Archives of “October 25, 2021” day

rssThe market tends to overestimate Fed hiking

A reminder

US 2-year note yields are down 3.7 bps to 0.427% today in a retracement after the march higher from 0.2% at this time last month.

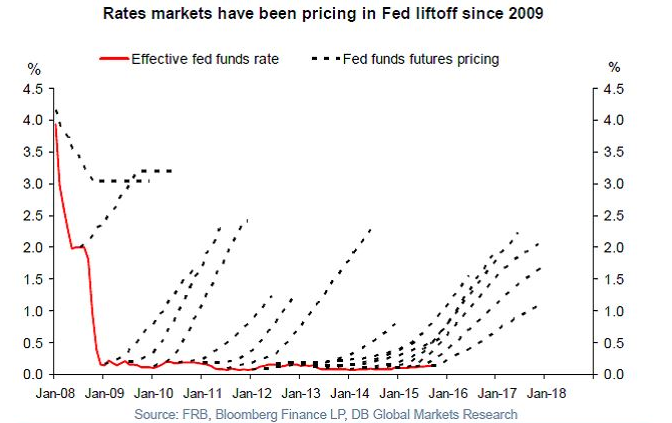

We’re in the post-pandemic era but that doesn’t mean it’s time to forget all the lessons of the post-financial crisis era. One of the big ones was that the market consistently overestimated Fed hiking.

Here’s a chart that clearly shows mistakes in futures pricing:

That’s worth keeping in mind as the market begins to price aggressive rate hikes.

Maybe this time is different but the most recent Fed projections showed a slightly better than 50/50 chance of a hike next year while the market is pricing in two hikes.

For now the trade is likely to pricing more hikes but at some point it will run too far. I spoke with Reuters about the Bank of Canada and pricing for four hikes next year and four the year after.

“Central banks are being bullied by the market at the moment,” said Adam Button, chief currency analyst at ForexLive. “At some point the Bank of Canada has to acknowledge a shift in market expectations or push back more strongly.”

The Bank of Canada decision is on Wednesday and that will set the tone for the Fed and others.

European equity close: Mixed bag to start the week but mostly higher

Closing changes for the main European equity bourses:

- German DAX +0.5%

- UK FTSE 100 +0.3%

- Frrench CAC -0.1%

- Spain IBEX +0.3%

- Italy MIB +0.8%

Italian stocks got an extra lift after clearing the August high:

Bundesbank says German economic growth to slow significantly in Q4

Bundesbank remarks in its latest monthly report

- Services momentum to slow considerably, industrial supply chain issues to persists

- Full-year growth likely to be “significantly” below June forecast of 3.7%

- Inflation to continue rising for the time being, before gradually declining next year

This fits with the narrative surrounding the euro area economy at the moment, with the ECB also likely to tone down their optimistic take on the outlook derived during the summer. As supply and capacity constraints persist for a protracted period of time, expect that to weigh more heavily on the German economy going into next year.

Actually if you get the vax then you become immortal

China says will probe coal, energy price index providers

China continues to try and address the power crunch

China continues to try and address the power crunch

The energy crisis in China isn’t getting much better as they have ramped up electricity imports from its neighbours in a report late last week here.

Local authorities are still doing what they can in order to try and prevent a surge in prices and keep it from impacting consumers and businesses especially, in fears that it will throw the economy out of whack even more than it has been as of late.

China’s President Xi says opposes unilateralism, protectionism, hegemony, zero-sum games

Xi speaking, aiming his comments at the US and its allies. Relations between the US and China are thawing a little but its not smooth sailing yet.

Xi speaking along the ,lines that:

- China has always worked together with people across the world in defending intl fairness and justice.

- China firmly opposes hegemony and power politics.

- Chinese people firmly support developing countries’ just fight for sovereignty, security and development interests.

Goldman Sachs on oil – see demand rising to 100m bbls/day or more

GS cite as a partial driver a switch from expensive gas to oil.

- Say that’ll drive demand further by at least 1m bbls a day

China continues to try and address the power crunch

China continues to try and address the power crunch