Closing changes for the main European bourses:

- UK FTSE 100 -0.5%

- German DAX +0.1%

- French CAC -0.5%

- Spain IBEX -0.4%

- Italy MIB +0.3%

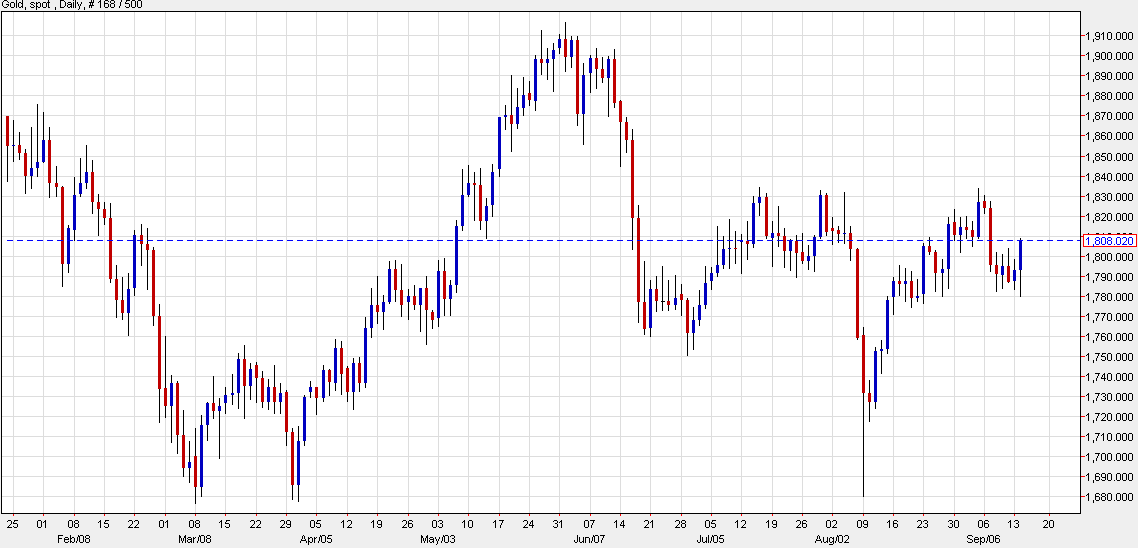

If anything, this is more of a sentiment indicator and shows how the market is roughly positioned and well handled to receive any taper announcement by the Fed in the months to come. As mentioned before, the timeline for the moment fits with:

A good summary on the oil market situation right now as delta variant concerns are still persisting but less impactful as what we saw over the past few months. Adding to that is the hype surrounding fossil fuels amid a cold winter and higher energy prices.

The fact that it came through such a big source (globalnewswire) made it “believable” at first glance and got the market excited. But just as it was quickly tweeted, it was also rather quickly debunked and that sent Litecoin back down to earth in the aftermath.