Archives of “November 10, 2020” day

rssDr Fauci: Expect approval of Pfizer Covid vaccine to go smoothly

Dr. Fauci has been positive about the Pfizer vaccine news

- expects approval of Pfizer Covid vaccine to go smoothly

- Pfizer vaccine doses should be available for people at the highest priority in December

Fauci is speaking on MSNBC

EIA oil projections for US crude and petroleum markets

EIA estimates for oil production and demand

- crude oil output to fall 860,000 BPD to 11.39M BPD in 2020 (vs 800K last month)

- Output to fall 290,000 to 11.10 M BPD in 2021 (vs fall of 360K last month)

- US petroleum demand to fall 2.38 million BPD ti 18.16 million BPD in 2020 (vs. decline of 2.31 million BPD previously forecasted)

- US petroleum demand to rise 1.69 million BPD to 19.85M BPD in 2021 (vs rise of 1.74M BPD previously forecasted)

WTI crude oil futures for December delivery is trading up $0.88 or 2.18% at $41.18. The January contract is up $0.86 or 2.14% $41.49

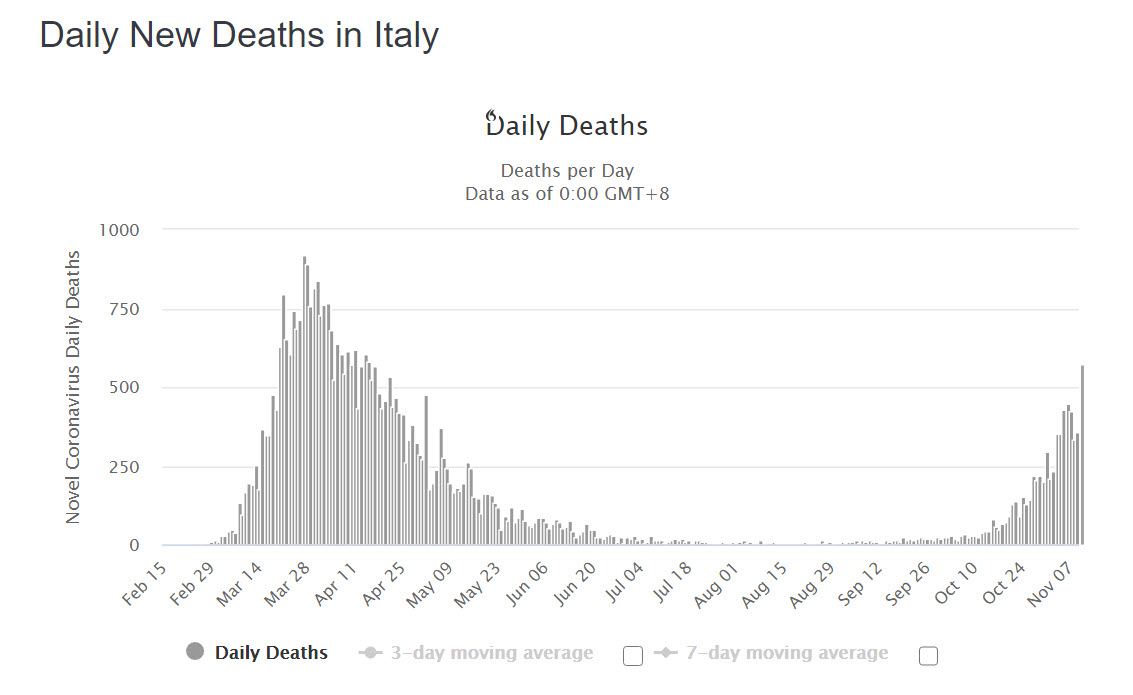

Italy has 35,098 new coronavirus cases vs. 25,271 the prior day

Covid cases out of Italy

Italy has 35,098 new coronavirus cases vs. 25,271 from the prior report

- Deaths come in at 580. That is the 1st daily toll above 500 since April 21. The high death count reached 921 on March 27th.

The case count reached an all-time high last week at 39,809. The dip in cases yesterday was congruent with the and the weekend data.

European shares end the session with gains

Continue to outperform

The European shares are ending the session with gains. The last 6 or 7 days have been higher as hopes for a solution for Covid brings buyers into the more depressed stocks around the globe.

The provisional closes are showing:

- German DAX, +0.8%

- France’s CAC, +1.9%

- UK’s FTSE 100, +1.9%

- Spain’s Ibex, +3.3%

- Italy’s FTSE MIB, +0.5%

Although the gains over the last 7 or so days have been impressive, the major indices still remain lower on the year:

- German DAX, -0.65%

- France’s CAC, -9.15%

- UK’s FTSE 100, -16.48%

- Spain’s Ibex, -19.25%

- Italy’s FTSE MIB, -11.23%

In other markets as European traders look to exit:

- spot gold is trading up $19.40 or 1.05% at $1882.62

- spot silver is up $0.26 or 1.09% at $24.36

- WTI crude oil futures are up $0.71 or 1.76% of $41

in the US debt market, yields are higher but steady and off the highest levels:

- 2 year 0.178%, +0 point basis points

- 5 year 0.447%, +1.9 basis points

- 10 year 0.954%, +3.0 basis points

- 30 year 1.743%, +3.4 basis points

Pfizer CEO explains why they rejected subsidies. A must read for all interventionists

EU clears hurdle to unlock €1.8 trillion budget, stimulus

EURUSD extend above its 100 hour moving average

The EU has cleared hurdle to unlock €1.8 trillion budget, stimulus. The headline has given the EURUSD a little boost. The price moved above the 100 hour moving average 1.18168.

EURUSD moves lower and remains in up and down trading range

The high yesterday stalled near the early September high

The EURUSD has moved lower again today, a day after the high for the day stalled near the September 10 high at 1.19165 (the high reached 1.19195 and backed off – see the daily chart below).

The stall near the high is similar to the lows from last week, that stalled near the low from the later part of September in the 1.16016 to 1.1611 area).

So the pair on the daily chart, trades in a red box between 1.1601 and 1.1919. The current price is just above 1.1800.

Technically on the daily chart, the next downside target for the pair is at 1.17518 area. More important support would be in in the 1.1687 to 1.1710 area. That is home to a swing area (see yellow area) and also the key 100 day MA at 1.16886 (blue line).

Drilling down to the hourly chart below, the pair fell sharply yesterday after falling below the 1.1846-50 area. The pair fell toward the rising 100 hour MA and bounced however (blue line).

The subsequent corrective rise today move back up to test the 1.1846-50 area, only to find sellers ahead of the level. The move back down cracked below its 100 hour moving average for the 1st time since November 4 and has been able to stay below (on a closing basis) since that time (there was a brief peek above the level only to find sellers overwhelm the buyers).

The next key target on the downside would be near the 50% retracement 1.17606 (there is a swing area to 1.1768 near that target) and then the 200 hour moving average at 1.1743 (green line).

It would take a move back above its 100 hour moving average at 1.18156 (blue line) to tilt the trading bias more to the upside.

China COVID-19 vaccine producer Sinovac still trying to find info on halt of trial

Chinese vaccine producer Sinovac said it is still trying to find out more details on the halted trials of their vaccine candidate.

Earlier headline:

- China COVID-19 vaccine trial halted because of a death, unrelated to vaccine

The Brazilian health regulator on Monday halted trials of Sinovac’s COVID19 vaccine in the country due to unspecified “adverse incident.”