Archives of “February 25, 2021” day

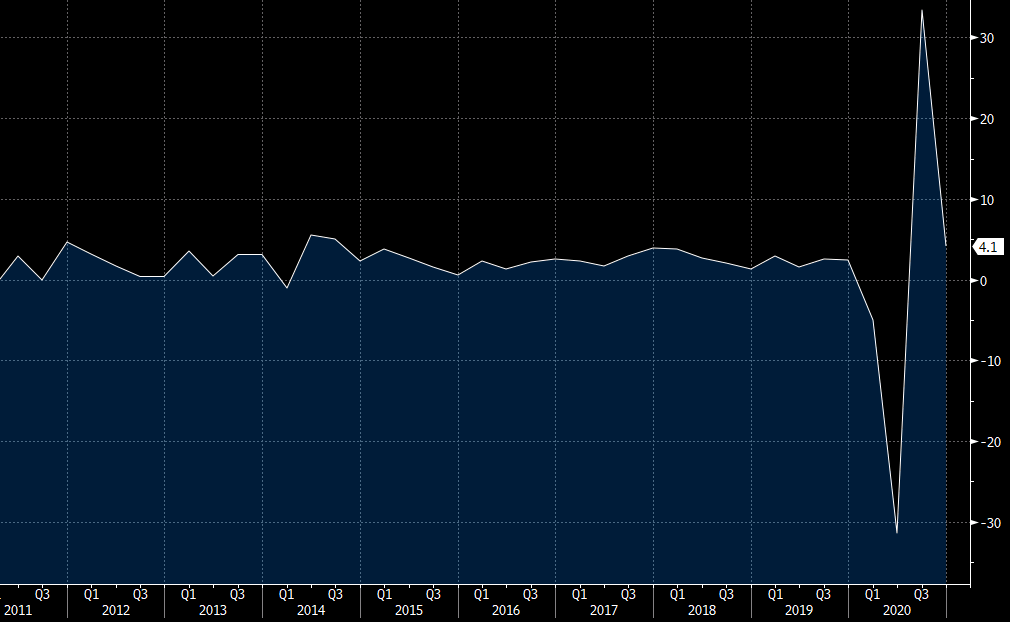

rssUS Q4 GDP (second reading) +4.1% vs +4.2% expected

Fourth quarter 2020 GDP estimate

- First reading was +4.0%

- Final Q3 reading was +33.4%

- Personal consumption +2.4% vs +2.5% expected

- GDP price index +2.1% vs +2.0% expected

- Core PCE +1.4% vs +1.4% expected

- Deflator +2.0%

- Full report

Details:

- Ex motor vehicles +4.7% vs +4.5% prelim

- Final sales +3.0% vs +3.0% prelim

- Inventories added 1.11 pp to GDP vs 1.04 in prelim report

- Business investment +14.0% vs +13.8% prelim

- Business investment in equipment +25.7% vs +24.9% prelim

- Exports +21.8% vs +22.0% prelim

- Imports +29.6% vs +29.5% prelim

- Home investment +35.8% vs +33.5% prelim

The consumer was a tad weaker in Q4 than initial reports while business and home investment was a bit stronger. Overall, I don’t see anything here that will bleed into Q1 2021.

US weekly initial jobless claims 730k vs 825k expected

Initial jobless claims for the week ending 20 February 2021

- Prior 861k; revised to 841k

- Continuing claims 4,419k vs 4,460k expected

- Prior 4,494k; revised to 4,520k

The headline is lower than estimates and is also better than the previous week at least. The 4-week average for initial jobless claims fell to 807,750 in the week to 20 February from the prior week of 833,250.

That said, claims have sort of hit a floor and we’re seeing this relatively high figure week in, week out. So, there’s that to ponder if you are the Fed.

The largest increases in initial claims were in Illinois (+28,110), Ohio (+6,563), Idaho (+4,764), Kansas (+1,744), and California (+1,664).

Meanwhile, the largest decreases were in Maryland (-9,835), Rhode Island (-6,129), Georgia (-5,854), New Jersey (-4,630), and Texas (-4,234).

