Archives of “April 21, 2021” day

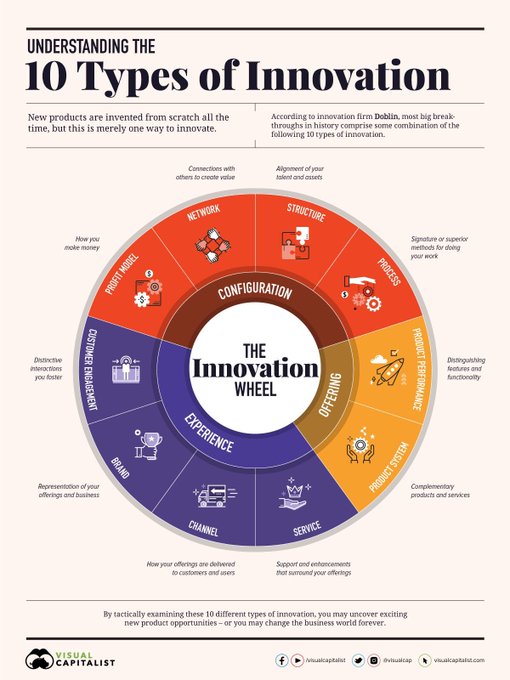

rss10 types of innovation

Japan PM Suga says to decide on state of emergency measures this week

Remarks by Japanese prime minister, Yoshihide Suga

This looks inevitable, so expect a formal announcement to follow later in the week. Earlier reports suggest that Tokyo will observe a state of emergency from 29 April to 9 May to start with, so that provides some idea of the proposal.

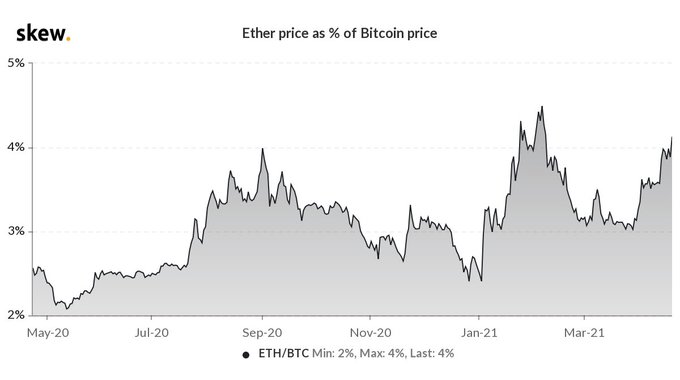

ETH / BTC > 0.04

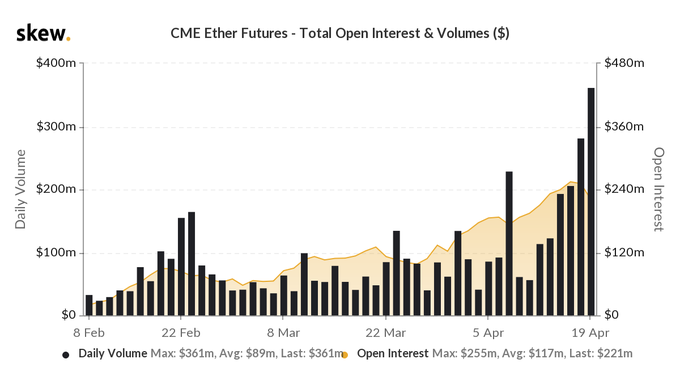

CME ether futures saw record volumes on Monday

Oil slips further on the week, tests near-term support levels

Oil falls by 1.4% on the day to $61.65

There aren’t much headlines involving oil so far this week but the risk retreat yesterday is one of the few things influencing price action in the commodity.

Oil tumbled from $64.00 to a low of $61.50 yesterday and is trading thereabouts again, testing the 38.2 retracement level @ $61.78 as well as its 200-hour moving average (blue line) @ $61.68. Break below that region and sellers will seize near-term control.

In the bigger picture, this looks to be a bit of a light pullback in oil after a modest rally in the past two weeks. Key support is still seen closer to $60.00 and then the 12 February low @ $57.43, so there is still some ways from a stronger technical breakout.

