Archives of “August 21, 2021” day

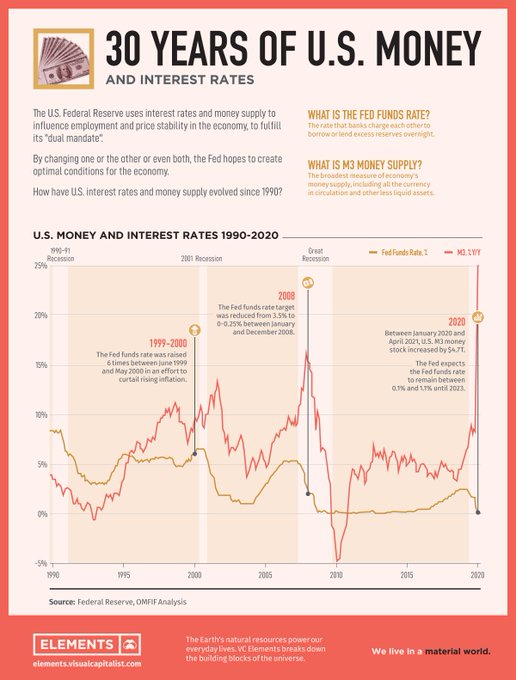

rss30 years of monetary policy. Every excessive printing is followed by a monumental collapse

Key events and releases next week. Jackson Hole symposium the highlight

Feds Powell to speak at 10 AM ET on Friday August 27

Next week’s key events and releases will be highlighted by the Jackson Hole symposium which will take place from August 26 through August 28. The main speech made by Fed chair Powell, will take place on August 27 at 10 AM ET/1400 GMT.

The market will be focused on any time one projections from the Fed chair for taper. There have been a number of Fed officials who have expressed the desire to begin the taper sooner rather than later. However, Feds Kaplan – one of the more hawkish Fed Presidents – dialed back a bit on concerns if the Delta variants starts to impact production.

Other key events include:

Monday, August 23:

- Australia flash manufacturing and services PMI 7 PM ET/2300 GMT

- France flash manufacturing and services PMI. 3:15 AM ET/715 GMT. Estimate 57.1 manufacturing. 56.2 services

- German flash manufacturing and service PMI, 3:30 AM ET/730 GMT. Estimate 65.1 manufacturing and 61.0 services

- UK flash manufacturing and services PMI. 4:30 AM ET/830 GMT. Estimate 59.5 manufacturing and 59.0 services

- US flash manufacturing and services PMI. 9:45 AM ET/1345 GMT. Estimate 62.8 manufacturing and 59.1 services

Tuesday, August 24

- New Zealand retail sales, 6:45 PM ET Monday/2245 GMT Monday. Estimate 2.0% versus 2.5% last month. Core retail sales 1.9% versus 3.2% last month

- US new home sales, 10 AM ET/1400 GMT. Estimate 698K versus 676K last month

- US Richard Fed manufacturing index. 10 AM ET/1400 GMT. Last month 27.0

Wednesday, August 25:

- German Ifo business climate. 4 AM ET/800 GMT. Estimate 100.6 versus 100.8 last month

- US durable goods orders. 8:30 AM ET/1230 GMT. Estimate -0.2% versus +0.9% last month. Core durable goods +0.4% estimate versus +0.5% last month

- Weekly crude oil inventories. 10:30 AM ET/1430 GMT. Crude oil has been down for seven consecutive days

Thursday, August 26.

- US preliminary GDP 3Q. 8:30 AM ET/1230 GMT. Estimate 6.6% versus 6.5% for the first cut

- US unemployment claims. 8:30 AM ET/1230 GMT. Estimate 355K versus 348K last week

- Start of Jackson Hole symposium

Friday, August 27

- Australian retail sales, 9:30 PM ET Thursday/1330 GMT. Estimate -2.0% versus -1.8% last month

- US Core PCE price index MoM, 8:30 AM ET. Estimate 0.3% versus 0.4% last month

- Fed chair Powell speaks at Jackson Hole symposium. 10 AM ET/1400 GMT

- US revised University of Michigan consumer sentiment. Estimate 10 AM ET/1400 GMT. Estimate 71.2 versus 70.2 preliminary

Saturday, August 28

- Jackson Hole symposium

Jackson Hole Summit to be held virtually

The summit was to be held face-to-face

The Jackson Hole Summit will be held virtually instead of face-to-face. This according to the Kansas City Fed who stages the event annually. The risk of Covid is leading to the decision. The scheduled three day event will now be all conducted on August 27th.

With the event now being held virtually, I can’t think that the Fed Chair would be in a hurry to start to taper, or tilt more in that direction.

Moreover, if other events start to cancel/report restrictions on events (think football), it would be a temporary negative to the economy until this crisis is once again over. The good however,, is it may also get more people to get vaccinated (think the rabid football fan base from southeastern portion of the United States where most of the hotspots and unvaccinated are found).

This market is on a Russian roulette mode “While the S&P 500 may only be 2% or so from its record highs, the average stock is down 15.8% from its 52-week highs”

NASDAQ the big winner today but major indices close lower for the week

All 11 sectors higher

The major indices all closed higher for the day led by the NASDAQ index which rose 1.17%.

- All 11 sectors of the S&P are higher

- indices close near the session highs

- Dow snaps a three-day losing streak

- S&P and NASDAQ close up for the second consecutive day

- major averages post weekly losses

- Dow has its worst week since mid-June

- NASDAQ had its best day in four weeks

the final numbers are showing

- Dow industrial average rose 225.50 points or 0.65% at 35120.08

- S&P index rose 35.86 points or 0.81% at 4441.66

- NASDAQ index rose 172.88 points or 1.19% at 14714.66

- Russell 2000 index gained will 35.18 points or 1.65% at 2167.60

Technology and utilities led the gains today. Consumer staples and energy lagged but still closed higher on the day.

For the week:

- Dow industrial average fell -1.11%

- S&P index fell -0.61%

- NASDAQ index fell -0.73%

For the Dow 30 stocks, the big winners today were:

- Microsoft, +2.52%

- Home Depot, +1.96%

- Cisco, +1.68%

- Walgreens, +1.58%

- Nike, +1.32%

- Salesforce, +1.21%

The laggards today were led by:

- Intel -0.82%

- Amgen, -0.39%

- Coca-Cola, -0.39%

- Visa, -0.11%

- Honeywell, -0.04%

- Chevron, -0.02%

Thought For A Day