Archives of “October 7, 2021” day

rssEuropean equity close: Bounce back continues

The rebound started midway through yesterday’s trade

European gas prices are down another 10% today after the huge reversal yesterday. That’s taking the pressure off margins, particularly for manufacturers and industrial companies. I flagged the buying opportunity in the DAX yesterday.

- UK FTSE 100 +1.3%

- German DAX +1.8% — best session in 5 months

- French CAC +1.6%

- Spain IBEX +1.7%

- Italy MIB +1.6%

This is a nice three-candle reversal in the DAX:

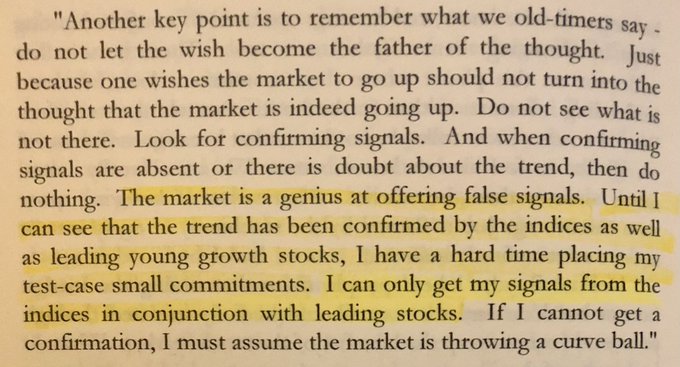

‘How To Trade In Stocks’ – Livermore 1940

The Perfect Speculator

Global food prices in real terms at the higher level in five decades 👇 But at least investors are doing fine in 2021.

Oil slumps further after the surge in energy prices cools

A setback for oil at least in the short-term

WTI crude is now down over 2% to $75.50 levels while Brent is also marked down to just below $80 on the day, as the retreat from yesterday continues.

The retreat in energy prices is playing some part in all of this as the hype cools off but in the case of WTI, it comes as price came close to testing the key $80 mark this week. The high hit $79.76 before things started turning around in favour of sellers.

Right now, the shove lower even sees buyers lose near-term control on a drop below the key hourly moving averages @ $77.04 and $76.04 respectively. The weekly chart has a gnarly-looking candle forming as well so that’s something to be wary of:

We’re also seeing price fall back below key resistance @ $76.88-96 so that is knocking some wind off the sails of buyers in the short-term at least.

A tighter market going into next year may keep prices underpinned but for now, perhaps we have seen a short-term high posted before the next catalyst comes along.

J.P. Morgan’s Michael Feroli weighs in the Federal Reserve trading controversy.

Apple is experiencing record waiting times to deliver the new iPhone 13 as the supply chain issues keep increasing

Market industries in a BEAR MARKET over past 6 months

US Senator McConnell says a short-term debt ceiling vote is possible on Thursday

McConnell now suggesting Thursday as a vote. Democrats have already indicated they’ll be in assent. So, the vote looks set to pass (famous last words?) when it does happen. US government gets funded through to December when we can begin the charade all over again.