German 10-year bond yields climb to highest since March last year as the global steepening continues

10-year bund yields rise to -0.255%, the highest since March last year

As mentioned earlier, if it didn’t work with Lagarde, it isn’t going to work with Lane.

The big story in the market today continues to be that of bonds as the steepening continues with the long-end of the curve rising sharply.

10-year Treasury yields are up nearly 7 bps to 1.442% while 30-year Treasury yields are up 6.4 bps to 2.297% currently in European morning trade.

European stocks are starting to see gains chipped away while US futures reflect a decline in tech with Nasdaq futures down 0.7% after a brief and minor rebound. S&P 500 futures are down 0.2% near the lows but Dow futures are up 0.1%.

Japan reportedly to end state of emergency in five prefectures at the end of the month

Kyodo News reports on the matter

This will apply to the prefectures of Osaka, Kyoto, Hyogo, Aichi, and Gifu – most of which were already anticipated since last week. Tokyo will likely have to wait until 7 March before its state of emergency is lifted but there’s still some debate on that before a formal decision is announced by the Japanese government this Friday.

AUD/USD hits 0.8000 for the first time in over three years

The aussie has hit the key milestone, what’s next?

AUD/USD is extending gains on the day as the dollar remains pressured, with the pair now touching above 0.8000 for the first time since 2 February 2018.

This is one that has been coming since the latter stages of last year but I would argue that it is playing out in a much quicker timeframe than I would have anticipated.

Granted, the commodities rally and latest round of dollar weakness is part and parcel contributing to the surge higher since the end of last week but this has been a truly remarkable recovery in AUD/USD from the depths of the pandemic lows last year.

As price hits the key milestone, it puts into focus the 2017 and 2018 highs around 0.8125-36 – at least from a technical perspective.

However, now that we’re here, I would argue that the RBA will be more actively watching price levels and verbally intervening moving forward.

That said, I’m quite doubtful of their abilities to pin down the currency so long as the market landscape and fundamentals continue to play out as they have in recent months.

Adding to that is the fact that the Fed put will continue to keep the dollar pressured to the downside in the bigger picture.

Despite already reaching such levels early on in the year, it is tough to fight the market momentum if the focus continues to be on reflation (bolstering commodities) and a global economic reopening (better for riskier currencies).

As such, gains may be more bumpy from hereon if the RBA decides to make known their dissatisfaction with price levels but if equities carry on with the party and the global economic outlook continues to improve, we may be targeting 0.8500 next.

Going back to the technicals, just take note that the 200-month moving average sits @ 0.8256 as well. But price looks set for a first monthly close above the 100-month moving average – which sits @ 0.7860 – since August 2014.

Dollar fails to take comfort in higher yields so far today

EUR/USD climbs to a six-week high of 1.2200

Despite yields ticking higher to start European morning trade, the dollar is actually tracking lower across the board – except against the yen – in the major currencies space.

EUR/USD has climbed to a fresh high of 1.2200, its highest level since 13 January, as buyers look to try and break through resistance around 1.2170-97 at the moment.

The two key levels to watch going into the daily close will be the 22 January high @ 1.2190 and the 61.8 retracement level of the swing move lower this year @ 1.2197.

Keep a daily close above that and buyers will have more confidence in chasing a further move to the upside, with the dollar also looking vulnerable elsewhere.

AUD/USD is inches away from touching 0.8000 while USD/CAD is being pressured down to three-year lows just below 1.2500 at the moment.

While the dollar may be failing to find shelter now, the drop in US futures reflect more of a rotation trade rather than any broad risk aversion. But if the latter is to come around, just be mindful that it could help to keep the dollar somewhat supported later on.