There has been talk of OPEC+ skipping its ministerial meeting next week but considering that they have already committed to production quotas over the next few months, there shouldn’t be much to really talk about for the time being.

Performance of agricultural commodities and stocks in 2021

A closer look at agricultural commodities, stocks so far this year

The Brexit and pandemic of COVID-19 in 2020 had serious repercussions all over the world, especially in the European market. The food or agriculture sector is facing a teething problem due to the same. Even the market experts are finding it difficult to assess the situation because the transportation of goods and services have been marred. And agricultural goods are essential commodities.

Keeping the date of expiry on the bay has become a headache for the countries exporting agricultural commodities. It’s like myriad work at hands with little time in hands. It has led to the loss of millions of pounds, and it may extend in the absence of any policy further.

However, the entire food and agriculture business cannot be attributed alone to pandemic and Brexit. There are several reasons that require serious attention. The period for the Agri commodity is volatile, and that can put further pressure on retail prices. It can push the rates up.

Food and agriculture organisation

Last December, the food prices crossed the six-year high barrier of the retail price globally as per the assessment of the Food and Agriculture Organization of the United Nations.

Interestingly, it has been surging ever since then. The FAO Food Price index of January 2021 hiked by 4.3 per cent. Its eight consecutive months of price rise or inflation in the retail essential commodity market.

Key inflationary drivers in pandemic (more…)

Defining organisational change: Improvement, Innovation and Transformation.

China said to consider plan to help Huarong via PBOC funding

China to help Huarong clean up its balance sheet

As mentioned here last week, China will never allow for a state-owned firm such as Huarong’s stature to collapse and this is further evidence of that. It is said that the PBOC would assume more than $15 billion of assets from Huarong to help the firm clean up its balance sheet and refocus on managing distressed debt, according to Bloomberg sources.

Recent public remarks by Chinese authorities have already helped to soothe local markets and this latest report will only bolster confidence and mitigate credit risk fears.

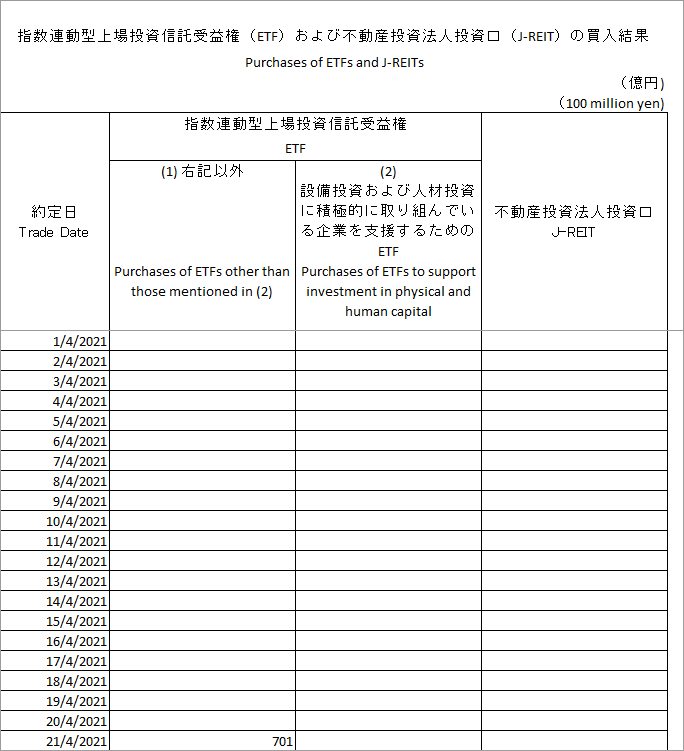

BOJ steps in with ¥70.1 billion worth of ETF purchases today

BOJ walks the talk with ETF purchases for the first time this month

This comes amid a 2% drop in the Topix, with the index inching closer towards its March lows and testing its 100-day moving average for the first time since late October last year.

It still isn’t quite the consistent and sizable purchases seen last year amid the virus crisis but the BOJ is at least letting the market know it is still in business to shop.