Archives of “October 18, 2021” day

rssQE = Welfare for the rich US is a socialist country, but for the rich.

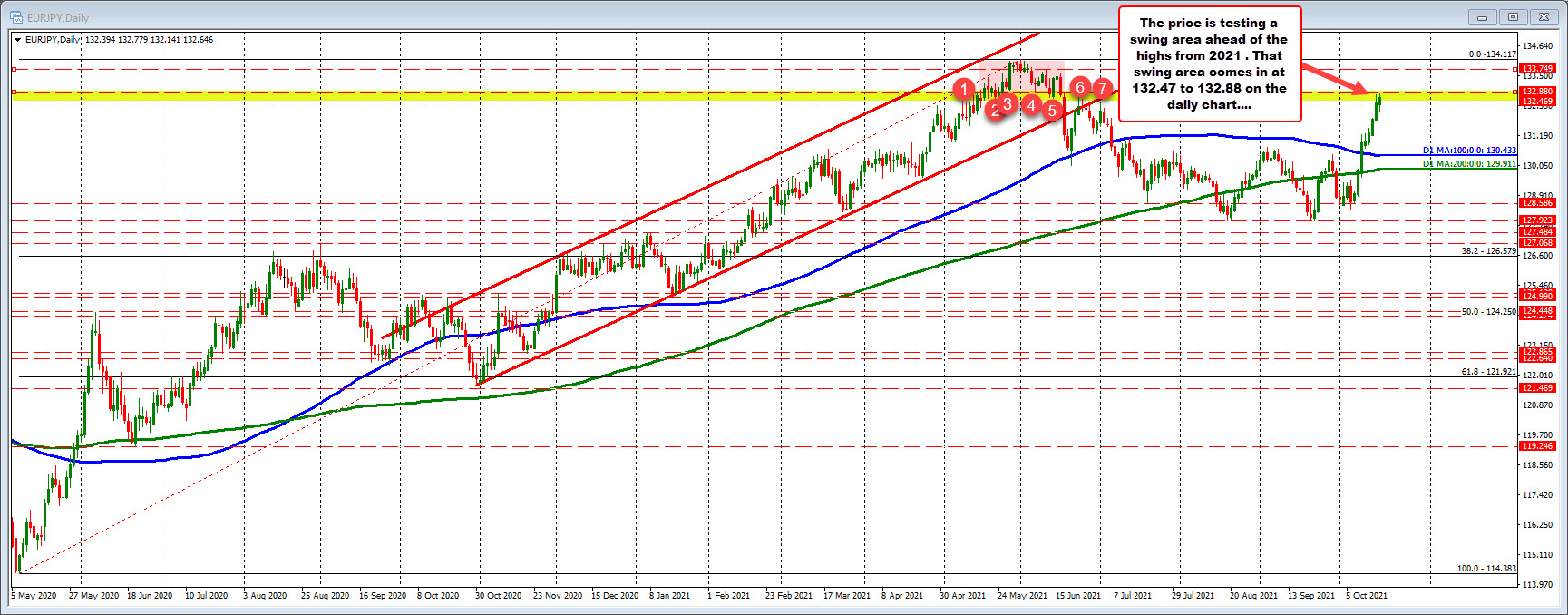

EURJPY works on 8th straight day to the upside

Price trades at the highest level since June 17

The EURJPY is up for the eighth straight day. In the move higher, the price last week extended above both its 200 day moving average (currently at 129.91) and the 100 day moving average (currently at 130.433). There has been little in the way of a correction since the breaks.

The price is currently up around 19 pips at 132.69. The high price reached 132.78. In moving higher, the price has moved into the a swing area for the second consecutive day on the daily chart below between 132.469 and 132.88. A move above that area would push the price into the high extreme for the year up to the end of May/early June high at 134.117.

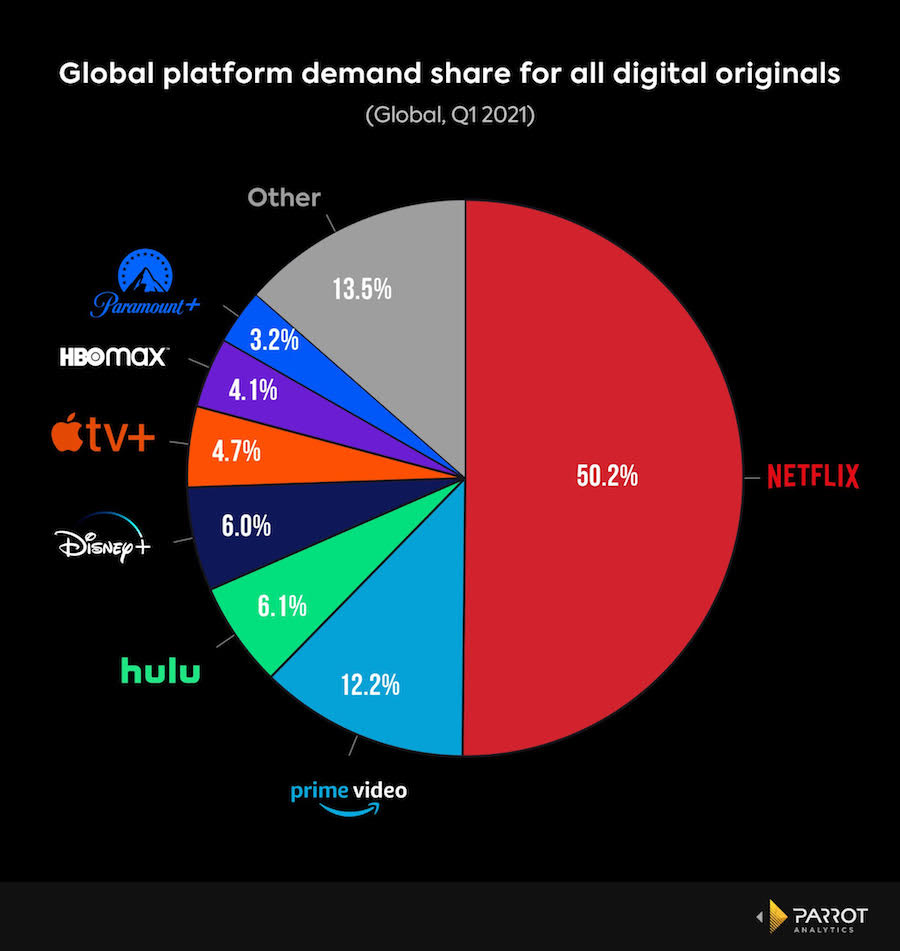

New Platforms Gaining Demand Share at Expense of Netflix

US 5-year yields hit a new cycle high as rate hike probabilities rise

Rates higher across the curve

The belly of the curve is leading the way again today with US 5s up 7 basis points to 1.19%. That’s the highest since the pandemic got underway.

It’s not a consistent picture in the yield curve with 2s up 4 bps then 5y and 7y yields up 6-7 bps. It moderates from there with 30-year bonds flat.

That paints a picture (at the risk of reading too much into it) of the Fed moving sooner and more aggressively but ultimately snuffing out inflation at too-low rates.

Fed implied probabilties show that a Fed hike next July is now more likely than not, at about 60% with a decent chance of two hikes by then. A month ago, there was an 85% chance of no hike.

The other likely driver today is energy. Oil is up another 1.6% today after 8 straight weeks of gains. The surge in metals also continues.

The move in bonds is beginning to spill over to USD/JPY, which has quickly recouped the dip a short time ago. Stock futures are also losing some ground.

#Tin futures have streaked up to a new 2021 high.

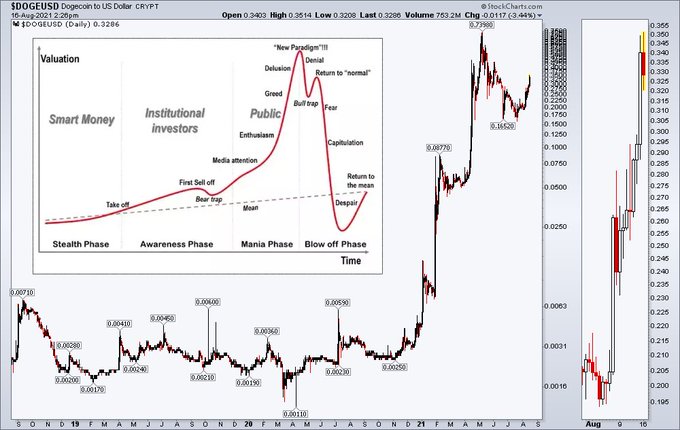

Will China’s cryptocurrency ban slow a wider adoption of digital coins?

An overview of China’s crackdown on cryptocurrencies

Cryptocurrencies in China have been under constant threat, but they have never been considered illegal. This scenario could change. In late September, Chinese regulators stated that mining cryptocurrency and crypto trading or crypto use as legal tender is forbidden. The statement came from the Chinese central bank, the People’s Bank of China, citing the need to regulate and maintain national security. China has tried to curb the use of digital coins for more than eight years. The Chinese government is transparent in saying that cryptocurrencies are not legitimate coins, and their existence is a risk to the Chinese financial sector. Before this announcement, the crackdown on cryptocurrencies by the Chinese government had been piecemeal. This statement was the first that laid down the gauntlet. The question for investors is whether the Chinese ban on cryptocurrencies will slow the broader adoption of cryptocurrencies.

What Has Changed from Prior Crackdowns? (more…)

Long thermal #coal, short Indian economic growth? Macquarie chart.

The transitory narrative continues to fall apart Mon 18 Oct 2021 08:43:23 GMT

K 2-year gilt yields climb by 15 bps on the day, the most since 2010

The front-end of the curve is repricing things rather quickly now and all of it is pointing to higher rate expectations as the story of rampant inflation in the months ahead is set to become the dominant theme. Team transitory is basically throwing in the towel.

US 2-year yields are also up to their highest since March last year, keeping a push above 0.40%. In terms of central bank pricing, a rate hike for the Fed is fully priced in for September 2022 while a rate hike for the BOE is fully priced in for December (!) this year.

While equities and FX are relatively sanguine for the time being, expect further moves in rates to have more significant reverberations if this keeps up.

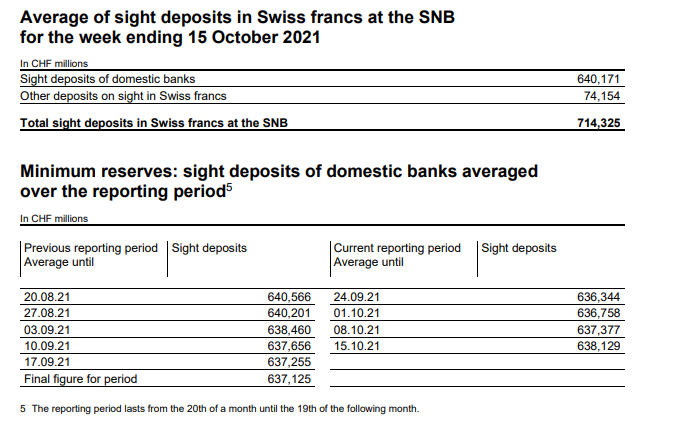

SNB total sight deposits w.e. 15 October CHF 714.3 bn vs CHF 714.1 bn prior

Latest data released by the SNB – 18 October 2021

- Domestic sight deposits CHF 640.2 bn vs CHF 638.4 bn prior

Little change in terms of overall sight deposits once again as the SNB is not really intervening all too heavily in the swissie at least for the time being.