Archives of “April 7, 2021” day

rssJap. Finance Minister Aso: Yellen minimum global tax proposal puts the brakes

Japan finance minister Aso from Tokyo

Japan’s finance minister Aso is applauding Janet Yellen’s minimum global tax proposal saying that it puts the brakes on competitive reductions in global corp. tax rates.

Italy is also weighing in by saying the proposal is consistent with ongoing work in the G20 and that there may be an agreement by July

Crude oil inventories -3.522M vs est -1.436M

Weekly crude oil inventory

- crude oil inventories -3.522m vs -1.436m estimate

- gasoline inventories +4.044M vs -0.221M estimate

- distillates, +1.452K versus +0.486M estimate

- Cushing OK crude, -0.735M

- crude oil implied demand 17667 versus 17370 last week

- gasoline implied demand 9573.3 versus 9431.1 last week

- distillates implied demand 4756.6 versus 4815.9 last week

WTI crude oil futures trading down $0.31 among 0.51% of $59.02

Microsoft Windows in 1983:

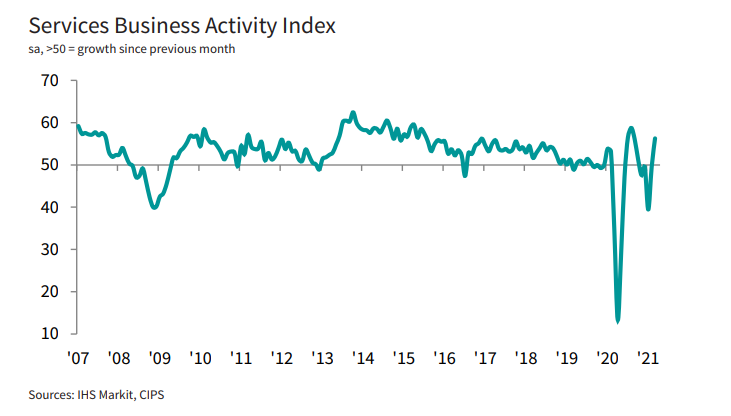

UK March final services PMI 56.3 vs 56.8 prelim

Latest data released by Markit/CIPS – 7 April 2021

- Composite PMI 56.4 vs 56.6 prelim

The preliminary report can be found here. Minor downward revisions as the final readings just reaffirm a modest rebound in overall activity in March as output and incoming new work saw strong increases last month.

Business expectations for the year ahead was the strongest since December 2006 in anticipation of the continued success in the vaccine rollout. Markit notes that:

“UK service providers were back in expansion mode in March as confidence in the roadmap for easing lockdown restrictions provided a strong uplift to new orders. Total business activity increased at the fastest rate since August 2020 and this return to growth ended a four-month sequence of decline.

“Forward bookings for consumer services and rising optimism about recovery prospects resulted in extra staff hiring across the service economy for the first time since the start of the pandemic. Business optimism improved for the fifth month running in March and was the highest since December 2006.

“Around two-thirds of the survey panel forecast an increase in output during the year ahead, which reflected signs of pent up demand and a boost to growth projections from the successful UK vaccine rollout. Of the small minority citing downbeat expectations in March, this was often linked to uncertainty about international travel restrictions.

“There were further signs that strong cost pressures have spilled over from manufacturers to the service economy, especially for imported items. Higher prices paid for raw materials, alongside rising transport costs and utility bills, meant that operating expenses across the service sector increased at the strongest rate since June 2018.”

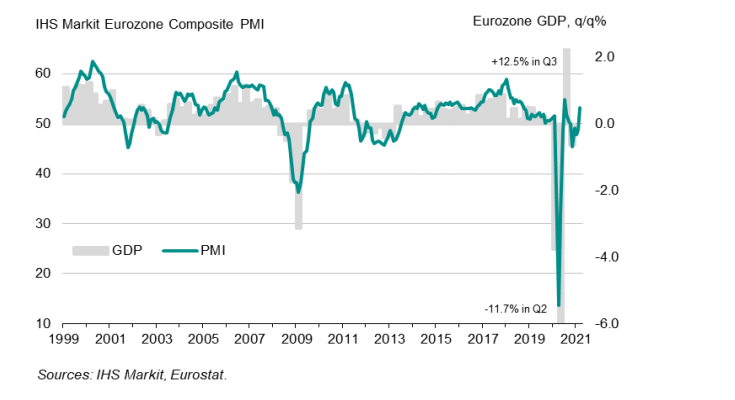

Eurozone March final services PMI 49.6 vs 48.8 prelim

Latest data released by Markit – 7 April 2021

- Composite PMI 53.2 vs 52.5 prelim

The preliminary report can be found here. Some modest upside revisions to the final readings as also seen in the earlier French and German reports. The composite reading is the highest since last July as economic activity stabilised towards the end of Q1.

The manufacturing sector continues to take the lead with services activity seen improving slightly amid tighter restrictions. That may yet remain the case in Q2 as the virus situation continues to pose a threat for the time being. Markit notes that:

“Eurozone business activity bounced back in March, returning to growth after four months of decline with an even stronger expansion than signaled by the forecast-beating ‘flash’ data.

“Manufacturing is booming, led by surging production in Germany, and the hard-hit service sector has come close to stabilizing as optimism about the outlook improved further during the month. Firms’ expectations of growth are running at the highest for just over three years amid growing hopes that the vaccine roll-out will boost sales in the coming months.

“Strengthening demand has already led to the largest rise in backlogs of uncompleted work seen for almost three years, encouraging increasing numbers of firms to take on additional staff. Improving labour markets trends should help further lift consumer confidence and spending as we head into the second quarter.

“The survey therefore indicates that the economy has weathered recent lockdowns far better than many had expected, thanks to resurgent manufacturing growth and signs that social distancing and mobility restrictions are having far less of an impact on service sector businesses than seen this time last year. This resilience suggests not only that companies and their customers are looking ahead to better times, but have also increasingly adapted to life with the virus.”

Dax has entered a strong period of the year

DAX

There is a general enthusiasm for German stocks despite the recent set back in terms of COVID-19 across the eurozone. Taking a look at the seasonals we have the following data from April 06 – April 30 over the last 10 years.

The DAX has been helped higher by the run up last month in Volkswagen stocks as it makes a move for the electric car market. In fact the rising DAX futures the day after further lockdowns were announced in France was an important affirmation that investors are happy to keep buying German stocks even with an impending third wave of infections.

The average gain has been +2.63% and the maximum profit was +7.81% last year. The only year of loss was in 2015 with a drop of -5.52%. The win ratio is 90% and you can see further breakdown here of the max drop during those periods. Aside from the year of loss in 2015 the largest draw down was -3.54% in 2014. So, the pattern is skewed to the upside for the DAX.

These stats come courtesy of the team at Seasonax.

The only area of concern is further lockdowns across the eurozone. However, it hasn’t held the DAX back so far, so perhaps investors are just content to keep looking to the time when the virus is finally under control. Any return back down to 1460 would offer good value to buyers and provide a key area to define and limit risk. The upside surprise would be if there was a sudden increase in the speed of vaccinations across the eurozone. So, two way risks here along with the strong seasonals.

Get ready for a very busy 15 minutes beginning at 1.45pm New York time on 7 April 2021

At 1.45pm New York time (1745GMT) on Wednesday US President Biden will be speaking on his infrastructure proposal

Then, immediately following, at 2pm NY time (1800GMT) the Federal Reserve Federal Open Market Committee minutes of the March meeting are due:

- Preview of FOMC minutes due Wednesday 07 April 2021