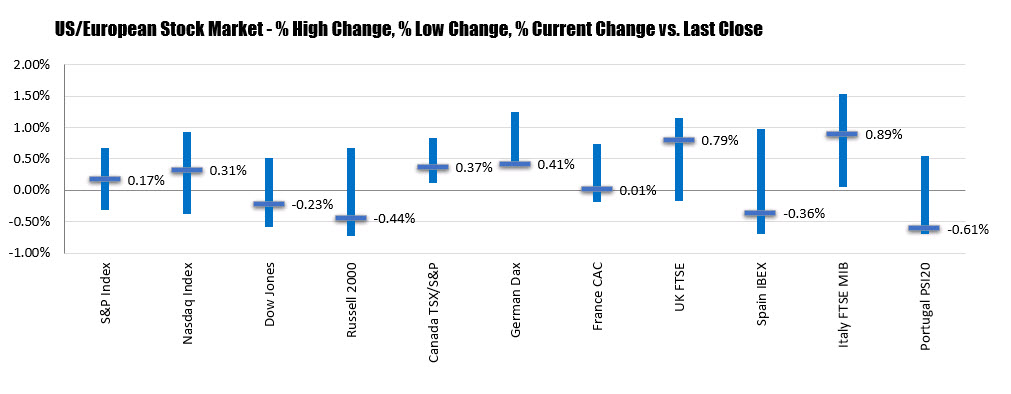

German Dax up 0.4%. France’s CAC unchanged

The European shares are closing with mixed results. The provisional closes are showing:

- German DAX, +0.4%

- France’s CAC, unchanged

- UK’s FTSE 100, +0.7%

- Spain’s Ibex, -0.4%

- Italy’s FTSE MIB, +0.80%

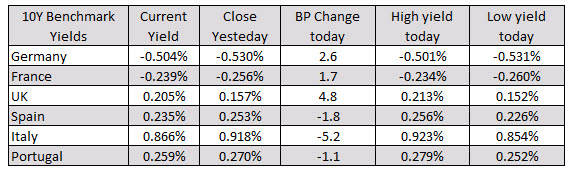

In the European debt market, the benchmark 10 year yields are ending the session mixed as well. Germany, France, and UK yields are higher, while Spain, Italy, and Portugal yields are lower.

In other markets as London/European traders look to exit are showing:

In other markets as London/European traders look to exit are showing:- spot gold is down $13.75 or -0.72% $1899.20

- spot silver is down $0.37 or -1.53% at $24.34

- WTI crude oil futures are trading up $0.15 or 0.3% at $39.46

In the forex market, the USD has taken the lead and is the strongest of the major currencies (see the strongest and weakest from the start of the North American session by clicking here). The GBP and AUD are the weakest. For the GBPUSD, the pair has moved back toward its 100 and 200 day moving average is 1.2720 area. The price is just below that level as I type at 1.2716.