Archives of “October 18, 2021” day

rssGrowth of the internet, 1969 to 1977:

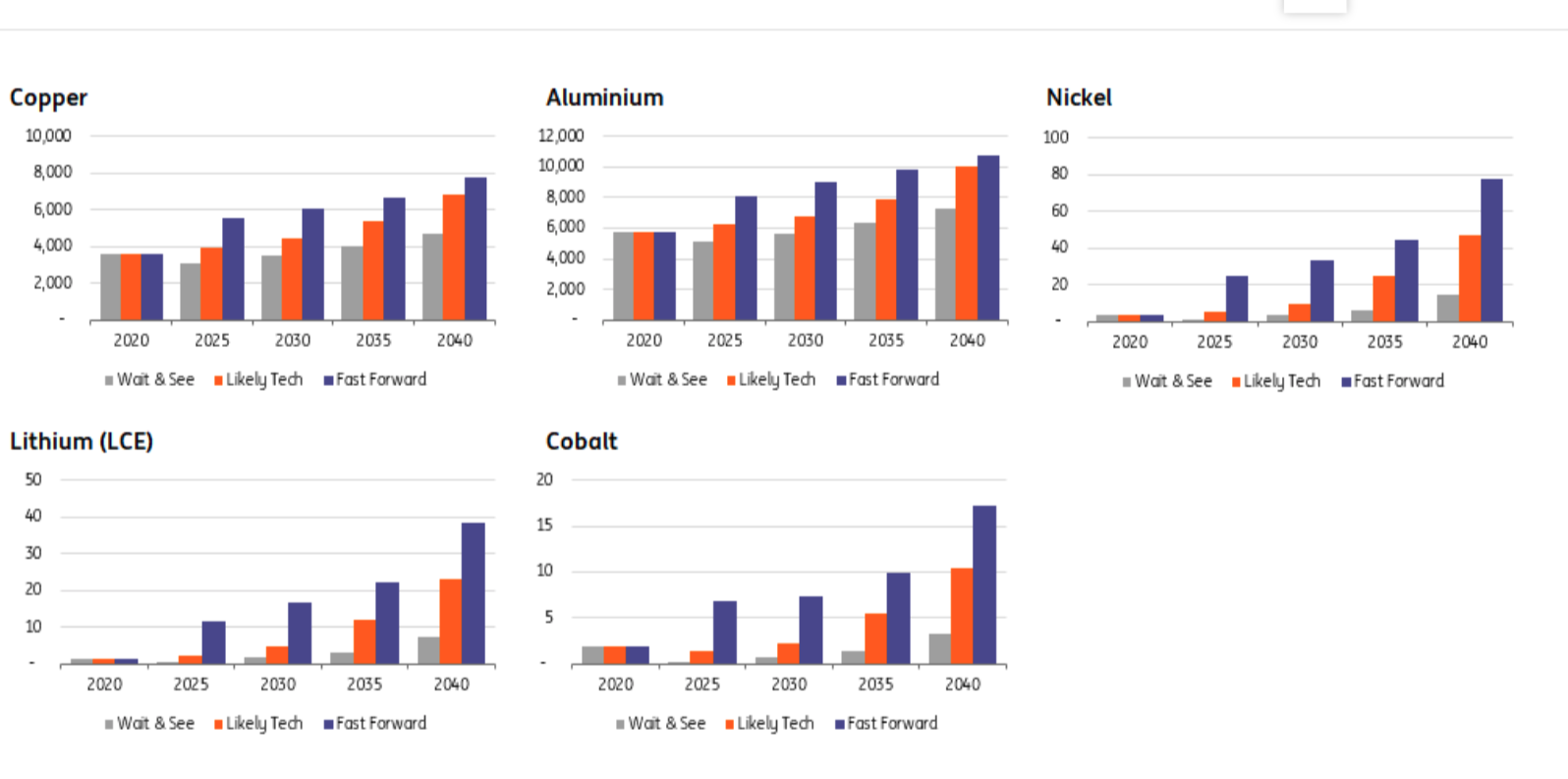

Metals set to gain in a green world

NG have an interesting piece here where they make a case for rising metal demand. They have a three fold scenario outlook which ranges from ‘wait and see’ through to ‘fast forward’. These projections essentially show their slowest projections up to their fastest. The key areas that are going to develop are things like energy storage, transmission cables, and distribution cables. The IEA see at least around 79 million KM of the stuff on the way.

