Archives of “September 25, 2021” day

rssMajor economic releases and events next week

What are the major economic releases and events for next week

Sunday, September 26:

- German federal elections

Monday, September 27:

- ECB Lagarde speak. 7:45 AM

- FOMC member Evans speaks, 8 AM ET

- US durable goods orders, 8:30 AM ET. Estimate 0.7% versus -0.1% last month

- FOMC Williams speaks, 12 PM ET

- FOMC Brainard speaks, 12:15 PM ET

- BOE Gov. Bailey speaks, 2 PM ET

Tuesday, September 28:

- Australia retail sales, 9:30 PM ET, 0230 GMT. Estimate -2.5% versus -2.7% last month

- US conference board consumer confidence, 10 AM ET. Estimate 115.2 versus 113.8 last month

- FOMC Bostic speaks, 3 PM ET

Wednesday, September 29

- US pending home sales, 10 AM ET. Estimate 1.1%

- US crude oil inventories, 10:30 AM ET

- ECBs Lagarde, UK Gov Bailey, BOJ Gov Kuroda and Fed Chair Powell speak at the ECB forum on central banking, 11:45 AM ET/1645 GMT

Thursday, September 30

- China manufacturing PMI , 9 PM ET/0200 GMT. Estimate 50.3 versus 50.1 last month

- US final GDP 2Q, 8:30 AM ET. Estimate 6.7%

- US unemployment claims, 8:30 AM ET. Estimate 328K

- FOMC Williams speaks, 10 AM ET

- FOMC Bostic speaks, 11 AM ET

- FOMC Evans speaks 12:30 PM ET

Friday, September 30,

- German file manufacturing PMI, 3:55 AM ET, estimate 58.5%

- Canada GDP, 8:30 AM ET

- US core PCE price index 8:30 AM ET, estimate 0.2%

- US ISM manufacturing PMI, 10 AM ET. 59.6 estimate

- US University of Michigan consumer sentiment, estimate 71.0

The House will vote on infrastructure bill on Monday and it will be contentious

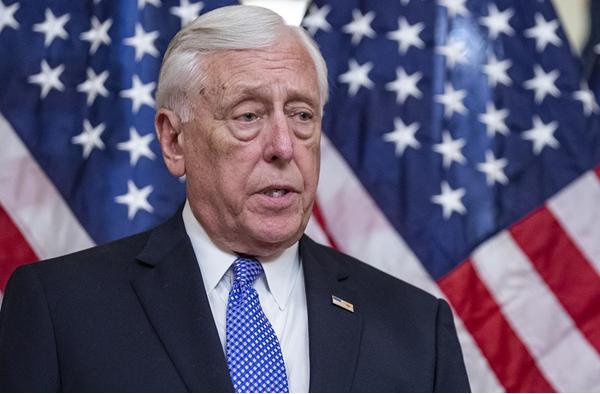

House majority leaders says the vote will take place

CNN’s Manu Raju reports that:

Moderate Democrats met with House Dem leaders in Pelosi’s office for an hour and 15 minutes, and afterward they were was high expectation the vote on the Senate’s infrastructure bill would still occur on Monday. “I’m bringing the bill to the floor on Monday,” Hoyer told us

Pelosi hinted that she doesn’t have the votes to pass it earlier today. Left-leaning Democrats don’t want to agree to this until there’s an agreement on a larger reconciliation bill. It’s tough to guess who backs down here but there could be a failed vote on Monday.

Earlier, the same reporter had this:

[Democratic Congressman] Pramila Jayapal told me at least 50 of her progressive members still plan to vote to sink the infrastructure bill if it goes forward Monday. She added that leadership taking some steps to move ahead on the big reconciliation bill is “not enough.”“I don’t think the speaker is going to bring a bill to the floor that’s going to fail. We have at least 50 people who are not going to vote for the bill. What we need is to take the temperature down a little bit …. The vote is going to drive up tensions not drive down tensions.”

A failed vote could cause some turmoil in markets on Monday.

I tend to see that as an opportunity to buy some kind of dip because you know it’s going to get done eventually, just like the debt ceiling.

US stocks buck early negativity to finish mostly higher

US stocks finish largely unchanged

Futures pointed to a 25 point decline in the S&P 500 at the open but after some early softness the market quickly firmed.

Closing changes:

- S&P 500 +7 points to 4455 or +0.1%

- Nasdaq -0.1%

- DJIA +0.1%

- Russell 2000 -0.5%

On the week:

- S&P 500 +0.5%

- Nasdaq +0.1%

Here’s the weekly chart of the S&P 500:

Thought For A Day