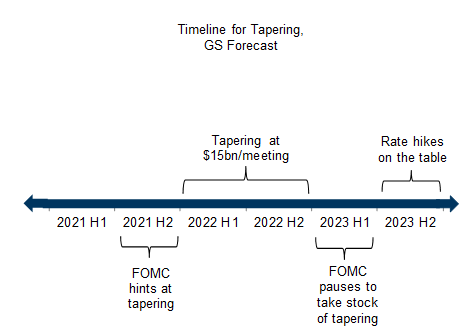

This preview in brief ahead on the Federal Open Market Committee meeting today, main points from Goldman Sachs:

- We expect the taper timeline to keep rate hikes off the table until roughly mid-2023

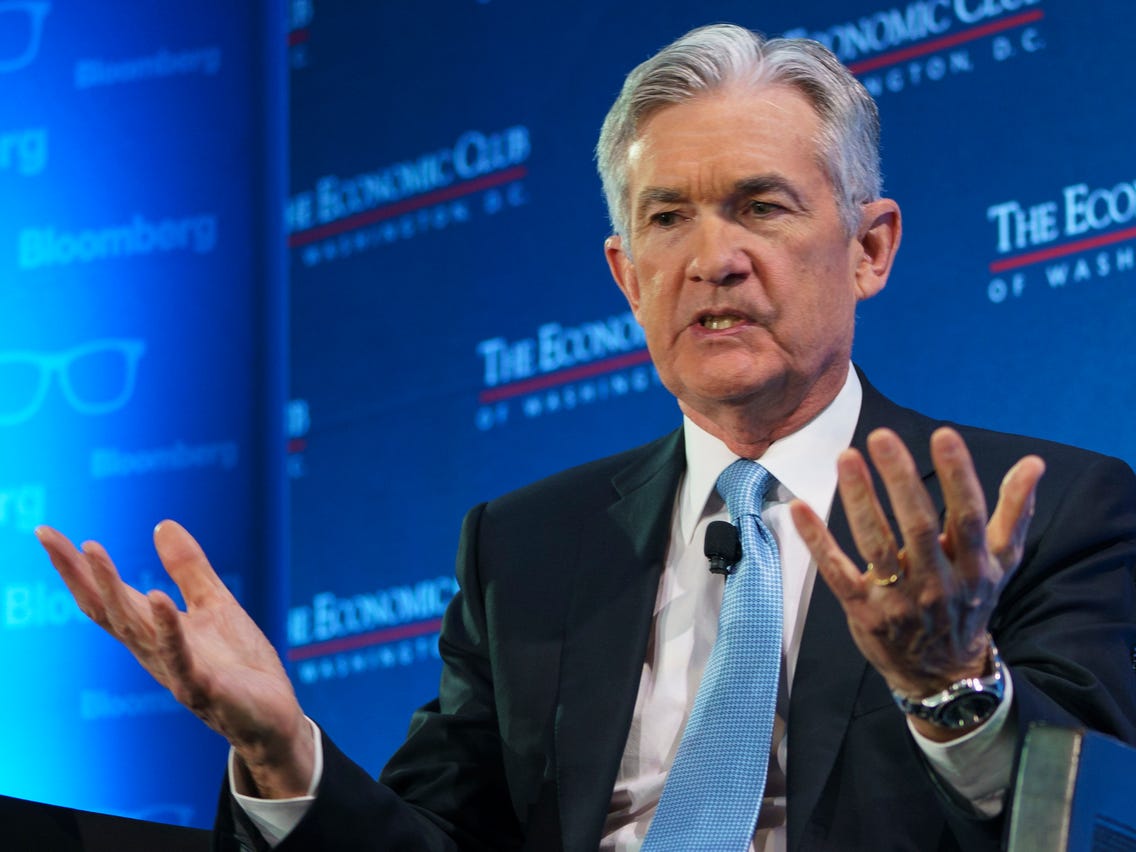

- Labour market slack remains too high for the Federal Open Market Committee to begin hinting at tapering

- Economic recovery has accelerated sharply since the FOMC last met in March

GS pic on the tapering time line ahead: