JMMC didn’t revise demand forecast today

OPEC+ ministers will meet virtually on Wednesday but the plan to hike production by nearly 800,000 barrels per day in May is unchanged, according to a Platts report.

This is no surprise. There had been some light talk about delays due to rising covid cases in India but demand elsewhere remains solid and growing.

The spot to watch — as always — is Saudi Arabia. A bit more than half of the planned production increase in the month is due to the reversal of Saudi voluntary cuts. If they don’t like the demand picture, they could hold off.

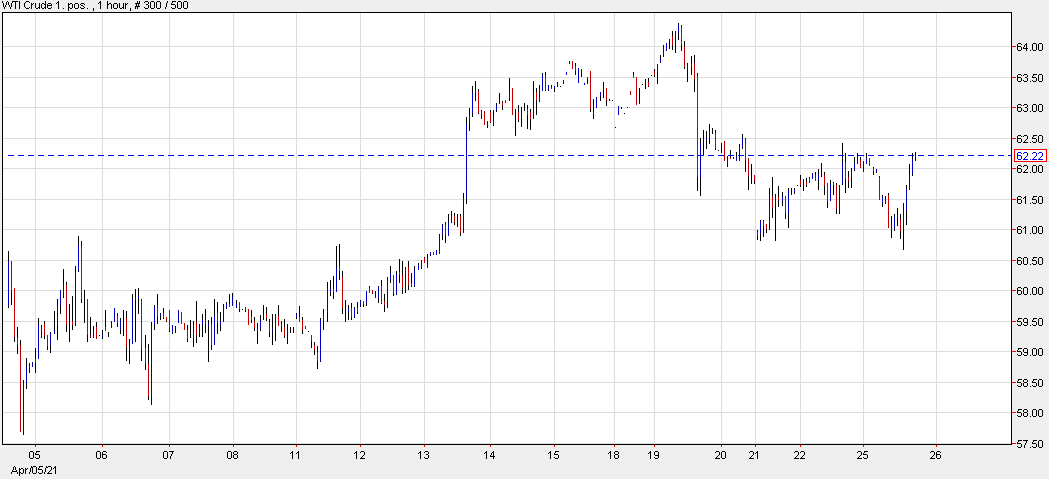

WTI is back to flat on the day at $62.14 after falling as low as $60.66. One-hour chart: