Archives of “October 1, 2020” day

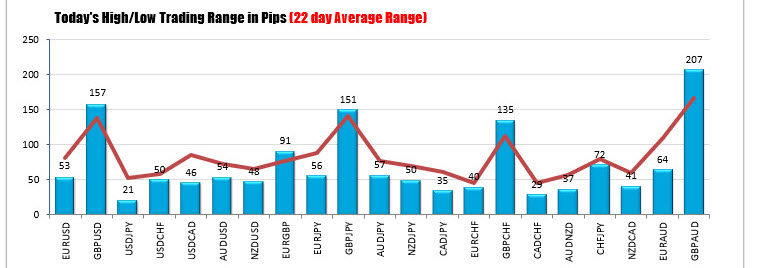

rssMost pairs remain contained in trading today

The GBP pairs had their spat of Brexit headline volatility, but other pairs not, not so much.

The major indices vs. the US dollar open the day with ranges less than 54 points with the exception of the GBPUSD, and that’s where the ranges have remained. In fact, looking at the major pairs at the start of the NY session the low to high ranges showed:

- EURUSD 53 pips

- GBPUSD 157 pips

- USDJPY 21 pips

- USDCHF 50 pips

- USDCAD 46 pips

- AUDUSD, 54 pips

- NZDUSD 48 pips

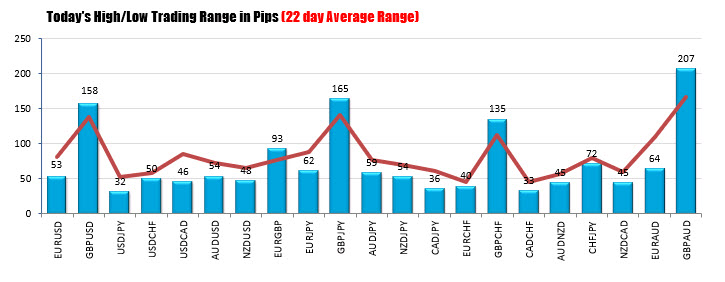

- EURUSD, the same 53 pips

- GBPUSD 158 pips, the range was increased by 1 pip

- USDJPY 32 pips,. The very narrow range was increased by 11 pips

- USDCHF, the same 50 pips

- USDCAD, the same 46 pips

- AUDUSD, the same 54 pips

- NZDUSD, the same 48 pips

The major crosses are also little changed vs the early NY session.

The major crosses are also little changed vs the early NY session.- EURUSD: The EURUSD stalled near the 50% retracement at 1.17641. A move with momentum above that level should ignite some buyer. Close resistance at 1.1755 (price is at 1.1743). On the downside falling below the 1.1713 level would take the price below a lower trend line on the hourly chart.

- USDJPY: Lower trend line at 105.42. On the topside, the high today stalled near swing highs from September 25, September 29 and a swing high from yesterday between 105.694 to 105.729. Get above should open up the upside.

- USDCHF: The low today stalled just ahead of the low from yesterday’s trade at 0.9162 (low today reached 0.91639). Ahead of that level on the downside sits the 50% retracement of the range since September 15 which comes in at 0.9173. Get below each of those levels should solicit more downside momentum. On the topside watch price action above the 0.9202. That was the broken 38.2% retracement of the same range since September 15

- USDCAD: The USDCAD trades just above its low from September 22 at 1.32827, and swing lows from today which ranged 1.32789 to 1.3283. There our 7 different hourly bar lows that bottomed in at 4-5 pip range today. Break below should solicit more selling. On the topside the high price today at 1.33214 was just short of the swing low going back to September 24 at 1.33238. A move above that area should solicit more buying.

- NZDUSD: The 50% retracement of the range since September 18 high comes in at 0.66539. A break above that level with momentum should solicit more buying. The earlier high for the day took a peek above the level only to fail (high reached 0.6656).

- AUDUSD: The AUDUSD stalled at the high today against a topside channel trendline. That trend line is now higher (around 0.74165 and moving higher). It would take a move above that level to solicit more buying. On the downside the lower channel trendline comes in at 0.7150. Break and stay below that line (it is rising) would be more bearish and should solicit more selling.

