Archives of “April 2021” month

rssOPEC+ might skip full ministerial meeting next week

OPEC could just have JMMC monitoring meeting

A report says OPEC+ is discussing downgrading the April 28 scheduled ministerial meeting and only having a JMMC monitoring meeting.

OPEC has already pre-committed to the next few months. They have the option to tweak it but with oil fairly steady and inventories running off, they’re probably happy to watch and see how the market unfolds for now.

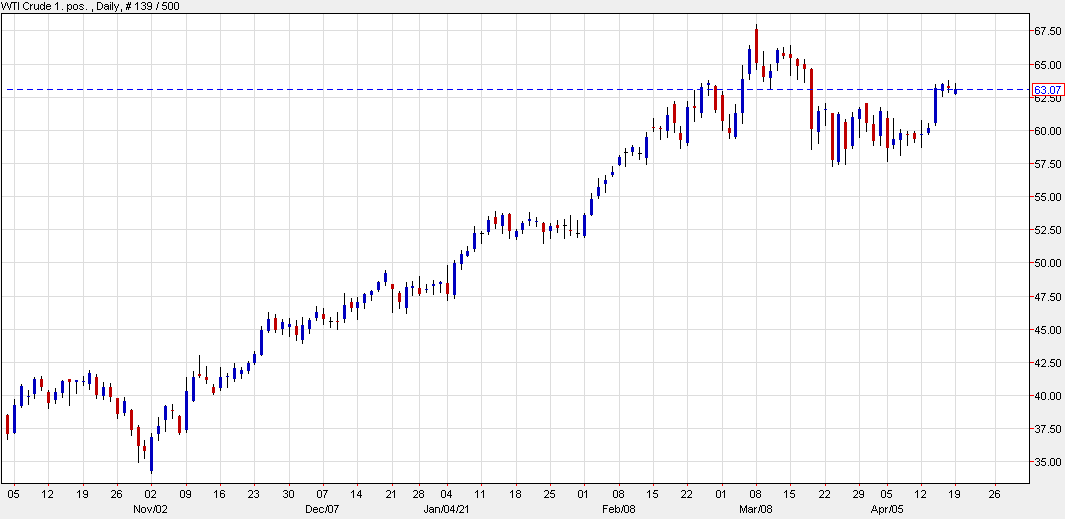

WTI is up 11-cents to $63.24 today as it continues to consolidate following last week’s break higher.

This time it is different.

Bank of Israel keeps benchmark rate at 0.10%

Rates in Israel unchanged, as expected

Israel is an interesting spot to watch in the reopening. The vaccine has been widely available there for a month and cases are down to 164 per day from a peak near 10,000.

The central bank continues to forecast 6.3% GDP growth under its optimistic scenario.

Economic data is light there but it hasn’t shown a reopening boom. In the most-recent report, the unemployment rate rose to 5.1% from 4.6%. For 2022, the forecast has been downgraded to 5.0% from 5.8% to 6.0%).

Some inflation is building but that’s likely import-related and up to 1.1% for the year ahead from -0.2% to +0.3%).

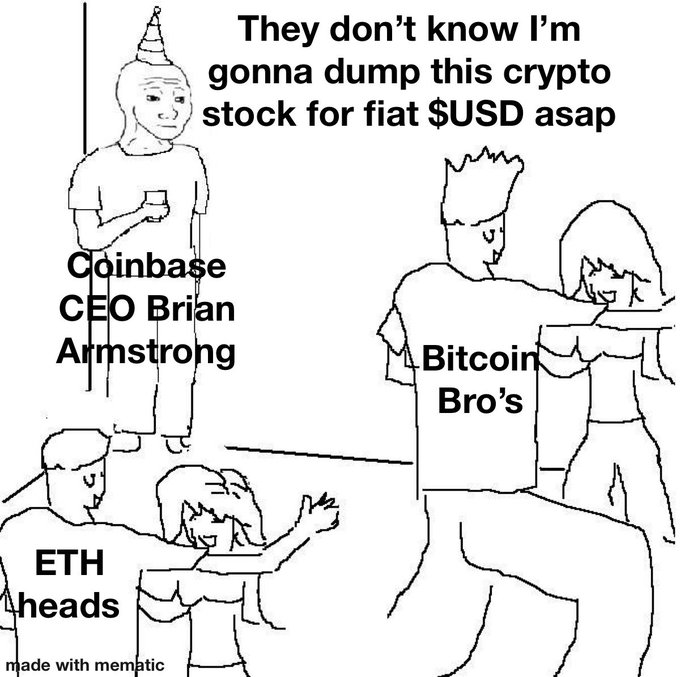

Coinbase CEO Brian Anderson has paper hands Sold 100% of his Coinbase stock immediately

Treasury yields keep lower so far on the session

Dollar gets no reprieve from softer Treasury yields

10-year Treasury yields are keeping with the break below 1.60% as they are seen down more than 2 bps to 1.559% currently. The low today hit 1.550%.

While US economic data and vaccine progress continues to reaffirm signs of a strong economic rebound in 2H 2021, it is tough to fight sentiment in the latest correction here.

The market seems to have realised it has gone too far, too fast and is now readjusting – needing to await more robust key economic data to compensate for its expectations.

In any case, lower yields today is but of little comfort for the dollar. For those watching the dollar index (pretty much a reflection of EUR/USD), it is approaching a key technical level in the form of its 100-day moving average now:

Nikkei 225 closes flat to kick start the new week

Chinese stocks lead gains in Asia

The Nikkei closes pretty much flat (+0.01%) on the day at 29,685.37 with the Topix seen down 0.2% to 1,956.56 at the close today. The sentiment mirrors a more tepid mood in US futures, though Chinese equities are faring well in Asian trading.

The Hang Seng is up 0.6% while the Shanghai Composite is seen up 1.3% as investors take comfort in easing worries surrounding Huarong’s debt problems.

S&P 500 futures are seen down 0.1%, Dow futures down 0.3%, while Nasdaq futures are up 0.1% in a bit of a mixed performance ahead of European trading.

China – Huaraong has rapid bend debt due April 18

ArticleBody Recent weeks have seen markets buzzing with worries over a default by the firm: Markets pondering the implications of (China’s) Huarong debt – will it default?

And , this:

- China Huarong said to be ready to repay S$600 million of bonds due at the end of the month

Reports now (Bloomberg) that the firm has repaid the bond due April 18

—

Gotta find another reason to fret now …

CME Group is not launching dogecoin futures

One of the more fanciful tweets over the past 24 hours is that the CME will be launching Dogecoin futures.

They will not.

The end.

OK not quite the end. The rumour of the launch was, and still is, unsourced. Good luck to all those DOGE folks out there and well done if long, but this is a completely fabricated rumour.