Archives of “April 16, 2021” day

rssEuropean shares end the day/week higher

German Dax makes new all time highs

- German DAX, +1.34%

- Francis CAC, +0.85%

- UKs FTSE 100, +0.5%

- Spain’s Ibex +0.5%

- Italy’s FTSE MIB, +0.88%

#Bitcoin hash rate surges to 200 EH/s for the first time in history, as miners increase their investing in the network.

Fascinating insights already!

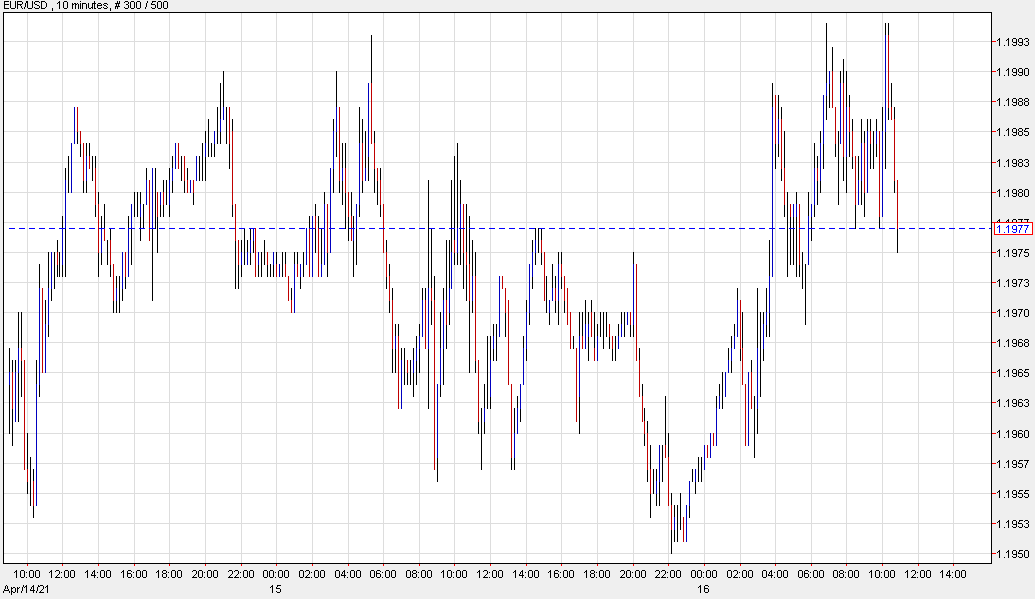

Euro tries and fails at 1.20 again

EUR/USD touches 1.1995

2021 the year of pharma: A look at Moderna and Pfizer stocks

An overview of Moderna and Pfizer stocks

2020 was all about COVID-19, the brand-new pandemic which took the world by storm, sweeping through continents and debilitating countries. 21st-century medicine came to the rescue, developing vaccines to fight the virus. Fast forward to 2021, the hot topic is the COVID-19 vaccine, or rather vaccines.

The infamous vaccine is not just ‘one’ vaccine, a number of pharmaceutical companies have developed different vaccines which are being rolled out in different countries. In fact, vaccines are a gigantic business at the moment highly affecting the status of the companies producing and selling them. Pfizer and Moderna became household names, celebrities one might say as anxious consumers hoped to see light at the end of the COVID-tunnel.

Where there’s business there’s money, and where there’s money there are opportunists. Investors spent their first lockdown studying every possible scenario for companies such as Pfizer and Moderna, foreseeing a major spike in their stocks, provided they indeed become saviors of the world.

Let’s take a look at how these companies have performed in light of releasing the vaccines and how their stocks have been affected. (more…)

2000: we’re coming for you…

Nikkei 225 closes higher by 0.14% at 29,683.37

Asian equities climb towards the end of the week

The Topix is also seen up 0.1% as stocks in Asia are buoyed by the gains in Wall Street overnight, though the gains in Japan are relatively mild. Elsewhere, China’s record GDP data, though failing to impress, is enough to keep sentiment buoyed as well.

China March Industrial production +14.1% y/y (expected +18%) + retails sales & investment data

China ‘activity’ data for March 2021

Industrial Production +14.1% y/y MISS

- expected 18.0%

Industrial Production YTD to March +24.5% y/y MISS

- expected 26.5%, prior was 35.1%

Fixed Assets (excluding rural) YTD +25.6% y/y MISS

- expected 26.0%, prior was 35.0%

Retail Sales +34.2% y/y BEAT

- expected 28.0%

Retail Sales YTD +33.9% y/y BEAT

- expected 31.7%, prior was 33.8%

Retail sales with the beat is indicative of a recovery in domestic consumption. Good news for China which, as is so often the case, has been leaning on exports and the property market to keep the fire in the economy.

China Q1 2021 GDP: +0.6% q/q (expected +1.4%)

Economic growth data from China for quarter 1 2021 (January – March inclusive)

- expected +1.4% (SA), prior was +3.2%, revsied higher from +2.6%

18.3% y/y

- expected +18.5% y/y, prior +6.5%

A miss for growth, not as strong as was the central estimate.