Archives of “April 2021” month

rss#Bitcoin is the 7th largest currency in the world.

#Bitcoin / $BTC Longing resistance here.

#Bitcoin is displacing Gold as an inflation hedge. The digital asset’s increasing scale has made it a more viable competitor to the traditional protector against currency debasement.

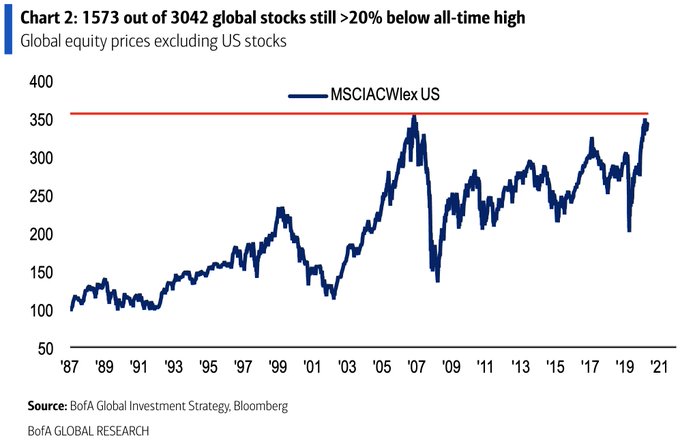

Just to put things into perspective: Global stocks still below pre-GFC highs when excluding US equities. 1573 out of 3042 global stocks still >20% below ATH.

$EEM / $SPY Weekly bear flag

Euro erases losses as the resilience continues

Euro back above 1.19

No one seems to like the euro as it struggles with another covid wave and an inability to conclude a collective fiscal passage.

Yet someone is buying. EUR/USD has climbed to 1.19 from 1.17 at the start of the month. Today it dipped back to 1.1867 but has rebounded to unchanged. Barring a surprise in the next few hours, it will close near the highs of the week.

We’re a universe away from the old days of 1.60 and Gisele Bundchen wanting to be paid in euros but the negative sentiment and reality that eventually Europe will get the vaccine is a recipe for a contrarian trade.

There are also signs that the eurozone is coping with covid better than expected. The surprise index from Citi for the eurozone is currently the highest in the world at +150.

CFTC Commitments of Traders: EUR longs continue to get covered. JPY shorts remain steady

Weekly forex futures positioning data for the CFTC for the week ending March 30, 2021

- EUR long 68K vs 74K long last week. Longs trimmed by 6K

- GBP long 20K vs 25K long last week. Longs trimmed by 5K

- JPY short 58K vs 59K short last week. Shorts trimmed by 1K

- CHF long 3K vs 4K long last week. Longs trimmed by 1K

- AUD long 4K vs 12K long last week. Longs trimmed by 8K

- NZD long 3K vs 4K long last week. Longs trimmed by 1K

- CAD long 3K vs 7K long last week. Longs increased by 4K

Highlights:

- All net positions trimmed

- The new positions show long currencies, and short the USD with the exception of the JPY which shows short JPY and long the USD

- The AUD long was trimmed the most (8k).

- JPY, CHF and NZD only saw positions trimmed by 1K

S&P and Dow close at record levels again

Nasdaq 1.9% from the all time high

The major indices are all closing higher and near highs for the day/week. The S&P and Dow industrial average both closed at record highs. The NASDAQ index is just under 2% away from the all time high.

The major indices also closed higher for the week with the NASDAQ index leading the charge at up 3.12%.

The final numbers are showing:

- S&P index +31.58 points or 0.77% at 4128.75. The high reached 4129.48 which is the all time high for the pair.

- Nasdaq +70.878 points or 0.51% at 13900.18. The all-time high price is at 14175.12. The index is 275 points from the all time high putting the index about 1.9% from the all time high

- Dow rose 298.68 points or 0.89% at 33801.25. That was just off the high for the week at 33810.87 (which is also the all time high).

For the week, the Nasdaq led. The Dow lagged but was still higher. The Russell 2000 index of small cap stocks fell -0.56%. The Nasdaq was up 3.12%.

Helping in the US was lower /steady rates despite the rise in rates today. Below are the changes for the week. The largest decline was in the 5 year sector with a decline of 11.59 basis points. The 10 year is down -6.49 basis points (rates are up about 4 bps today). Next week the US treasury will be auctioning of reopened 3, 10 and 30 year issues.

Thought For A Day