German Dax closes at a new record. France’s CAC just off all time highs

The European major indices are ending the session higher with the German Dax closing at a record level. France’s CAC is stalled just ahead of its all time high today.

A snapshot of the levels shows:

- German Dax, +0.7%

- France’s CAC, +0.59%

- UK FTSE 100, +0.35%

- Spain’s Ibex, unchanged

- Italy’s footsie MIB, +0.25%

France’s CACs all time high is up at 6111. The high price reached 6106.12 today. The German Dax reached a new all-time high of 15110.92.

In other markets as London/European traders look to exit:

- Gold is up $20.60 or 1.21% at $1728.20.

- Silver is up $0.35 or 1.45% at $24.77

- WTI crude oil futures are up $0.56 or 0.91% at $59.70. The remains between the high price of $60.83 and the low price of $58.91 as OPEC+ meet

- Bitcoin relatively unchanged at $59,027 (up about $70)

a snapshot of the US stock market is showing:

- S&P index up 34.85 points or 0.88% at 4007.73. The index is above the 4000 level for the first time ever

- NASDAQ is up 197 points or 1.48% at 13443

- Dow is up 132 points or 0.40% at 33114

In the US debt market, yields continue to move lower:

- 2 year 0.154%, -0.6 basis points

- 5 year 0.8945%, -4.4 basis points

- 10 year 1.675%, -6.6 basis points

- 30 year 2.34%, -7.0 basis points

The USD open the day mixed but mostly higher at the start of the NY session. As London/European traders look to exit, the USD continues to weaken and stands just behind the CAD as the weakest of the majors. Lower yields are pushing the green back lower. Gold is also a negative for the dollar.

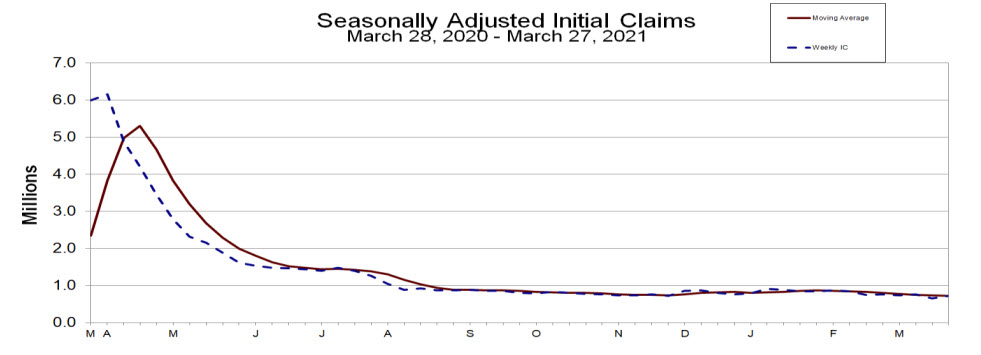

The jobless claims for worse than expected, but the four week moving average trend more to the downside. The market PMI data came in as expected (marginally higher than the preliminary). The ISM manufacturing data is much better than expectations.