Archives of “September 4, 2021” day

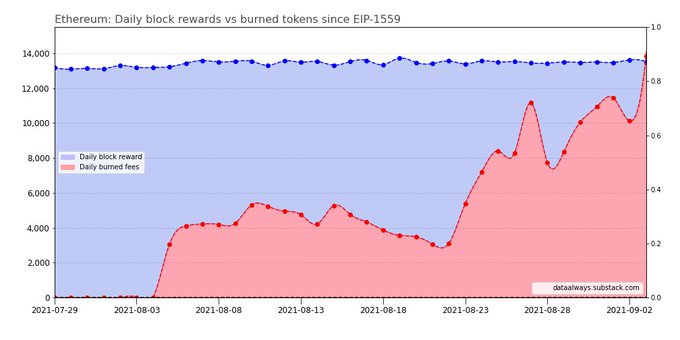

rssEthereum’s first ever deflationary day

If #Bitcoin can reach $1 Trillion, it can reach Hal Finney’s target of $100 Trillion.

Satoshi Nakamoto’s rough draft of the #Bitcoin source code called it the “timechain”, not “blockchain”.

If you look at 15 min, 1h, 4h, daily chart $DXY looks bearish, but if you ZOOM OUT. You can see that $DXY looks bullish. .

What now FED? Print more? Taper? Mfers are trapped.

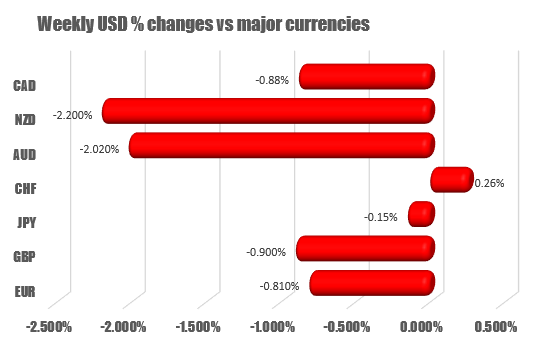

The USD falls vs all the major currencies this week except one

USD falls the most vs the NZD

The USD fell versus all the major currencies is weeks with the exception of one…the CHF.

The US dollar fell the most versus the NZD and AUD as those currencies benefited from risk on sentiment, somewhat improving China and expectations that as Covid spread slows, central banks would start to look toward reversing some of the expansionary policy.

After trading sideways on Monday, the NZDUSD rose on each successive day this week. The pair has risen 9 of the last 11 trading days.

Versus the AUDUSD, the pair was modestly lower on Monday, before also rising on each successive day this week.

For the USDCHF, last Friday, the pair closed near the low for the week. After trying to extend lower early in the session on Monday, the pair moved sharply higher. That moment it was reversed on Tuesday before rallying up to the weeks high on Wednesday and moderating lower on Thursday and again today. Overall, the week was full of up and down price action with only an 88 pip trading range.

The US stocks close mixed. Nasdaq close today is yet another record

&P and NASDAQ close lower

The major indices are closing mixed with the Dow and S&P lower, while the NASDAQ close higher and at a another record. The gain in the NASDAQ was the third gain in a row.

- S&P and NASDAQ have the second straight weekly gain

- Russell 2000 snapped a three day win streak

- Dow lower for the fourth time in five sessions this week

The final numbers are showing:

- S&P -1.44 points or -0.03% at 4535.50

- Dow -74.73 points or -0.21% at 35369.09

- NASDAQ up 32.34 points or 0.21% at 15363.50

- Russell 2000 fell-11.97 points or -0.52% at 2292.05

Looking at the S&P sectors,

- Technology +0.4%

- Healthcare, +0.1%

- Communications unchanged

- Real estate unchanged

The decliners today included:

- Utilities -0.8%

- Materials -0.7%

- Industrials -0.6%

- Financials -0.6%

For the week,

- Dow industrial average fell -0.24%

- S&P index rose 0.59%

- NASDAQ index rose 1.55%

Thought For A Day