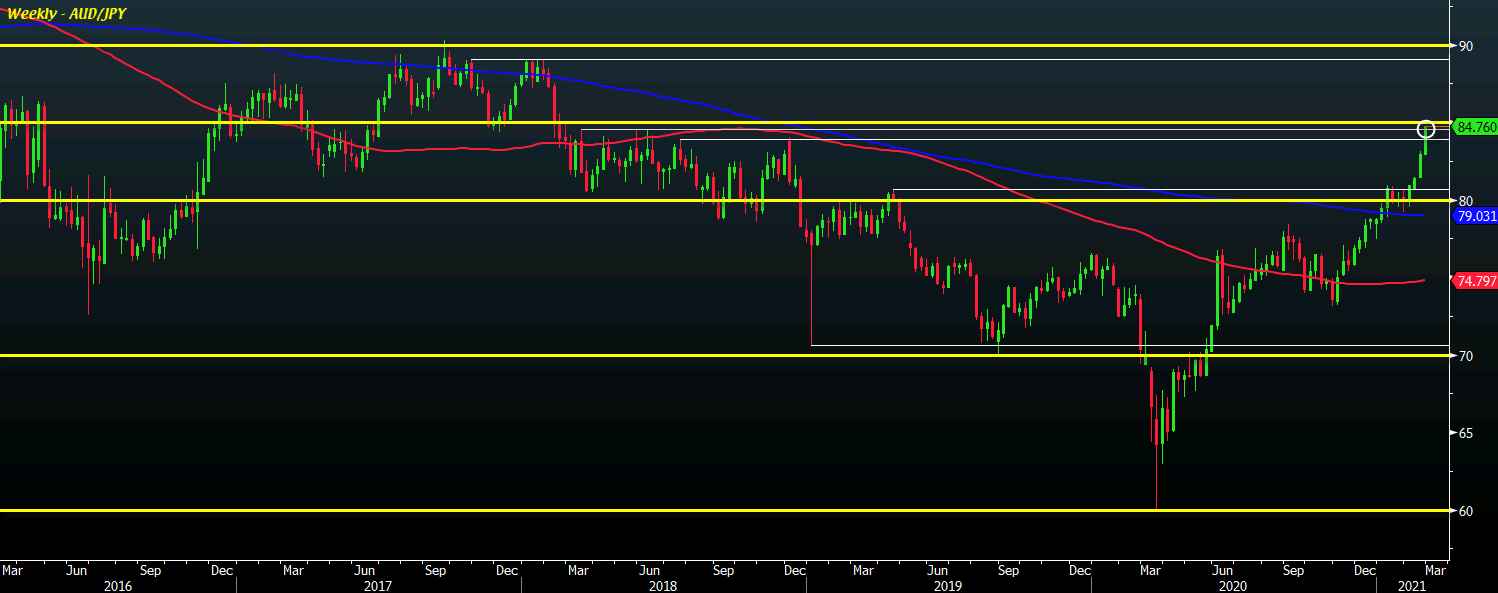

AUD/JPY climbs to fresh three-year high as the yen comes under pressure again

AUD/JPY up 0.5% to 84.76, its highest levels since February 2018

The yen is weighed lower on the back of higher yields once again to start European morning trade, with AUD/JPY pushing to fresh highs in three years currently.

The pair is looking to hold a push past the March to June 2018 highs around 84.48-53 and that may very well pave the way for buyers to target October 2017 and January 2018 highs just above 89.00 in the bigger picture of things.

The jump higher across yen pairs is largely a reflection of weaker yen sentiment due to higher yields as we are also seeing GBP/JPY looking to hold a break above 150.00 for the first time since May 2018.

Meanwhile, NZD/JPY is also contesting with resistance from its December 2018 high @ 78.87 as it touches 79.00 for the first time since April 2018.

Adding to that is CAD/JPY breaching its February 2020 high and trading closer towards 85.00 – its highest levels since March 2019 – at the moment.

