The market has gotten a look of how things may look like at the end of the pandemic tunnel, but what about the here and now?

European equities are keeping a little softer as US futures are also slightly lower on the session so far, with the exuberance from yesterday starting to show signs of fading.

This is somewhat similar to last week’s price action after the Pfizer news but to a lesser degree, with yesterday’s jump from the Moderna news also less impressive.

SPX

Still, the vaccine optimism in the past week has been great to fuel investor appetite and helped to push the S&P 500 to close at a record high yesterday (⬆).

But is there going to be any solid follow through to that momentum?

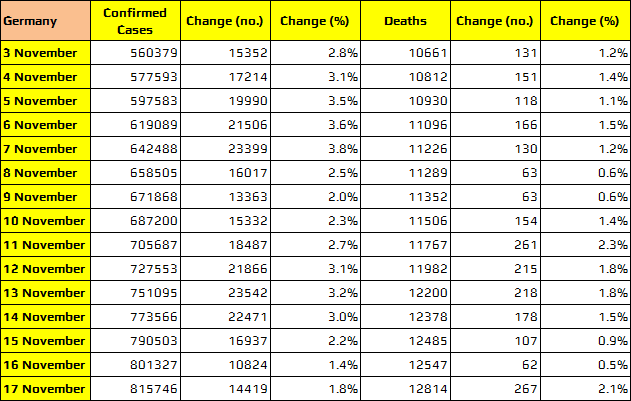

The here and now is plagued with negative virus developments as we see high case counts across Europe and the US, prompting tighter restrictions to be implemented.

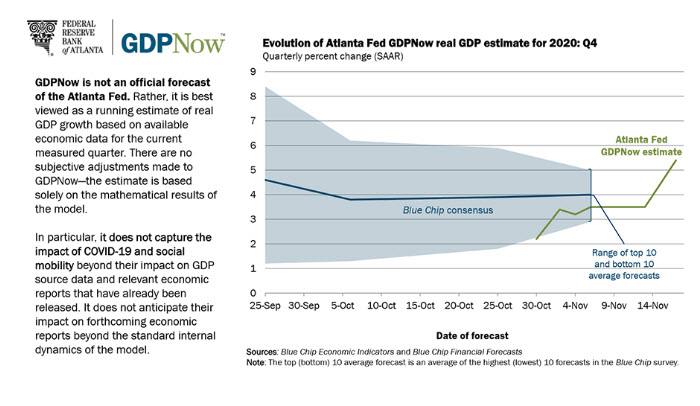

That is going to take a toll on economic activity in Q4 2020 and possibly Q1 2021, and the market may not quite be pricing in much pessimism on that front.

However, does that really matter when the world is starting to look forward to things becoming normal some time next year (hopefully)?

Investors may not care about the virus situation for now but the longer we go without a vaccine actually being rolled out to the masses, expect there to potentially be more signs of nervousness and shakiness in the market.

But at the same time, if vaccine hurdles continue to be crossed, investors may not care as the future looks inviting and with easy money still present, that could be all that matters.

For now, there is a slight pullback to yesterday’s push higher. The 3,600 level in the S&P 500 will be a key one to watch with the 2 September high closer to 3,588 going to turn into a support level that may define the strength of investor appetite this week.

Break below those levels and there could be a steeper drop to follow in equities/risk. But keep above, and that provides a platform for buyers to start getting greedier.