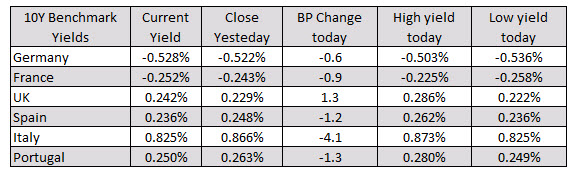

European shares close mostly higher

German DAX a downside exception

The European shares are closing mostly higher. The exception is the German DAX which is trading down about -0.4%. The provisional closes are showing:

- German DAX, -0.4%

- France’s CAC, +0.2%

- UK’s FTSE 100, +0.2%

- Spain’s Ibex, +0.2%

- Italy’s FTSE MIB, +0.3%

Politco: Chances for a Pelosi-Mnuchin deal are ‘looking quite grim’

No deal on the menu

Oil breaks the lows of the week in quick fall

Crude takes a tumble

EURUSD trades to a 7-day high. Tests 50% retracement/swing area

50% retracement 1.1764. Swing area between 1.1767 and 1.17748

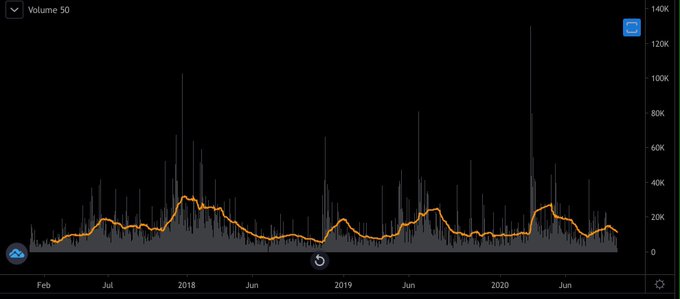

Coinbase btc/usd volume With this volume you’d make up an excuse to let workers go too

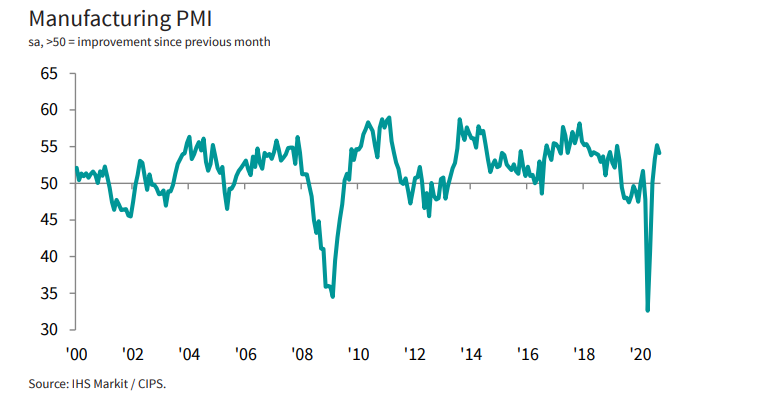

UK September final manufacturing PMI 54.1 vs 54.3 prelim

Latest data released by Markit – 1 October 2020

The preliminary report can be found here. Little change compared to the initial estimate, as factory activity expands for a fourth straight month but at a slower pace.

“September saw UK manufacturing continue its recovery from the steep COVID-19 induced downturn. Although rates of expansion in output and new orders lost some of the bounce experienced in August, they remained solid and above the survey’s long-run averages. Export demand is also picking up, as economies across the world restart operations and adjust to COVID-19 restrictions. Business sentiment remained positive as a result, with three-fifths of UK manufacturers forecasting a rise in output over the coming year.

“While the sector is still making positive strides, keep in mind that there remain considerable challenges ahead. This is especially true for the labour market, which saw further job losses and redundancies in September. The full economic cost incurred by 2020 will likely rise further as governments look to re-introduce some restrictions, job support schemes are tapered and rising numbers of firms start focussing on Brexit as a further cause of uncertainty and disruption during the remainder of the year.”

