Archives of “September 2020” month

rss24k gold PlayStation 5 for $10,000

Nine drugmakers promise to not seek approval for experimental Covid-19 vaccines until shown to be safe

The Wall Street Journal report now the firms have agreed to the measure – not to seek regulatory approval until a vaccine is shown to safely work effectively.

The pledge was signed by the heads of

- AstraZeneca

- GlaxoSmithKline GSK

- Johnson & Johnson

- Merck

- Moderna

UK breaking international law, head legal official resigns. GBP lower again in early Asia.

The news that UK PM Johnson was plotting to break, illegally, the treat with the EU was posted first thing Monday:

- UK is planning a new move that risks the collapse of talks with the EU

GBP has been falling ever since.

Further development overnight with the FT reporting that Jonathan Jones, the head of the government’s legal department, resigned.

GBP is setting Federal Reserve hows for the week here in pre-Tokyo trade.

AstraZeneca Covid-19 vaccine – study put on hold due to suspected adverse reaction in trial participant

The Phase 3 study testing the AstraZeneca and the University of Oxford COVID-19 vaccine has been put on hold due to a suspected serious adverse reaction in a participant in the United Kingdom.

Spokesperson for AstraZeneca

- standard review process triggered a pause to vaccination to allow review of safety data

- “a routine action which has to happen whenever there is a potentially unexplained illness in one of the trials, while it is investigated, ensuring we maintain the integrity of the trials.”

Risk negative, but so far little response. Eyes on the tech rout still. Globex equity index future trade reopens at the top of this hour.

Coronavirus – UK to tighten restrictions nationwide again

Maximum gatherings of people to be brought back to 6, from currently 30.

UK PM Johnson will make the announcement citing the rapid acceleration in cases.

Exemptions (amongst others):

- Work

- Schools

- University lectures

- Weddings

- Funerals

- Team sports that are “Covid secure”

ICYMI: Scientists question results from a study of Russia’s coronavirus vaccine

Taking a detour from the tech stock rout for just a moment, this on the much-touted Russian COVID-19 vaccine.

Via Bloomberg.

A group of international scientists say some of the published findings that appeared in the Lancet appeared improbable.

- flagged concerns over seemingly identical levels of antibodies in a number of study participants who were inoculated with the experimental vaccine

- This and other patterns in the data present “several different points of concern”

The link above has more. Is anyone surprised by this?

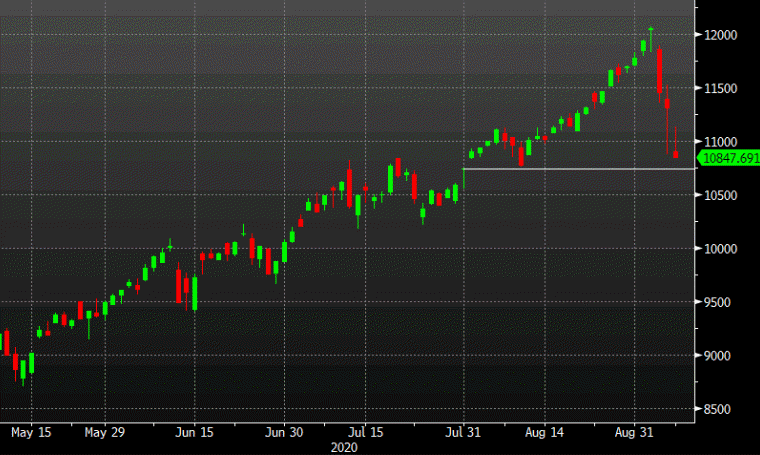

US stocks close on the lows. Nasdaq hits correction territory

Nasdaq takes a dive

A few attempts to bounce intraday fell flat and stocks finished near the lows of the day. The S&P 500 fell while the Nasdaq’s 4% drop extended the decline since last Wednesday’s record high above 10% — an unofficial correction.

The Nasdaq is now just 1.0% away from wiping out the entire August-Sept gain. Tesla shares fell 21% on the day, its worst ever one-day loss.

Nasdaq:

- S&P 500 -95 points to 3331

- Nasdaq -465 to 10847

- DJIA -632 to 27,500

Thought For A Day

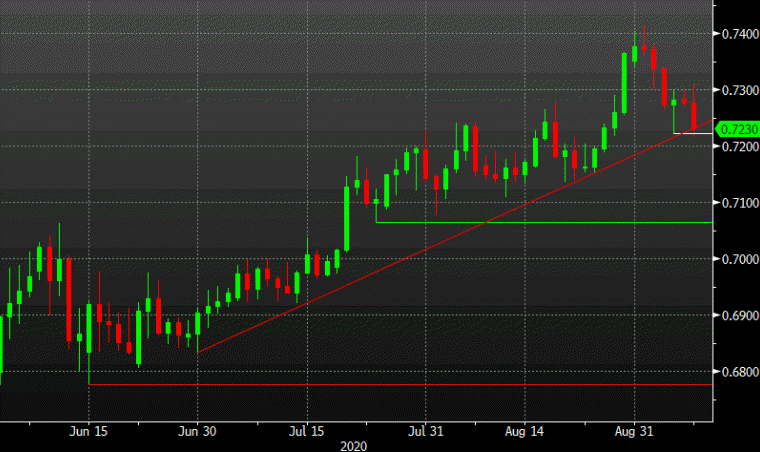

AUD/USD slips below last week’s low

AUD/USD fighting to hold above 0.7222

AUD/USD briefly fell below last week’s low of 0.7222 but has now raised its head back above water as it’s bounced around by equity market sentiment.

On the ground, some restrictions were eased in Victoria but retail, hospitality, tourist and entertainment will be restricted until October 26. Offices will work from home until Nov 23.

Today’s NAB business conditions survey today fell to -6 from 0.

What struck me about last week was how well that AUD/USD held up. Yes, it fell 180 pips but given the run it’s had and the rout in equities, it could have been much worse. Now it’s fighting for 0.7222.