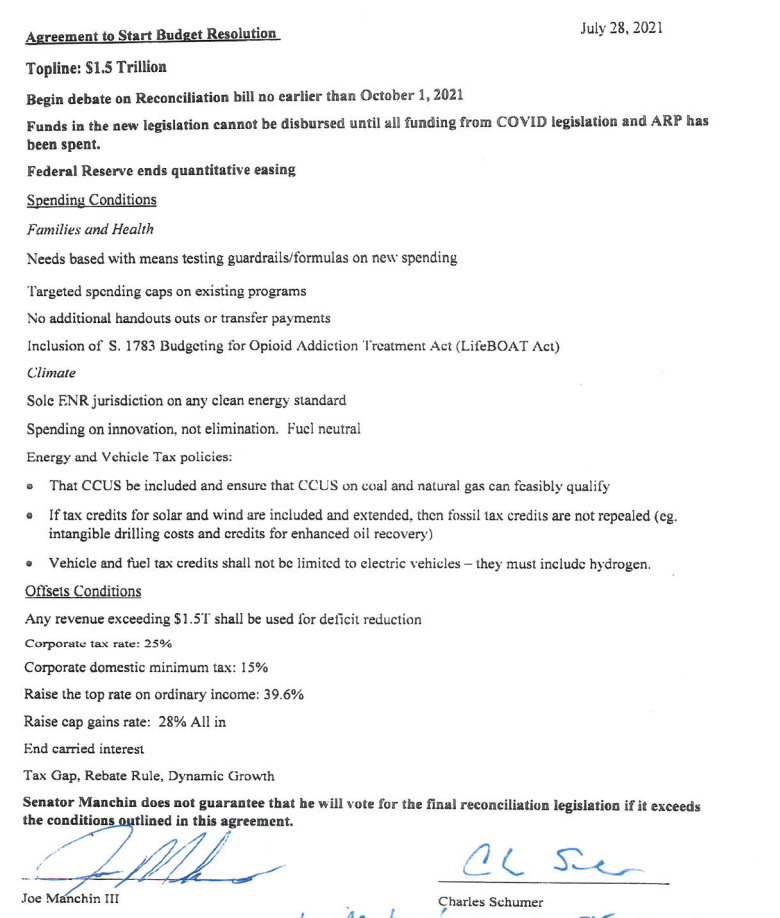

Memo covers tax, energy and spending and tops at $1.5 trillion

It looks like we’re down to the negotiating. Both sides are going to have to give but Biden has been a politician for 49 years. You can argue he’s spent his whole life preparing for this moment.

“Senator Manchin does not guarantee that he will vote for the final reconciliation legislation if it exceeds the conditions outlined in this agreement,” the paper obtained by

Politico reads in bold text.

Manchin proposes raising the corporate tax rate to 25%, the top tax rate on income to 39.6%, raising the capital gains tax rate to 28% and says that any revenue from the bill “exceeding” $1.5T will go to deficit reduction. Also asks Fed to stop quantitative easing program Additionally, Manchin is calling for means testing on as many new programs as possible, “targeted spending caps on existing programs” and “no additional handouts or transfer programs.” Manchin also asks his committee have sole jurisdiction over any clean energy standard

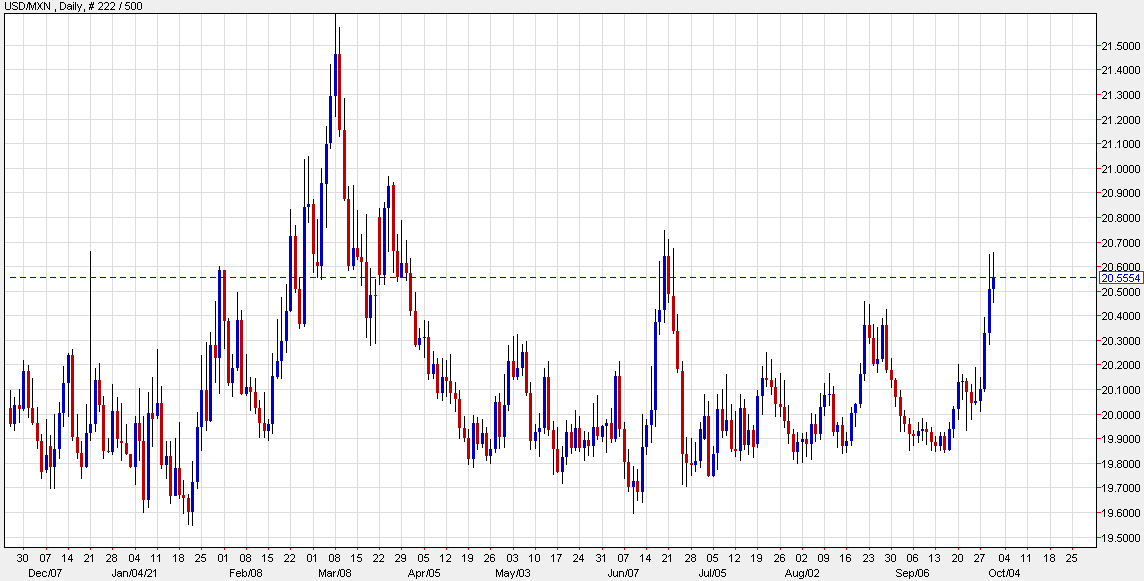

I mean, if his red line is stopping QE; that’s just stupid and this is going nowhere. But it makes me think that none of this is a real red line.

The document is also dated July 28, though they say he’s been redistributing it lately.

The other holdout is Sinema though and the press secretary at the White House yesterday said “it has the sense that Sen. Sinema does want to see a reconciliation bill”. Politico also had this on her:

Biden and the White House have been engaging in breakneck negotiations with Sen. Kyrsten Sinema (D-Ariz.), the other prominent holdout in the Senate. She’s generally aligned with Manchin on the spending number, but has expressed more concerns with Democrats’ tax plans than Manchin has.

Some quick notes:

- Capital gains is currently 23.8%, he would go to 28% “all in” (I’m not sure what the last part means).

- Highest rate would go to 39.6% from 37%

- Corporate rate to 25% from 21%