Archives of “April 2021” month

rssGold and Gold Miners – where people who aren’t buying bubbles are :)

NASDAQ Bottom Finder – Bottom Found

US vaccine progress

The VIX filled the gap from 1 year ago. Fitting conclusion

Thought For A Day

Paul Tudor Jones: 13 Insights

13 Insights From Paul Tudor Jones

1. Markets have consistently experienced “100-year events” every five years. While I spend a significant amount of my time on analytics and collecting fundamental information, at the end of the day, I am a slave to the tape (and proud of it).

2. Younger generation are hampered by the need to understand (and rationalize) why something should go up or down. By the time that it becomes self-evident, the move is over.

3. When I got into the business, there was so little information on fundamentals, and what little information one could get was largely imperfect. We learned just to go with the chart. (Why work when Mr. Market can do it for you?)

4. There are many more deep intellectuals in the business today. That, plus the explosion of information on the Internet, creates an illusion that there is an explanation for everything. Hence, the thinking goes, your primary task is to find that explanation.

As a result of this poor approach, technical analysis is at the bottom of the study list for many of the younger generation, particularly since the skill often requires them to close their eyes and trust price action. The pain of gain is just too overwhelming to bear. (more…)

Jason Zweig’s Rules for Investing

1. Take the Global View: Use a spreadsheet to track your total net worth — not day-to-day price fluctuations.

2. Hope for the best, but expect the worst: Brace for disaster via diversification and learning market history. Expect good investments to do poorly from time to time. Don’t allow temporary under-performance or disaster to cause you to panic.

3. Investigate, then invest: Study companies’ financial statement, mutual funds’ prospectus, and advisors’ background. Do your homework!

4. Never say always: Never put more than 10% of your net worth into any one investment.

5. Know what you don’t know: Don’t believe you know everything. Look across different time periods; ask what might make an investment go down.

6. The past is not prologue: Investors buy low sell high! They don’t buy something merely because it is trending higher.

7. Weigh what they say: Ask any forecaster for their complete track record of predictions. Before deploying a strategy, gather objective evidence of its performance.

8. If it sounds too good to be true, it probably is: High Return + Low Risk + Short Time = Fraud.

9. Costs are killers: Trading costs can equal 1%; Mutual fund fees are another 1-2%; If middlemen take 3-5% of your cash, its a huge drag on returns.

10. Eggs go splat: Never put all your eggs in one basket; diversify across U.S., Foreign stocks, bonds and cash. Never fill your 401(k) with employee company stock.

