Archives of “October 22, 2021” day

rssEvergrande main unit says cannot guarantee that financial obligations will continue to be met

A statement released by Evergrande main unit, Hengda Real Estate

The statement reads that it has not made substantial progress in disposing Evergrande assets and that the firm cannot guarantee it will be able to continue to meet financial obligations under its contracts.

Adding that if Evergrande fails to meet obligations and cannot reach alternative plans with creditors, it will have a significantly negative impact on the group.

That’s a bit concerning ahead of the 29 October deadline for the next offshore bond payment due date lapse. Risk trades are taking the headline in stride for the most part but expect nerves to show up if there are more default rumours in the next few days.

Eurozone October flash services PMI 54.7 vs 55.5 expected

Latest data released by Markit – 22 October 2021

- Prior 56.4

- Manufacturing PMI 58.5 vs 57.0 expected

- Prior 58.6

- Composite PMI 54.3 vs 55.2 expected

- Prior 56.2

Softer readings across the board, with overall business activity growth weakening to its slowest in six months. The details reveal that supply bottlenecks are a key issue, weighing on manufacturing output as it slumps to its weakest in 16 months.

Adding to that is a survey-record increase in prices, as firms reportedly sought to pass on the rise in costs on to customers. Markit notes that:

Evergrande makes bond payment but be mindful that there are other names in a tough spot too

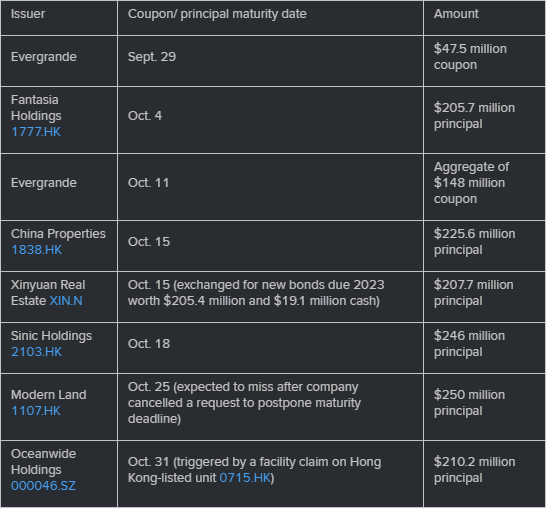

Evergrande may have averted a formal default (for now) but it isn’t the only name that is under pressure in the Chinese property sector.

The market may be focused on the next key deadline for Evergrande, that being 29 October (which relates to the non-payment on 29 September) but there are also other developers who have missed or are set to miss out on their offshore bond payments.

Here is a neat list compiled by Reuters:

AUD: The commodity currency

AUD & the drivers

One key to understanding the AUD well is not only how the central bank policy impacts the AUD. It is also how other markets impact it. This article will outline some of the major influences that go into the Australian dollar.

Influence #1 China

China is the world’s second largest economy. It is also the largest export market for Australia. This means that good news for China is also good news for Australia. The relationship means that sometimes the AUD is traded as a proxy for the Yuan. Expect good china news to lift the AUD as a general rule of thumb.

Influence #2 Iron Ore

Recently AUD prices have been heavily sold as China cut down on its steel mills usage. Iron Ore makes up around 20-25 % of Australia’s total exports. Around 80% of these go straight to China. So, you can see how influence 1 and influence 2 are correlated. Strong Iron ore prices is a positive for the AUD and vice versa.

Influence #3 Coal

Again another top export for Australia making up around 12-17% of total exports depending on your source.Recently notice that whereas Iron Ore prices have been falling, coal prices have been rising. See chart below

Influence #4 Gold

Gold mining is big business down under and around 5% of total Australian exports come in through the precious metal.

So, as well as considering the influence of the Reserve Bank of Australia and the USD make sure you include these other influences.

Federal Reserve Chair Powell and San Fran President Daly to speak Friday

Federal Reserve Bank of San Francisco President Mary Daly will take part in a conversation:

- “Facing an Uncertain World: the Federal Reserve and Climate Change Risk”

- This at an event hosted by the American Enterprise Institute

- at 10am US ET time, which is 1400 GMT

Following at 11am US ET time, 1500 GMT, is Federal Reserve Chairman Jerome Powell

- to participate in BIS-SARB Centenary Conference panel discussion before Virtual Bank for International Settlements-South African Reserve Bank Centenary Conference.

Reports that China has waived tax collection for coal miners, heating firms

Now the carrot, not collecting taxes to encourage greater output. That’s the substance of reports anyway. No further info at this stage.

China construction activity and industrial metal prices Down pointing backhand index Draw your own conclusions.

You Are Not Your Trades

It’s also crucial to remember that you are not your trades. You may want a particular trade to happen, but it doesn’t mean it will go the way you initially thought.

So try and stay away from those “if only” thoughts because those can mess with your emotions.

One of the most important things for traders is not to take their trades personally. This might seem difficult at first because there are real money consequences when it comes to trading, but it’s important to remember that you are not your trades.

Your feelings about what happens don’t affect the market itself, so try to separate yourself from your trading decisions.

What does “Memento Mori” mean?

The most successful generals in ancient Rome were awarded a “triumph” entry into the capital city on their return from victorious campaigns. It was a magnificent spectacle and parade that was meant as a ceremony to honor and appreciate the war won by a commanding general. The triumph was the biggest tribute awarded to a military commander in Rome. It was usually the peak of a general’s long military career. It was a thank you from the legions and population as an act of appreciation and respect.

While this was created to reward the current general and help motivate future generals aspire to greatness it worried the Roman senate that this could cause a general to grow too ambitious and power hungry. The senate had an idea to help keep a general’s ego in check during this process. While the honored general would be in his chariot adored by the Romans, a slave would remain sitting behind him and whisper in his ear “Memento Mori”. Many believe that this was had a larger meaning like many Latin phrases and could be fully translated into English as “Remember that you are a mere mortal and that you will die one day.” This phrase was said by a mere slave to remind the ambitious general that power and fame aren’t permanent, and that he would eventually die.

This was done to create a realistic perspective for someone who at the height of their power and success may be deluded into thinking they are a god or invincible. It was hoped to keep their ambitions in check as they realize they could go from a god in their mind to a corpse in a grave in a short amount of time.

This is a good reality check for traders, investors, executives, entertainers and politicians who have the delusion of invincibility that could lead to arrogance causing them to fall from the pinnacle of success to the rock bottom of failure and even in some cases death.

Remembering that you are a mortal and will one day die can help you keep a realistic perspective during your greatest success. Pride comes before the fall but staying humble can keep pride from becoming a weakness.