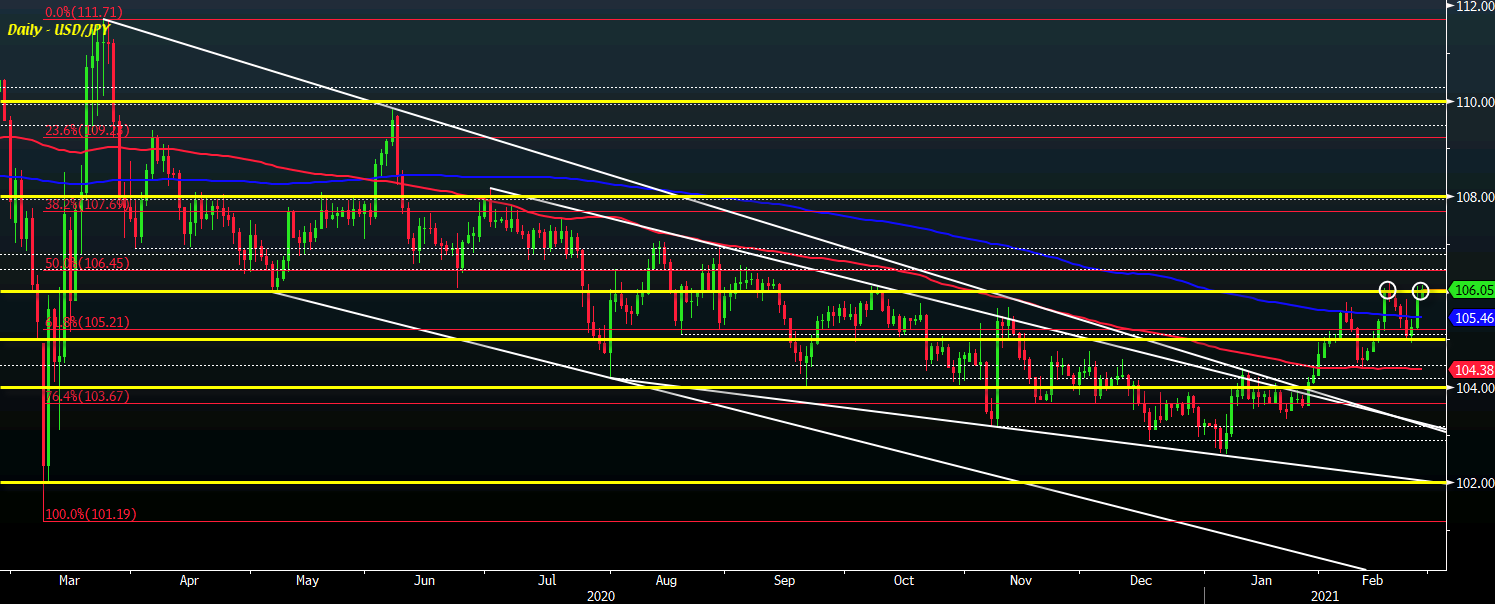

USD/JPY inches back above 106.00 as yields lurk higher

USD/JPY moves up to 106.05 to start European morning trade

This comes as Treasury yields are at the highs for the day, with 10-year yields up 4.5 bps to 1.421% and 30-year yields up 5.5 bps to 2.289%. This is putting some downward pressure on the yen and will be a key spot to watch – similar to yesterday.

The 106.00 handle has helped to limit gains in USD/JPY so far this month – at least in terms of the daily chart – so this remains a key level ahead of the weekend.

Meanwhile, the shove higher in yields is also starting to have some impact on equities sentiment with S&P 500 futures paring gains to flat levels and Nasdaq futures now seen down 0.1% as things get underway in Europe.

Nikkei 225 closes higher by 1.67% at 30,168.27

Asian equities bounce back after a beating yesterday

Stocks are off to a good start on the day with Asian investors taking comfort from the gains in Wall Street overnight, with the Nikkei paring the drop from yesterday’s session.

The Hang Seng is also seen trading up by 2.1% after a sharp decline yesterday while the Shanghai Composite is up 0.7% going into the closing stages.

Overall, risk sentiment is keeping in a firmer spot as we look towards European trading.

US futures are also higher so far today and that is keeping the calm in the market mood, with Treasury yields also marked higher across the curve. 10-year yields are up 2.4 bps to 1.40% while 30-year yields are up 3.4 bps to 2.267% currently.

A sharp selloff in bonds yesterday prompted some jitters in equities, which were then reversed. So, this is still one area to keep an eye out for in case there are spillovers today.