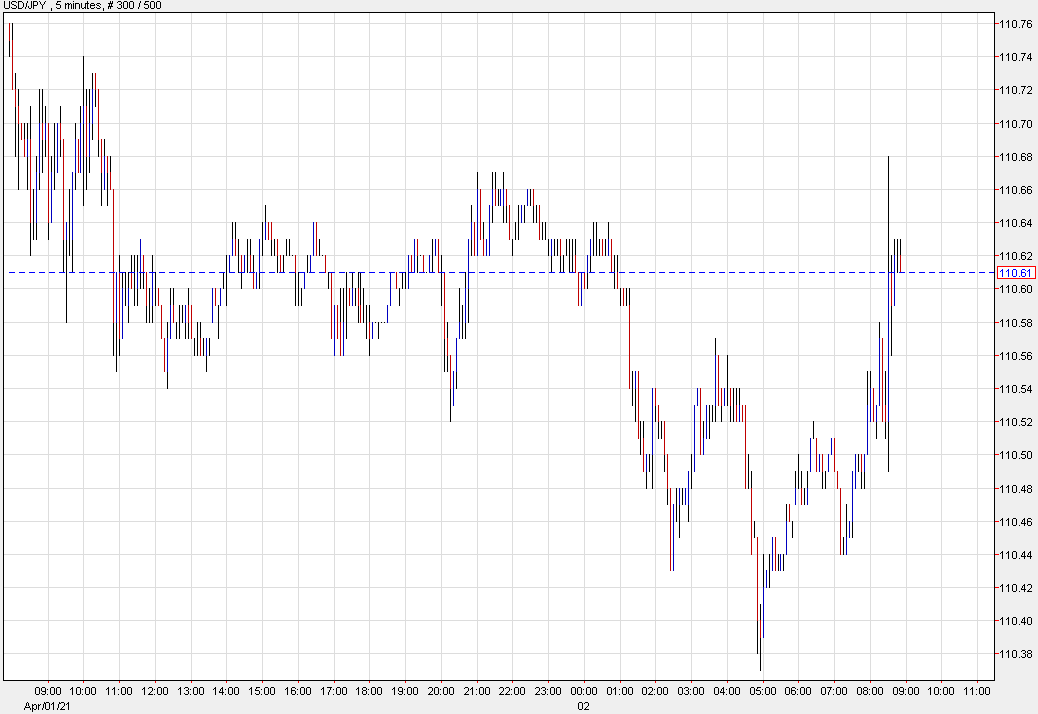

US dollar gets a small pop on non-farm payrolls

Decent US dollar move, but certainly nothing sensational

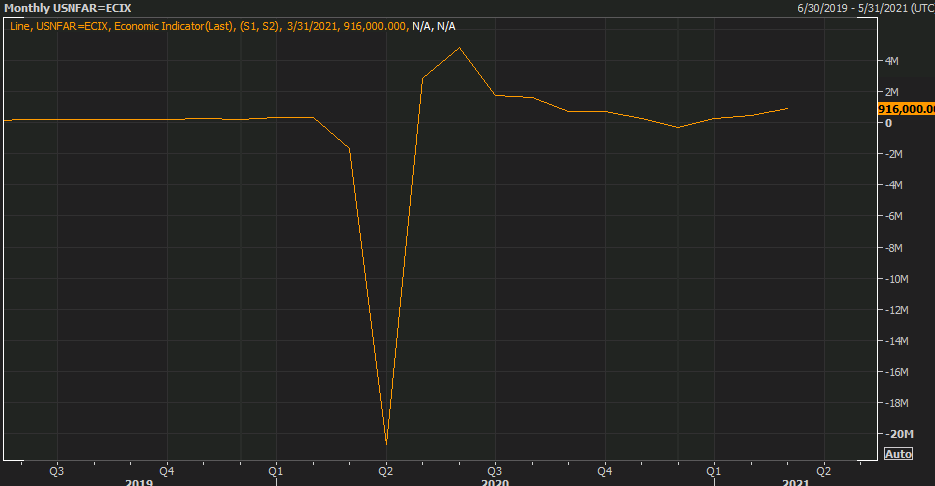

The US dollar caught a quick bid after a roundly-stronger March non-farm payrolls report. The US added 916K jobs in the month, besting the +660K consensus estimate.

USD/JPY jumped to a high of 110.68 from 110.55 on the data and there were similar USD kneejerk moves higher across the board. Overall though, the market was restrained, owing to holidays in Europe and North America.

Bonds also sold off with US 10-year yields up 2.2 bps to 1.68%. US equities will remain closed today but S&P 500 futures rose by 18 points.

I think this report will add more fuel to the dollar fire on Monday, particularly in USD/JPY and USD/CHF, which benefit from yield differentials. The US dollar fell against CAD on the report and is flat against the antipodeans. I think that’s generally the right idea, as the Canadian economy continues to piggyback on strong US reopening demand.

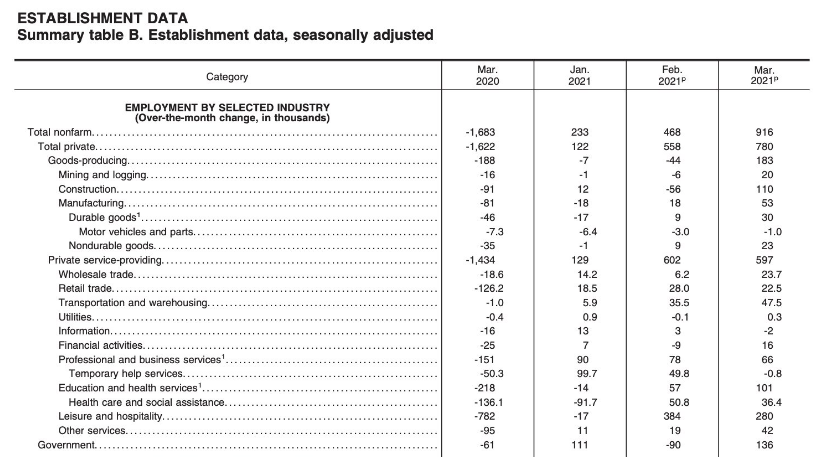

US March non-farm payrolls +916K vs +660K expected

March 2021 non-farm payrolls highlights

- Prior was 379K

- Unemployment rate 6.0% vs 6.0% expected

- Prior unemployment rate 6.2%

- Participation rate 61.5% vs 61.5% expected (was 62.8% pre-pandemic)

- Prior participation rate 61.4%

- Underemployment rate 10.7% vs 11.1% prior

- Average hourly earnings -0.1% m/m vs +0.1% expected

- Average hourly earnings +4.2% y/y vs +4.5% expected

- Average weekly hours 34.9 vs 34.7 expected

- Two month net revision +156K

- Change in private payrolls +780K vs +643K expected

- Change in manufacturing payrolls +53K vs +35K expected

- Long-term unemployed at 4.2m vs 4.1m prior

- The employment-population ratio, at 57.8% vs 57.6% prior

- Full report

This report lands on Good Friday into a thin market and we saw some quick pops in the US dollar but not as large as you would expect. The unemployment rate was in line with estimates but given the uptick in the participation rate, that’s good news.

There’s nothing to dislike in this report and it should continue to lift USD/JPY and USD/CHF. I don’t see it changing much from the Fed’s perspective; we’ll need quite a few of these kinds of reports to sop up all the slack in the workforce.

The leisure and hospitality sector was the biggest driver with 280K jobs but that’s not as much as you would think with the big headline. That means there’s more re-hiring that hasn’t yet taken place and will keep the numbers high for months to come. Otherwise, the job gains were broad-based.