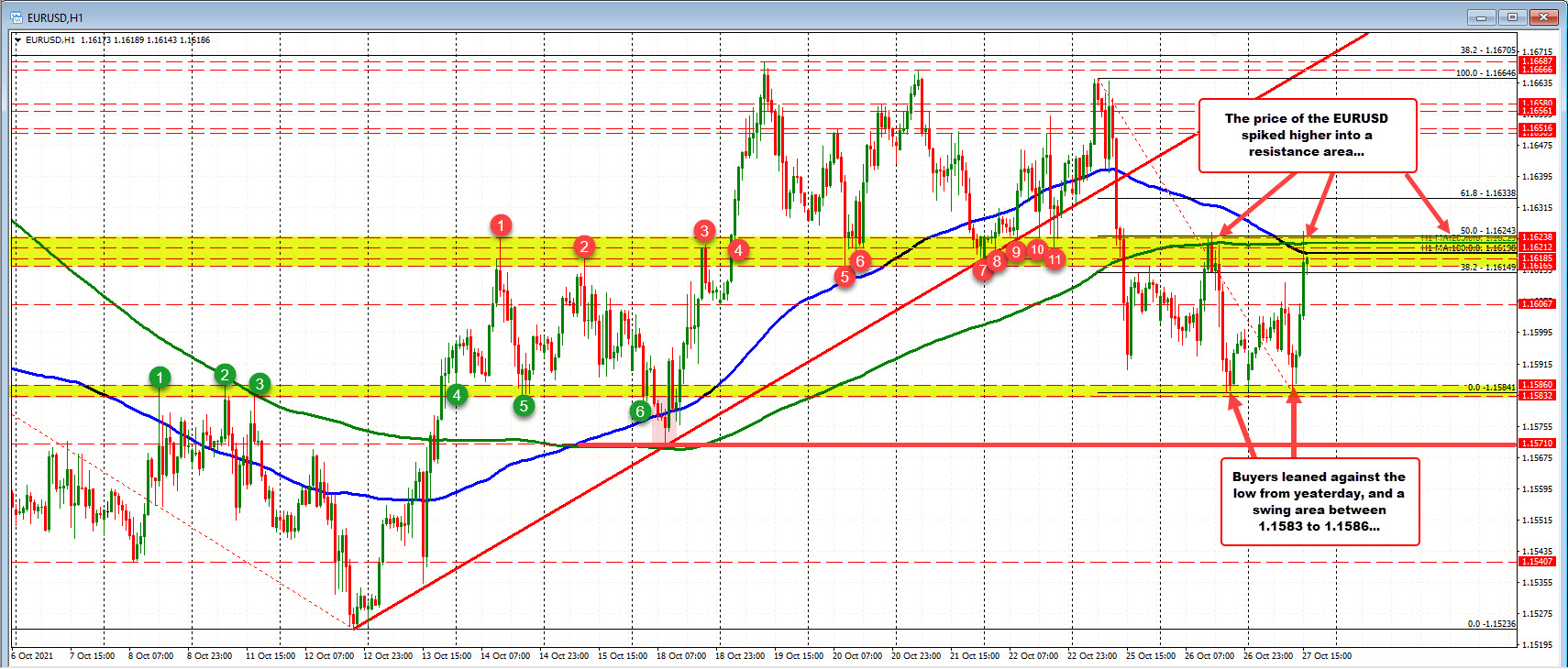

EURUSD snaps higher toward the midpoint of the range this week

100/200 hour MAs and swing area tested at the highs.

The EURUSD spiked higher in early US trading after the pair bounced off the low from yesterday and a swing area between 1.1583 to 1.1586. The low for the day reached 1.15841 before bouncing higher over the last 3-4 hours of trading.

The spike higher has seen the price move back up toward the highs from yesterday (so the range is pretty much covered).

- The high yesterday reached 1.16251.

- The price just printed 1.16254.

- Also near the high are swing levels going back to October 14 between 1.1616 and 1.16238, and

- the 100/200 hour MAs at 1.16198 and 1.16223 respectively.

The current price trades at 1.1618 between that resistance area between 1.1616 and 1.16254. A move below with momentum should increase the bearish bias. Conversely, if the area does hold close support, getting and staying above the swing area would open the upside.

Fitch downgrades yet another Chinese property developer

Kaisa Group downgraded to ‘CCC+’ on refinancing risk

Kaisa is a familiar name when it comes to this as it was the first Chinese property developer to default on its dollar bond coupon back in 2015. The firm came back from the dead to return to the debt market in 2019 but is facing more troubles once again now.

Just be wary that Kaisa has $3.2 billion of international bonds to repay next year, second only to Evergrande which has $3.5 billion.

Fitch says that the downgrade reflects Kaisa’s limited funding access and uncertainty over refinancing of significant US dollar bond maturities and coupon payment through to 2022. This will be something to watch out for in the months ahead.

Dollar, yen gains as long-end yields fall

10-year Treasury yields have fallen by over 2 bps to 1.596% on the day and that is seeing the yen gain further across the board but at the same time, major currencies are also seen slipping against the dollar and franc as well.

I’m not seeing any major hints of risk-off outside of FX but the action in the bond market is definitely interesting as long-end yields are falling at a much quicker pace than the short-end of the curve. 2-year Treasury yields are still up 1.5 bps at 0.499% now.

European equities are still keeping lower, down by about 0.3% to 0.5% while US futures have erased their light advance to be down 0.1% for the time being.

Going back to the long-end of the yield curve, 10-year yields are looking set for a fourth consecutive daily fall after clipping the 1.70% mark last week.

While breakevens are still elevated, real yields are still subdued and that underscores some real fears surrounding inflation and the economic outlook going into year-end.

For now, we’re seeing some of that weigh on FX with EUR/USD falling from 1.1605 to 1.1590 and USD/CAD rising to its highest in nearly two weeks above 1.2400:

Elsewhere, AUD/USD has also pared its earlier advance from 0.7520 to 0.7490 and NZD/USD has fallen from 0.7155 to 0.7130 levels currently.

Meanwhile, USD/JPY has also slipped from 114.00 to 113.55 with large expiries seen nearby now alongside minor support closer to 113.41.

Richest families!

The $1+ trillion dollar company club

US authorities have revoked the authorization for China Telecom to operate in US

China Telecom’s U.S. subsidiary has been given 60 days to discontinue U.S. services after nearly 20 years of operating in the country.

The U.S. Federal Communications Commission (FCC) voted on Tuesday voted to revoke authorization to operate, citing national security concerns:

- FCC said China Telecom “is subject to exploitation, influence, and control by the Chinese government and is highly likely to be forced to comply with Chinese government requests without sufficient legal procedures subject to independent judicial oversight.”

- which rasies “significant national security and law enforcement risks by providing opportunities” for the company and the Chinese government “to access, store, disrupt, and/or misroute U.S. communications.”