Archives of “April 2021” month

rssShell (world’s biggest fuel retailer) indicator suggests fuel demand recovery has remained slow

An ICYMI on the still-slow recovery from coronavirus impacts across much of the globe:

- Shell expects its fuel sales to fall or at best be broadly steady for the first quarter

- said it saw refined oil product sales at 3.7-4.7 million barrels per day (bpd) for the first quarter compared with just under 4.8 million bpd in the last quarter of 2020. It had previously forecast sales of 4-5 million bpd.

Info via Reuters, was posted overnight ICYMI.

People’s Bank of China wary of rising household debt – could damage economic recovery

A PBOC research paper is highlighting that a household credit boom could tend to drag down economic growth more so than corporate debt.

- researchers say household leverage slowed real per-capita GDP growth by 3.7% in five years

- due to indebted houlsegholds reducing consumption

- and that highly-indebted households are vulnerable to negative income changes

- recommend that policy makers strictly control the leverage of households

The rapid increase in household debt in China has been driven by mortgages & a relaxation in lending standards.

Major averages close near unchanged levels

The S&P index did close at a new record high

The major indices are closing their unchanged levels give or take. The broader S&P index traded to a high of 4083.16. That was just short of the all-time high reached yesterday at 4086.23 (but it did close at a new record high).

- The NASDAQ index is down for the second consecutive day but with only modest declines over each day (the NASDAQ fell -0.05% yesterday and declined -0.07% today)

- The volatility index (VIX) trades at the lowest level since February 2020. The low reached 16.87% today

- S&P is up for the fourth of five sessions but only marginally today. The S&P fell -0.10% yesterday.

- The S&P index did close at a new all-time record high at 4079.95. That took out the high close from Monday at 4077.91.

- Dow closes higher for the third day in the last four

A look at the final numbers shows;

- S&P index rose 5.79 points or 0.14% at 4079.73. The high reached 4083.13. The low extended to 4006 8.31

- NASDAQ index fell -9.536 points or -0.07% at 13688.84. The high reached 13733.03. The low extended to 13653.58

- Dow rose 15.96 points or 0.05% at 33446.20 . The high reached 33521.76. The low extended to 33347.96

Large cap growth stocks all rose with percentage gains above the averages today:

- Square, +3.6%

- Facebook, +2.23%

- Amazon, +1.72%

- alphabetic, +1.35%

- Apple, +1.34%

- Intel, +1.05%

- PayPal, +0.95%

- Microsoft, +0.82%

- Netflix, +0.45%

The Russell 2000 index of small-cap stocks did not fare well today. That index fell -37.12 points or -1.64% at 2222.05.

Thought For A Day

#Dow daily chart

Jap. Finance Minister Aso: Yellen minimum global tax proposal puts the brakes

Japan finance minister Aso from Tokyo

Japan’s finance minister Aso is applauding Janet Yellen’s minimum global tax proposal saying that it puts the brakes on competitive reductions in global corp. tax rates.

Italy is also weighing in by saying the proposal is consistent with ongoing work in the G20 and that there may be an agreement by July

Crude oil inventories -3.522M vs est -1.436M

Weekly crude oil inventory

- crude oil inventories -3.522m vs -1.436m estimate

- gasoline inventories +4.044M vs -0.221M estimate

- distillates, +1.452K versus +0.486M estimate

- Cushing OK crude, -0.735M

- crude oil implied demand 17667 versus 17370 last week

- gasoline implied demand 9573.3 versus 9431.1 last week

- distillates implied demand 4756.6 versus 4815.9 last week

WTI crude oil futures trading down $0.31 among 0.51% of $59.02

Microsoft Windows in 1983:

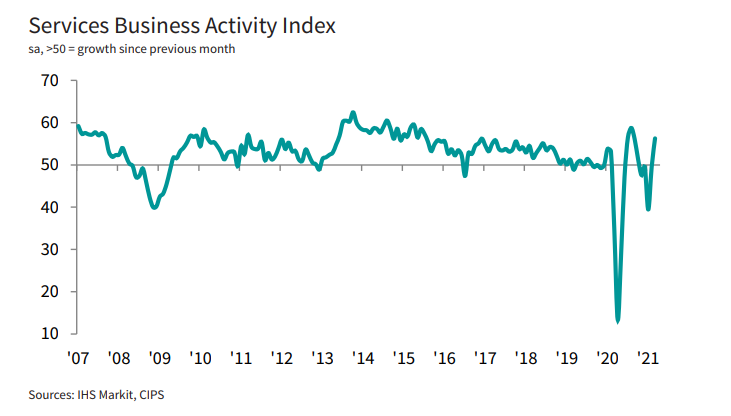

UK March final services PMI 56.3 vs 56.8 prelim

Latest data released by Markit/CIPS – 7 April 2021

- Composite PMI 56.4 vs 56.6 prelim

The preliminary report can be found here. Minor downward revisions as the final readings just reaffirm a modest rebound in overall activity in March as output and incoming new work saw strong increases last month.

Business expectations for the year ahead was the strongest since December 2006 in anticipation of the continued success in the vaccine rollout. Markit notes that:

“UK service providers were back in expansion mode in March as confidence in the roadmap for easing lockdown restrictions provided a strong uplift to new orders. Total business activity increased at the fastest rate since August 2020 and this return to growth ended a four-month sequence of decline.

“Forward bookings for consumer services and rising optimism about recovery prospects resulted in extra staff hiring across the service economy for the first time since the start of the pandemic. Business optimism improved for the fifth month running in March and was the highest since December 2006.

“Around two-thirds of the survey panel forecast an increase in output during the year ahead, which reflected signs of pent up demand and a boost to growth projections from the successful UK vaccine rollout. Of the small minority citing downbeat expectations in March, this was often linked to uncertainty about international travel restrictions.

“There were further signs that strong cost pressures have spilled over from manufacturers to the service economy, especially for imported items. Higher prices paid for raw materials, alongside rising transport costs and utility bills, meant that operating expenses across the service sector increased at the strongest rate since June 2018.”