Archives of “April 2021” month

rssDollar maintains slight advance on the session

GBP/USD falls to a low of 1.3840 on the day

The dollar continues to hold more resilient in European morning trade today, bouncing off the lows yesterday with Treasury yields keeping steadier.

The dollar’s advance is evident against the pound, loonie, aussie and kiwi with the former seeing a bit more of a noticeable drop in the past hour.

Cable has fallen from around 1.3900 to start the session to 1.3840 and is testing some support from a near-term trendline around 1.3847 for the time being.

The 100-hour moving average (red line) sits just below that @ 1.3829. Keep above that and buyers will continue to hold a more bullish near-term bias.

Although the pound is proving to be resilient, the dollar’s strength as of late has proven to be a bit of a sticking point – especially if yields continue to push the issue.

That will remain the key spot to watch in trading this week. 10-year Treasury yields are little changed now but well off earlier lows, at 1.707% currently.

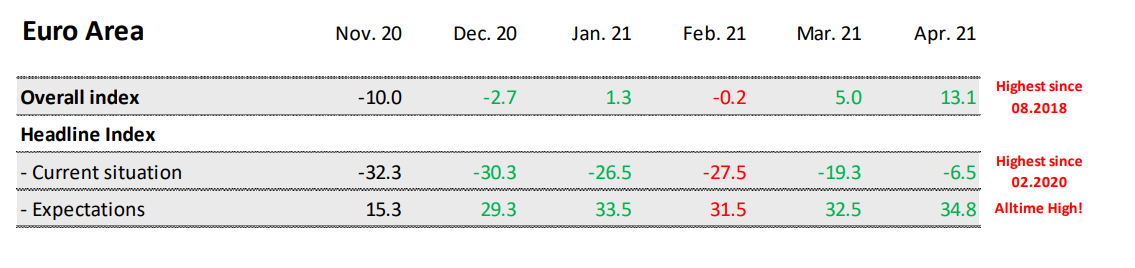

Eurozone April Sentix investor confidence 13.1 vs 6.7 expected

Latest data released by Sentix – 6 April 2021

- Prior 5.0

A solid beat in the headline reading, jumping to its highest since August 2018. This reaffirms the more upbeat mood surrounding economic expectations moving forward.

We’ll see how the vaccine rollout progresses in the coming months though to be sure but a Bloomberg report just out says that the EU is projecting near-virus immunity by the end of June, superseding its initial target estimate by the summer (end July).

Eurostoxx futures +0.7% in early European trading

Some catch up play for Europe going into the open

- German DAX futures +1.1%

- UK FTSE futures +0.6%

- Spanish IBEX futures +0.6%

After the more upbeat mood in US equities yesterday, European indices have some catching up to do following the Easter break since last Friday.

The early gains belie the more measured risk mood so far today though, with US futures pulling back slightly after yesterday’s stellar advance. S&P 500 futures and Dow futures are down 0.2% while Nasdaq futures are keeping flatter with Treasury yields a touch lower.

That is keeping the dollar steadier and major currencies little changed so far on the day.

Nikkei 225 closes lower by 1.30% at 29,696.63

A bit of a pullback in Asian equities today

The Nikkei clipped the 30,000 mark for the first time in just over two weeks yesterday but failed to hang on above that as a stronger yen from overnight trading, among other factors, weighed on the index. The Topix also closed 1.5% lower on the day.

Elsewhere, Chinese equities are still struggling somewhat with the Shanghai Composite down 0.2% despite more upbeat PMI data from earlier. That said, better economic prospects may prove to be a double-edged sword as it reaffirms fears of policy tightening

Valuation of the S&P 500 in relation to its sales.

The S&P 500 hit a new all-time high today, but if you relate the capitalization of the index to the Fed’s balance sheet, it is trading at the same 2008 level.”

China Caixin/Markit PMIs for March: Services 54.3 and Composite 53.1

China Caixin/Markit PMIs, Services and Composite, for March 2021:

Services 54.3

- expected 52.1, prior 51.5

- Business activity and sales both rise at quicker rates

- Employment returns to growth

- Business confidence hits highest for over a decade

- work backlogs rose for the first time in five months

Composite 53.1

- prior 51.7