Modest change in the weekly Baker Hughes rig count data

The Baker Hughes rig count data for the current week is showing:

- Oil rigs 342 versus 343 last week

- Gas rigs 96 versus 94 last week

- Total rigs 440 versus 438 last week.

The Baker Hughes rig count data for the current week is showing:

The European major indices are ending the week with mixed result today and also ending the week mixed.

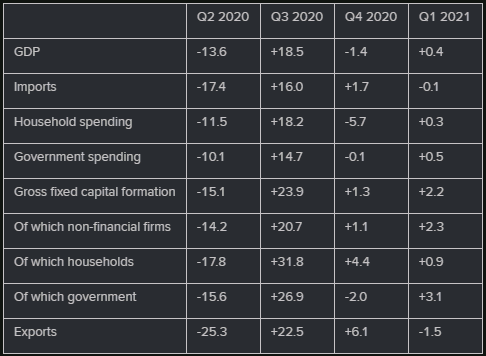

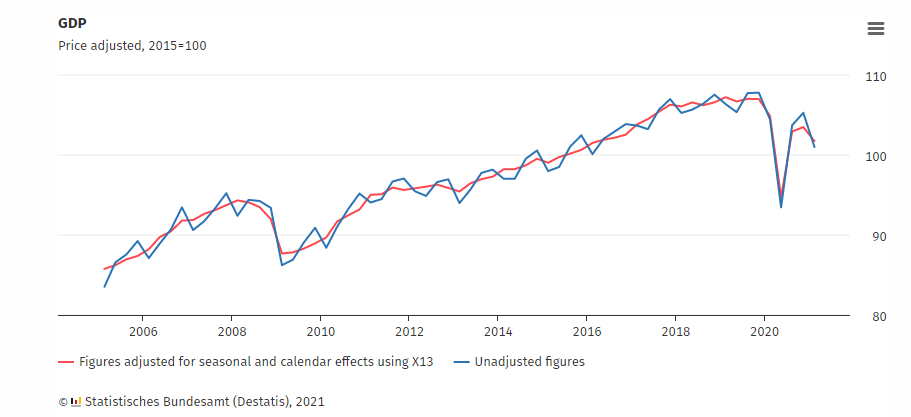

The readings are more or less within estimates as German economic activity contracted once again in Q1, though the resilience of the manufacturing sector has certainly helped to offset a chunk of the slump amid lockdown measures to start the year.

A solid beat here reaffirms the resilience of the French economy in Q1, which may very well set the tone for what to expect from other readings across the region later today. If so, that will certainly be of much comfort to euro area assets in general – even if the market is more focused on vaccine developments and the 2H outlook now.