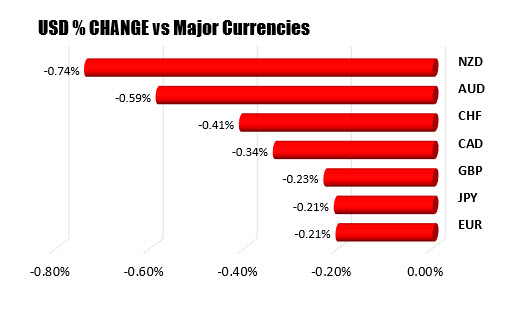

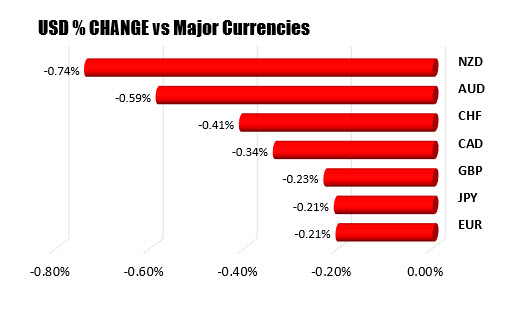

USD is the weakest of the majors

The Dow industrial average is trading to a new record high. The move surpassed the old high at 35631.19.

Over all these years, it has been an honour and a matter close to my heart to represent the Bundesbank as an institution – and thus all of you – and to shape the Bank’s positions together with you in the interest of a stable currency, a stable financial system, stable payment systems and a secure cash supply. I know of no other institution where so much expertise meets so much commitment to the manifold important public tasks.

This makes the decision to ask the Federal President for my release from office on 31 December 2021 all the more difficult. But I have come to the conclusion that more than 10 years is a good measure of time to turn over a new leaf – for the Bundesbank, but also for me personally.

I wish you continued determination, fortune, but also satisfaction in your important tasks. Remain an audible voice of reason in public discussions and preserve the Bundesbank’s important stability policy legacy, which makes this institution so unique. At the same time, I hope that you will remain fond of me and try to understand my decision.