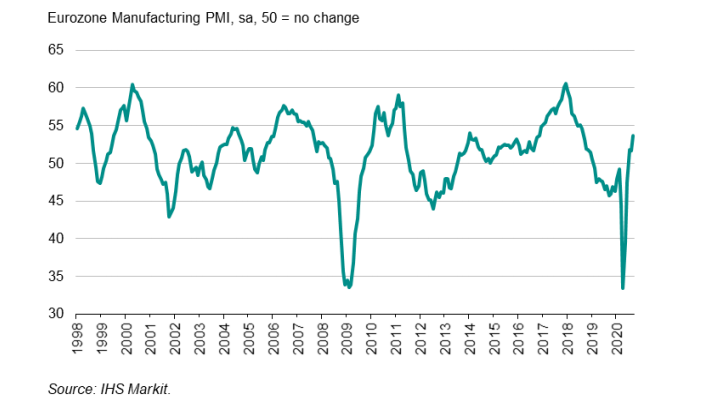

Eurozone September final manufacturing PMI 53.7 vs 53.7 prelim

Latest data released by Markit – 1 October 2020

“The eurozone’s manufacturing recovery gained further momentum in September, rounding off the largest quarterly rise in production since the opening months of 2018. Order book growth and exports also accelerated, indicating a welcome strengthening of demand. Job losses consequently eased as firms grew more upbeat about prospects for the year ahead, with optimism returning to the highs seen before the trade war escalation in early 2018.

“The recovery would have been far more modest without Germany, however, where output has surged especially sharply to account for around half of the region’s overall expansion in September. Germany’s performance contrasted markedly with modest production growth in Spain, slowdowns in Italy and Austria, plus a particularly worrying return to contraction in Ireland. Excluding Germany, output growth would have weakened to the lowest since June.

“Divergent export performance explains much of the difference between national production trends, with Germany the stand-out leader in terms of growth in September, led by a strengthening of demand for investment goods such as plant and machinery.

“Encouragingly, optimism about the future rose not only in Germany but also in France, Italy, Spain and Austria, hinting that the upturn could broaden out in coming months. Without a more broad-based recovery, the sustainability of the upturn looks at risk, with additional worries fuelled by rising Covid19 infection rates.“

NICOLAS DARVAS AND HIS $2,000,000

icolas Darvas viewed Wall Street as nothing more than a gambling casino; therefore, he set out to learn how to gamble.

I would like us to take a look at Mr. Darvas’ understanding of the stock market, as outlined in his best selling book How I Made $2,000,000 In The Stock Market, originally penned in 1960, as we recognize that what was true over 50 years ago still holds true today. In other words, trading the market today is THE SAME AS IT EVER WAS.

Mr. Darvas experienced an “important turning point” in his stock market career when he learned that “there is no such thing as cannot in the market. Any stock can do anything.” With this in mind Darvas developed his “box theory” based on the following realizations:

1. There is no sure thing in the market. I was bound to be wrong half the time. Darvas adopted what he called the “quick-loss weapon”. He already knew he would be wrong quite often (half the time); therefore, he decided to accept his mistakes realistically and get out of a losing trade with a small loss. “This way, I figured, I would never sleep with a loss. If any of my stocks went below the price I thought they should, I would not own them when I went to bed that night. I knew that many times I would be stopped out for the sake of a point just to see my stock climb up immediately after. But I realized that this was not so important as stopping the big losses. Besides, I could always buy back the stock by paying a higher price.”

2. My pride and my ego would have to be subdued. Darvas surmised that with a win ratio of 50% his profits had to be bigger than his losses. Breaking even was not a sustainable option. For that to happen he would have to take many losses while letting the winners run. Egotistical pride would have to give way to humble reality. “As if stocks were made to conform to my new attitude, I handled this quite successfully for quite a while. I bought with bold confidence when I thought I was right and coldly, without a hurt ego, I took my limited losses when I thought I was proven wrong.”

3. I must become an impartial diagnostician. Instead of trying to force his will upon market direction, Darvas allowed the market to direct him by becoming intimate with a few stocks at a time and by not listening to others. “To try to fit the market into a rigid pattern was a mistake. As I only handled five to eight stocks at a time, I automatically separated them from the confusing, jungle-like movement of the hundreds of stocks surrounding them. I was influenced by nothing but the price of my stocks. I could not hear what people said, but I could see what they did. It was like a poker game in which I could not hear the betting, but I could see all the cards. Of course, the poker players would try to mislead me with words, and they would not show me their cards. But if I did not listen to their words, and constantly watched their cards, I could guess what they were doing.”