The bottom line of ING’s research is as follows in terms of metal demand. However, remember their caveat that some technologies need for metals may change as the technology changes.

Wind is number one

Wind is to hold the biggest share of the power mix by 2040 under the two faster progression speeds. Copper and aluminium are the winners under this scenario.

China Q3 GDP +0.2% q/q (expected +0.5%)

China July to September 2021 economic growth data comes in at 0.2% q/q for a miss

- expected +0.5% q/q, prior was +1.3%

And 4.9% y/y

- expected +5.2% y/y, prior was +7.9%

January – September GDP is 9.8% y/y

more to come

Q3 saw a renewed round of COVID-19 outbreaks and restrictions, supply chain bottlenecks and a relatively tight PBOC policy stance.

Oil (WTI) futures up $1, and in China copper & coal higher while iron ore is lower

Commodities kicking off with a solid beginning to the week with coal and copper futures in China trading higher.

- iron ore is lower though

Meanwhile in US overnight trade CL (oil) is up $1 or so.

Across FX after earlier rises EUR, AUD, NZD GBP have all turned down against the dollar. USD/JPY also falling away. US equity index futures following a similar pattern.

Bitcoin is on approach to its earlier weekend high circa $62,700 and thereabouts. Its been underpinned by the imminent launch of BTC futures ETFs.

Global Indices :#Nikkei #HangSeng #ShanghaiComposite #FTSE100 #CAC #DAX #RTSI —#AnirudhSethi

To read more enter password and Unlock more engaging content

An Update :::::#DOW #SPX500 #NASDAQCOMPOSITE : #AnirudhSethi

To read more enter password and Unlock more engaging content

“Perfect storm” to keep US inflation at its highest in 30 years

Daiwa Capital Markets list supply-chain bottlenecks, tight labour markets, ultra-easy monetary and fiscal policies as likely to keep US inflation its highest since 1991.

The comments are contained in a Wall Street Journal report on economist survey expectations for US CPI in the months ahead, in brief:

- Economists on average see inflation at 5.25% in December, just slightly less than the rate that has prevailed since June. Assuming a similar level in October and November, that would mark the longest inflation has been above 5% since early 1991.

- will drop to 3.4% by June of next year, then 2.6% by the end of 2022

Here is what’s on the economic calendar in Asia today – China Q3 GDP & September Activity data

2130 GMT New Zealand services PMI for September

- BusinessNZ Performance of Services Index (PSI), prior

- unlikely to have too much immediate impact on NZD

2145 GMT NZ CPI – inflation in New Zealand for Q3

- CPI expected 1.4% q/q, prior 1.3%

- CPI expected 4.1% y/y, prior 3.3%

- The RBNZ is assessing the inflationary trend in NZ as broad-based, which contributed to their reading for their rate hike earlier in the month, and likely more to come.

- Later in the NZ day will the Reserve Bank of New Zealand’s own measure of inflation. This is due at 0200 GMT. I’ll have more to come on this separately.

- prior 0.3% m/m and 5.8% y/y

- expected +0.5% q/q, prior was +1.3%

- expected +5.2% y/y, prior was +7.9%

- Renewed coronavirus outbreaks and associated shut-ins, port closures impacting during the quarter

- Industrial Production

- Fixed Assets

- Retail Sales

Russia’s Novak says ready to increase supply to Europe

Russian Deputy Prime Minister Alexander Novak spoke on Saturday.

He said that despite record-high gas consumption in Russia and his intention to refill its own gas storage reserves before it increases supplies to Europe, he would increase supplies to Europe should it be requested.

via Reuters, link (not a lot more)