Archives of “April 2021” month

rss“Am I too late” to buy bitcoin?

#Bitcoin was the fastest asset to reach $1 Trillion.

Thought For A Day

Coinbase tomorrow. From page 327 of their filing doc

European shares end with mixed results

France’s CAC up 0.4%

The major European indices are ending the day with mixed results. A look at the provisional closes showing:

- German Dax, +0.15%

- Frances CAC, +0.4%

- UK’s FTSE 100, unchanged

- Spain’s Ibex, unchanged

- Italy’s FTSE MIB, +0.5%

In other markets as London/European traders look to exit for the day:

- Spot gold his trading up $11 or 0.64% at $1743.81.

- Spot silver is trading up $0.54 or 2.18% $25.35

- WTI crude oil futures are trading up $0.59 or 0.99% at $60.29

- Bitcoin is soaring by $3650 or 6.1% at $63,665. Coinbase will be going public tomorrow and that has helped to push of bitcoin in anticipation of a stellar IPO.

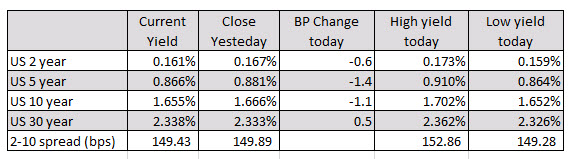

In the US debt market, yields are mostly lower ahead of the 30 year bond auction. The 30 year yield is marginally higher ahead of that auction.

In the forex market, the major currencies have scrunched together with the EUR holding onto a slim lead as the strongest of the majors. The GBP is the weakest (followed by the USD). However, all the currencies are close together indicative of a market that is struggling with directional bias.

In the forex market, the major currencies have scrunched together with the EUR holding onto a slim lead as the strongest of the majors. The GBP is the weakest (followed by the USD). However, all the currencies are close together indicative of a market that is struggling with directional bias.

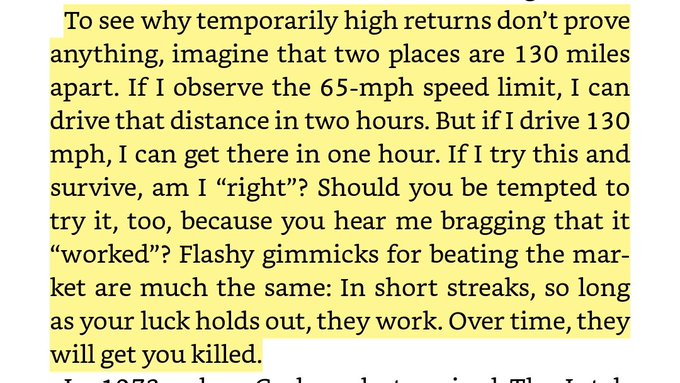

Consistency > Speed From the book “Intelligent Investor”

FDA official says 1 US death after J&J vaccine, one patient in critical condition

FDA briefing on Johnson & Johnson vaccine

Earlier, the FDA said there were 6 clots reported after more than 6.8 million doses.

They are warning health care providers who get patients with a low blood platelet count or blood clots to check if they’ve recently had the J&J vaccine.

Seeing these numbers, are we really going to halt the global rollout for 1 death among 6.8 million people? For a virus that’s killing thousands a day?

Update: The FDA said the pause is expected to be ‘a matter of days’.

What times we are in?

US dollar slump extends as yields decline

US dollar under pressure

The dollar is slumping hard today with US 10-year yields now down 1.2 bps to 1.65% from a high of 1.70%.

However the dollar move has far-exceeded the move in yields. EUR/USD is now up to 1.1940 from 1.1890 just before the CPI report. The commodity currencies are also taking advantage of the dollar move.

The big news today is the pause in the J&J vaccine but the equity market is taking it in stride. Given that it’s a bigger problem for Europe than the US (which has ample Pfizer and Moderna vaccines) then that can’t be the trigger.

It’s clear that this is about CPI with some flows mixed in but that is a surprisingly large reaction to inflation that’s a touch higher than expected but not as high as feared following last week’s PPI jump.